A trio of dividend stocks for income seekers

15th February 2023 10:08

by Rodney Hobson from interactive investor

Our overseas investing expert Rodney Hobson gives his view on these well-known names.

The US seems to be developing a curate’s egg economy – good in parts. Job numbers overall have held up remarkably well, while the narrower tech sector has been shedding workers by the busload; some companies have suffered from higher costs, while others have been able to pass price rises on with comparatively little pain.

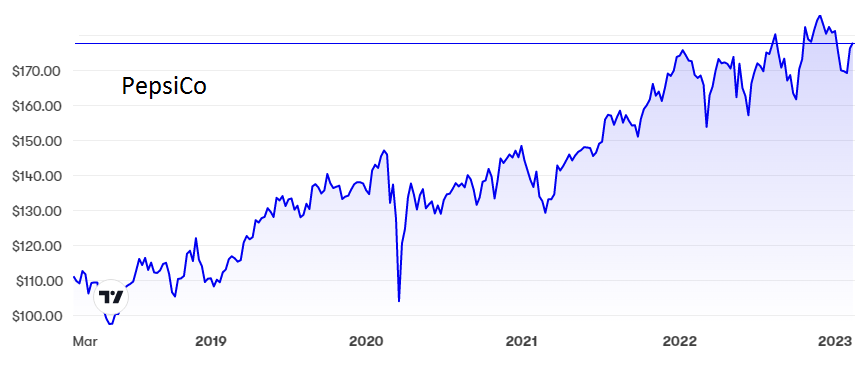

This very mixed picture is reflected in figures for fizzy drinks maker PepsiCo Inc (NASDAQ:PEP), which increased sales in the final quarter of 2022 beyond expectations despite (and also because of) raising prices substantially.

- Invest with ii: Top US Stocks | US Earnings Season | Open a Trading Account

Revenue jumped 10.9% to $28 billion (£23 billion) in the quarter, but net profit slumped 61% to $518 million, and while the setback was partly due to restructuring and impairment charges Pepsi was also struggling with higher input costs, freight charges and rising wages.

Having strong brands, such as Doritos crisps and Quaker porridge oats in addition to the cola it is best known for, will help but the company admits that inflation will persist. Yet Pepsi has promised to refrain from further price rises throughout 2023, so there will inevitably be a further squeeze on profits.

Apart from a short, sharp dip as the Covid epidemic broke, Pepsi shares have risen relentlessly over the past five years from below $100 to a peak of $185 in December. At the current $176, the price/earnings (pe) ratio is demanding at 27.5, but the dividend is a respectable 2.5%.

- These five American giants made $100bn profit: buy, hold or sell?

- Are we heading for a lost decade of investment returns?

With profits for the full year rising 9.1% to $10.7 billion, Pepsi has felt able to raise its dividend total by 10% to $5.06, the 51st consecutive year of dividend increases.

Source: interactive investor. Past performance is not a guide to future performance.

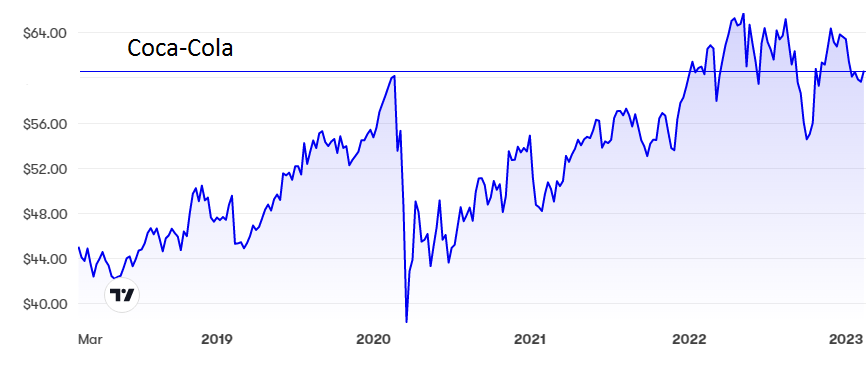

It was a similar story at rival Coca-Cola Co (NYSE:KO), where revenue rose and profits fell for the final quarter and for the year as a whole as costs rose. The revenue rise of 7% to $10.1 billion was slower than earlier in 2022 and, more seriously, a 16% fall in net income to $2 billion was worse than for the previous nine months. Even so, the company raised its dividend by 5%.

Coca-Cola shares have followed a similar pattern to Pepsi, rising from $42 and peaking at $66 before coming off the boil at just under $60, where the p/e is a touch lower than Pepsi’s at 26.6 and the yield a touch higher at 2.9%.

Source: interactive investor. Past performance is not a guide to future performance.

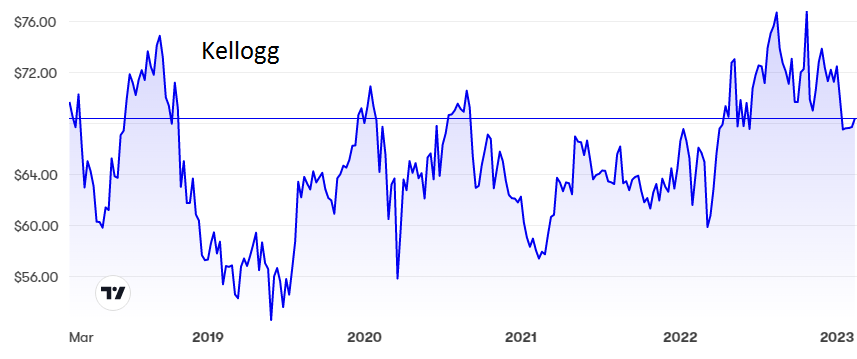

Cost inflation is also an issue for cornflakes and Pringles crisps maker Kellogg Co (NYSE:K). Throw in the impact of an industrial dispute, the after-effects of a massive fire in a Memphis factory in 2021 and continuing supply chain bottlenecks and you realise how well the company has done to raise revenue by 12% in the final quarter.

Revenue was up 8% for the full year but profits slipped 36% as profit margins were crunched down from 11% to 6.3%.

Source: interactive investor. Past performance is not a guide to future performance.

Unfortunately Kellogg has had to abandon its plan to spin off or sell its underperforming meatless food business. While this arm brings in only 2% of total sales, it is an unwanted distraction when the company has quite enough problems to grapple with.

The shares have bounced between $56 and $76 over the past five years and are currently just above the halfway mark, with a p/e of 24.5 and a yield of 3.42%.

Hobson’s Choice: I have been cautiously optimistic about Pepsi for some time and still rate the shares as a solid hold for patient investors who prefer boring, slow progress over erratic excitement. I have tipped Coca-Cola several times over the past four years at various prices ranging from $39 to $57. Anyone following that advice is currently ahead and they have also pocketed decent dividends. Still a buy. I rated Kelloggs a buy below $73 last June and still think the downside is limited. So is the upside, making this one for dividend-seekers only.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.