Two bank stocks to buy and one to hang on to

19th April 2023 08:42

by Rodney Hobson from interactive investor

We’ve already seen broadly positive results from the bank sector, but there are still opportunities to get in at a good price, argues overseas investing expert Rodney Hobson.

Investors’ nerves have been eased if not entirely assuaged by early first-quarter results from American banks. Figures are better than analysts expected so the positives far outweigh concerns about the state of the banking sector.

As usual, quality is what counts as banks cope with fewer issues than during the previous crisis in 2008, and there are fewer potential basket cases to drag down national economies.

Figures for major United States banks, as for their British counterparts, come out ahead of the rest of the pack of company results, so they are always watched with particular interest. First-quarter figures were especially important because they followed the collapse of tech bank Silicon Valley Bank, and then the demise of Signature Bank that sparked fears of wider contagion in the sector.

- Learn more: SIPP Portfolio Ideas | How SIPPs Work | Transfer a SIPP

Such concerns appeared justified when Credit Suisse ran into problems and was rescued in a deal engineered by the Swiss government. However, Credit Suisse was, like SVB, a special case with mistaken decisions dating back over several years finally taking their toll.

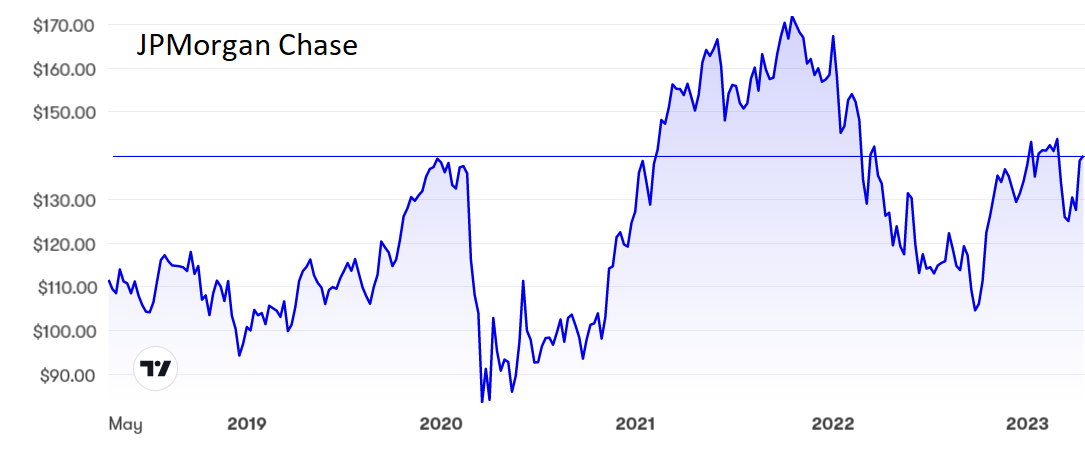

Major American banks look to be on firmer ground thanks mainly to the extra profits created by higher interest rates. In a great start to the reporting season, JPMorgan Chase & Co (NYSE:JPM) recorded revenue up 25% to a record $39.3 billion and net income up 52% to $12.6 billion.

See Keith Bowman’s analysis ii view: banking mammoth JP Morgan reports record revenue

JPMorgan shares jumped on the results, but they are still below the peak of $144 recorded several times in January and February. These could be the results that break the ceiling. The price/earnings (PE) ratio still does not fully reflect the improved prospects at 10.2, while the dividend is reasonable at 2.9%.

Source: interactive investor. Past performance is not a guide to future performance.

Citigroup Inc (NYSE:C) produced less spectacular figures but still impressed, with the fixed income arm performing particularly well. Revenue climbed 12% to $21.45 billion and net income 7.0% to $4.61 billion. Significantly, banking activity picked up from the end of 2022.

- ii view: Citi beats estimates after personal banking boost

- Will Tesla and Netflix shares join results season rally?

As at JPMorgan, the shares have recovered somewhat after a poor start to the year but remain below recent highs. The PE ratio is remarkably low at 6.8 while the yield is quite attractive at 4.1%.

Source: interactive investor. Past performance is not a guide to future performance.

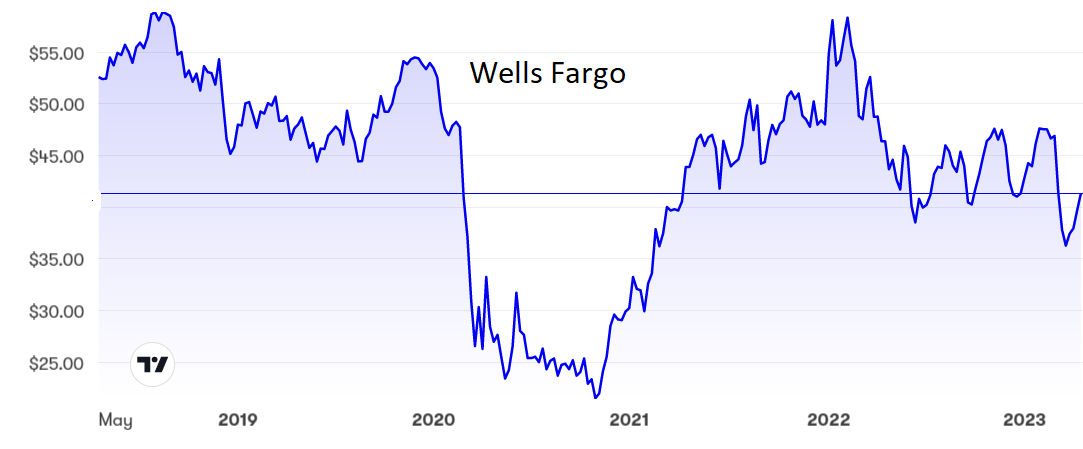

Wells Fargo & Co (NYSE:WFC), which has been seen to struggle in recent years, was the surprise package out of the trio announcing results together. Revenue rose 16.9% to $20.7 billion and profits jumped 31.8% to $4.99 billion. Even so, the immediate reaction on the stock market was muted.

The shares remain well below their February level. Even though the yield at 2.78% is not far short of JPMorgan’s, Wells Fargo is seen as more vulnerable to possible credit failures.

Source: interactive investor. Past performance is not a guide to future performance.

Inflation in the US, as elsewhere, will prove difficult to control, but the worst of the interest rate rises are over. Although that means a limit on the extent to which banks can count on continuing rises in income and profits, it does also reduce the risk of company and individual defaults that would force banks to set aside onerous provisions.

- Funds and trusts four professionals are buying and selling: Q2 2023

- Decarbonisation: shares, funds and trusts for the race to net zero

- Equities and sustainability: was 2022 the death of ESG?

US Treasury Secretary Janet Yellen, previously head of the Federal Reserve Bank, reckons the US economy will continue to grow, that the labour market will remain strong and that inflation will come down. While as a government official she has a bias towards optimism, all the signs so far are that she will be proved right.

Hobson’s choice: Buy JPMorgan below $145. The shares topped $170 in October 2021 and could well do so again. Citigroup remains a buy at least up to $54. I have tipped both several times and any investor who took my advice in March to put them in an ISA portfolio is already ahead.

I remain doubtful about Wells Fargo although the shares probably deserve a hold rating at current levels.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.