A top share worth bending the rules for

Find out which stock our shares analyst has dropped from his coverage and which one he's recommending.

14th June 2019 15:15

by Richard Beddard from interactive investor

Find out which stock our shares analyst has dropped from his coverage and which one he's recommending.

A vote of no confidence in Vp

Over the years I have been unable to work out how Vp (LSE:VP.), a plant and tool hire firm, is so relentlessly profitable, while other hire firms, Speedy and HSS for example, have boom-bust reputations.

Vp describes itself as a group of specialist businesses. Specialists can offer services that generalists cannot, and perhaps develop closer and more profitable ties with customers. But the gaggle of specialists tag wore thinner when Vp acquired tool hire firm Brandon Hire in 2017 (subsequently merged with Vp's Hire Station and renamed Brandon Hire Station).

At Brandon Hire Station you can hire a vast range of tools from wallpaper steamers to cement mixers. Since it is Vp's biggest division and Vp financed the acquisition with debt, Vp seemed to have taken a step closer to the unspecialised over-leveraged business models of some of its competitors.

Vp does not go out of its way to explain what it does differently, so last year I gave the company a so-so-score. Last month I included it on a list of companies I am not planning to write up in detail any more.

The market has lost confidence in Vp too, because one of its specialist divisions, Groundforce, is suspected of colluding with two rivals to rig prices. The Competition and Markets Authority's provisional verdict is that the three companies operated as a cartel, but the companies will now have their say and we must wait for the conclusion to its investigation for confirmation, and to discover how much, if anything, it will fine Vp.

In preliminary results for the year to March 2019, Vp had little to say about the investigation except that it has made a provision of £4.5 million, the mid-point of a range of outcomes it has calculated from previous competition cases, which it makes "without any admission of culpability".

The upper-limit of Vp's calculation was £9 million, which would not damage the business permanently (it made £34 million pre-tax profit in 2018). But the development increases my misgivings, and the lower share price will not tempt me into reinstating Vp in my priorities.

Vp may be more interested in compelling customers to pay more for plant and tool hire through dominating markets and fixing prices, than winning their business by dint of an original or superior service.

If that is true, it is in strong contrast to Churchill China (LSE:CHH)...

A vote of confidence in Churchill China

With over 200 years of experience in the tableware industry, Churchill China is one of Stoke-on-Trent's survivors, a group that resisted the arrival of cheap Chinese competition including Portmeirion (LSE:PMP), which is not really a competitor as it sells plates to you and I (or maybe our parents!), Steelite, and until April, Dudson.

Like Churchill, Steelite manufacturers and Dudson manufactured tableware for the hospitality industry: pubs, restaurants, hotels, and other venues with cafes, canteens and restaurants.

Dudson shows that some potters are still being outcompeted. It went under in April. Bad news for the business, but good news, probably, for Churchill China, which bought two of its brands out of administration.

Hopefully, Churchill China will emulate Portmeirion after the financial crisis, when it revived two venerable but mismanaged retail brands, Spode and Royal Worcester. Churchill's investment is not big, and this is not a deviation from its strategy. At its AGM, Churchill revealed it was trading well.

Rather than repeat much of last year's in-depth review, which you can read here, let's skip straight to a summary of how I score Churchill China today. My answers to the following questions score from zero to two, reflecting my level of confidence, except the final question on the company's valuation, which can score between minus two or two.

Does Churchill China make good money?

Increasingly so. During the financial crisis when Churchill China was beginning to put in place its current strategy, profitability was not that impressive but it has improved year by year. In the year to December 2019, it achieved a return on capital of 24%. It operates without recourse to debt, financing innovation and increased capacity from its own cash flows.

Score: 2

What could prevent it from growing?

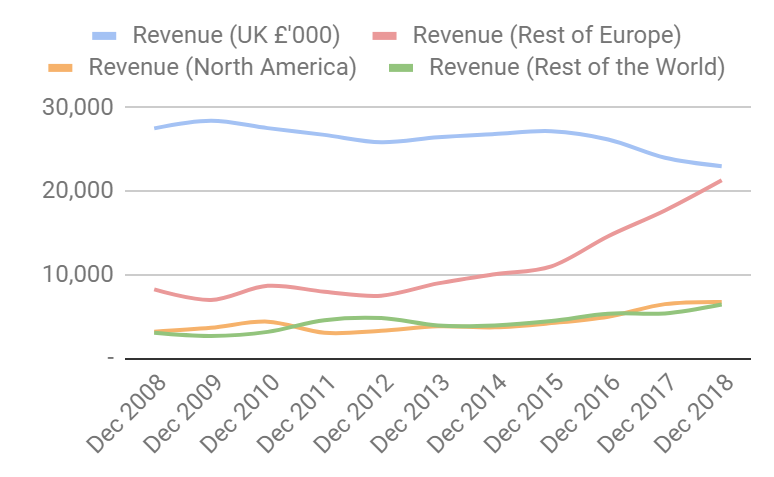

In Europe, Churchill China’s biggest market outside of the UK, and its fastest growing market larger German competitors dominate, particularly for the hospitality industry’s staple: plain white tableware. Life could get harder for Churchill if tariffs follow a Brexit.

Score: 1

How will it overcome these challenges?

Reassuringly, Churchill China is growing very strongly in Europe where it is a smaller fish in a bigger pond. Hospitality sales have grown at an average rate of 20% a year for the last five years. Its secret sauce, the result of a strategy shift over the last decade, is coloured, patterned and textured plates, an area in which it and other Staffordshire potters, has a natural advantage.

Due to the clays they use and the processes they have developed over hundreds of years, British tableware is particularly hardy, and so are the patterns which sit under the glaze rather than on it. This is particularly important in tableware for the hospitality industry, because repeated dishwashing gives it a proper bashing.

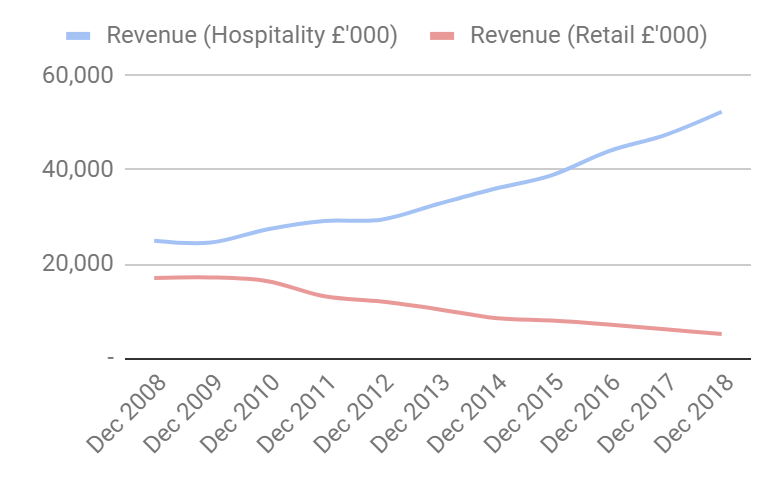

Churchill has simplified the process of manufacturing textured and patterned tableware (like the Studio Prints and Stonecast ranges). It says these "added value" products are relatively cheap to produce but attract a premium price, contributing 44% of revenue, compared to 10% in 2013.

The growth trend in Europe has been partly obscured by a smaller decline in UK sales, partly because of the deliberate contraction of the retail business, and more recently because UK restaurants are in the doldrums.

Churchill China is more resilient to economic woes than it was during the financial crisis because of its almost total focus on the hospitality industry, which is characterised by repeat purchases of products with long-life cycles. Between 2008 and 2010, when a greater proportion of Churchill China's sales were retail, its retail profit margins almost halved, but hospitality profit margins remained steady. Today it earns 91% of revenue from hospitality:

Despite pervading economic and political uncertainty, Churchill China is pressing home its advantage, increasing capital expenditure to extend its factory, make more added value products, and export them.

Score: 2

Will we all benefit?

The company is family-owned and committed to investment for the long term. The directors are handsomely rewarded, but not egregiously so by current standards, and tremendously experienced. Staff development is described as part of its core strategy, and the company describes the workforce as loyal, motivated, and highly trained. Reviews by staff on recruitment sites are sparse, but they speak of a friendly, challenging, workplace.

Score: 2

Are the shares cheap?

Sadly not. The shares cost about 21 times adjusted profit (which is itself at record levels) after adjusting for cash on the company's balance sheet.

Score: -0.2

It is such a good business, and on the cusp of being good value too. A score of 6.8 is fractionally below the arbitrary level of 7 required for a recommendation but perhaps Churchill China is an exception worth stretching the rule for.

Richard owns shares in Churchill China.

Richard owns shares in most of the shares listed by the Decision Engine, especially the higher ranked ones.