Time to sell this great company as results loom?

Shares in this $30 billion tech firm have doubled in less than a year, but what now? Overseas investing expert Rodney Hobson discusses the future for the stock and what investors should do now.

4th October 2023 08:59

by Rodney Hobson from interactive investor

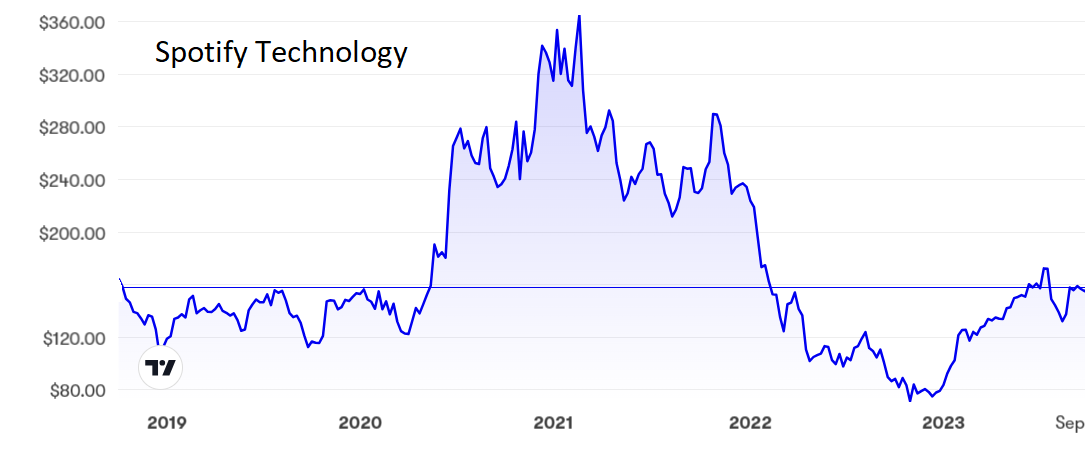

hares in music streaming site Spotify Technology SA (NYSE:SPOT) have swung up and down like a soprano’s voice in a Puccini aria. They seem to have settled around middle C but it is not clear whether they can hit the high notes again.

Spotify was founded in Sweden in 2006 but is listed on the New York Stock Exchange. It offers a growing number of subscribers access to millions of songs and playlists. They pay less per month than it would cost them to buy just one CD or vinyl version, and the company earns revenue from a limited amount of advertising.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The big problem is that a steady rise in subscribers from just over 200 million five years ago to more than 550 million now has not translated into profits. Rather, it has led to massive losses. Fewer than half of those who have signed up actually pay the monthly subscription that allows them to listen free of advertisements. Like many internet-based companies, Spotify has a free service, funded by advertising, to lure in frugal users who it hopes will eventually be persuaded to cough up for the real deal.

Meanwhile, it has to keep investing heavily to stay ahead of the game, particularly in artificial intelligence that divines what individual subscribers want and channels appropriate music to them so they remain engaged for as long as possible. A new feature called AI DJ not only selects songs that it thinks the subscriber will like but also provides an AI-generated voice that comments on the music, just like a real DJ. It could be a winner – or it could be intensely annoying.

Another new feature is Clips, which enables musicians to create short videos to try to win over new fans or engage with and retain existing ones. This type of video has been a hit on other social media platforms.

These features are designed to appeal to Generation Z, the young audience that currently accounts for most of the growth in subscriber numbers and, in theory, should provide a long-term audience. However, these tech-savvy youngsters are also the ones more likely to flit from one service to another as rival streamers try to outsmart each other at considerable cost.

It ought to be a recipe for success but there is intense competition, mainly from Apple Music and Amazon Music, and Spotify operates on thin margins. For every dollar that comes in from subscribers, 75 cents is spent on buying the music content.

- Dumb Money: when investors get caught out by bubbles

- This share is a magnet for income investors with a long-term view

- ii view: profits beat proves Nike can do better

In the second quarter, the latest for which figures are available, Spotify ran up a net loss of $305 million, much worse than the $125 million net loss in the same quarter last year. Admittedly, this was partly because of a 34% rise in spending on research and development, but that demonstrates the spiralling cost of creating growth.

The shares bounced along just below their current level just above $150 before suddenly taking off in April 2020, when technology for use at home during Covid lockdowns really came into fashion. The peak of $365 came the following February but then followed a long slide to a low of $80.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: The near doubling of the share price in just under 12 months opens up a selling opportunity, either to take profits for those who made the right guess last year, or to cut losses for those who got sucked in when the bandwagon was racing ahead unrealistically.

Third-quarter results are due on 24 October and if, as is likely, they show another sizeable loss, then a continued downward lurch is to be expected. Spotify is potentially a great company, but investors never got rich buying into companies that always turn in a loss.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.