Topping up some old favourites and adding something new

Two fund holdings have been topped up, while a new position has been introduced.

19th April 2021 17:57

by Douglas Chadwick from ii contributor

Two existing fund holdings have been topped up, while a new position has been introduced from the technology sector.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

To control the overall risk of a portfolio, we advocate holding funds from a range of different Investment Association (IA) sectors. Some sectors tend to be much more volatile than others, which is great when they are going up, but they can go down just as quickly. Others are much slower and steadier.

Each week, we provide performance data on the IA sectors along with individual rankings for funds, investment trusts and exchange-traded funds (ETFs).

We also run a couple of demonstration portfolios showing how the information we generate can be used, and what we are doing with some of our own money.

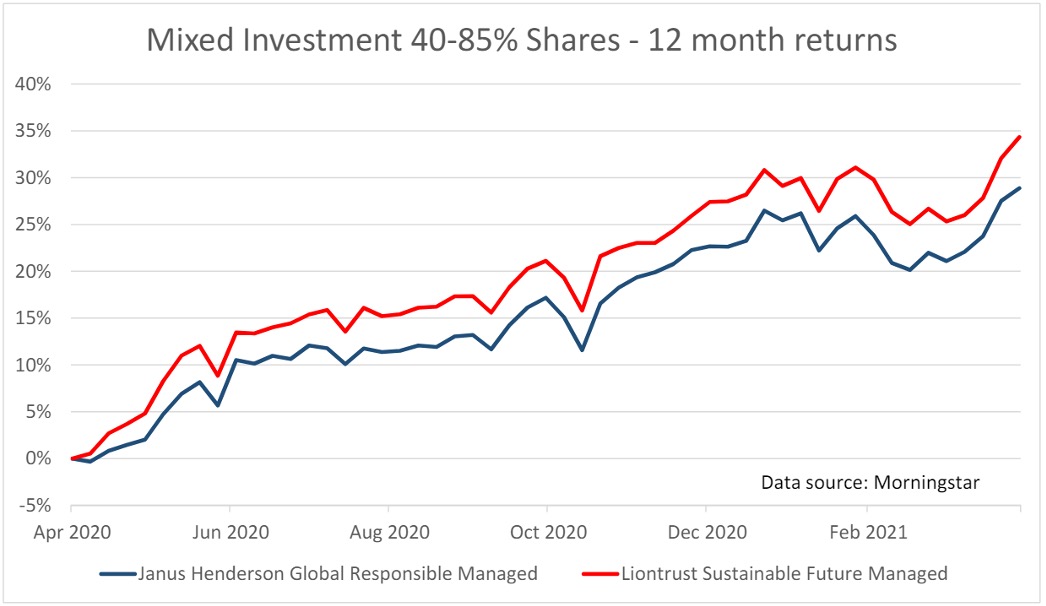

Last week, we added to a couple of funds that we have held for some time from the Mixed Investment 40-85% Shares sector, which we consider to be one of the least volatile sectors. The funds were Janus Henderson Global Responsible Managed and Liontrust Sustainable Future Managed.

We also invested in the Marlborough Technology fund, from the racier Technology and Telecommunications sector.

The definition for the ‘Mixed Investment 40-85% Shares’ sector is “funds in this sector are required to have a range of different investments. However, there is scope for funds to have a high proportion in company shares (equities). The fund must have between 40% and 85% invested in company shares.”

This gives the fund manager a wide range of options, not only in the ratio of equities to fixed income, but also the geographical diversity of the shares.

We first invested in the Janus Henderson Institutional Global Responsible Managed and Liontrust Sustainable Future Managed funds in February 2019. We held them until the beginning of March 2020, when global stock markets were heading south. We ended up selling almost everything, but these were the last funds to go.

They were also some of the first funds that we went back into, along with the Royal London Sustainable World and Baillie Gifford Managed funds from the same sector.

- Why investors need to rethink the 60/40 investment rule

- Check out our award-winning stocks and shares ISA

Since then, they have performed well, but they did have a slight downturn earlier this year and so we reduced our overall exposure to the sector.

They now look like they are back on track and have started featuring in our shortlists of best-performing funds again. That is why we have recently topped up our holdings.

At the beginning of last week, I also highlighted a few funds from the North America, North American Smaller Companies, and Technology and Telecommunications sectors that had caught our eye. Later that week, we invested in the Marlborough Technology fund.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.