Two massive names but I’d only buy shares in one of them

14th June 2023 09:41

by Rodney Hobson from interactive investor

Despite a strong 12 months, this American icon has dramatically underperformed its biggest rival since the pandemic. Overseas investing expert Rodney Hobson decides what to do with the shares.

Aerospace and defence group Boeing Co (NYSE:BA) has vowed to rebuild trust one plane at a time. Unfortunately, the planes seem determined to undermine Boeing’s reputation one at a time.

The latest blow is that Boeing has been accused by a former supplier, Wilson Aerospace, of stealing Wilson’s intellectual property and substituting inferior products used on the International Space Station, thus endangering astronauts. While Boeing said it would defend the lawsuit, this is an added distraction that management can well do without.

It came only a day after Boeing identified yet another new defect in its long-haul 787 Dreamliner jet, the key to the company’s future. The problem has been found on several aircraft that have not yet been delivered to customers, which at least means it can be put right before any further damage is inflicted on Boeing’s reputation.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Boeing says planes already in service are not affected and those due for delivery this year will be ready in time. Nevertheless, shareholders should worry about whether subsequent events will undermine this optimism.

To add insult to injury, also this month Boeing once again delayed the first crewed flight of its Starliner space capsule after discovering a new technical issue.

Like the Starliner, the Dreamliner has already suffered from various defects, and Boeing was not allowed to deliver any to customers for 15 months in 2021-22. Then in February this year deliveries were again halted for several weeks, and the US Federal Aviation Administration announced that in future it would inspect each new 787 individually.

This setback came just as airlines were enjoying a rebound in operations and were finding aircraft in short supply after reducing their fleets during the pandemic. Then in April deliveries of Boeing’s best-selling plane the 737 Max were held up by the discovery of defects and by a shortage of parts from a supplier.

There is admittedly positive news for Boeing as airlines continue to place orders for more fuel-efficient aircraft to replace ageing, less efficient fleets. The biggest order so far this year has been from Ryanair for up to 300 new 737-MAX-10s worth about $40 billion, with 150 to be delivered between 2027 and 2033.

The most recent financial figures, for the first quarter of 2023, did show a much-needed improvement. Despite problems in the supply chain, revenue rose 28% to just under $18 billion compared with the previous pandemic-affected first quarter, and the net loss narrowed sharply from $1.24 billion to $425 million. The improvement was down mainly to a much better performance in commercial airplanes, with 130 aircraft delivered. Cash flow remains positive.

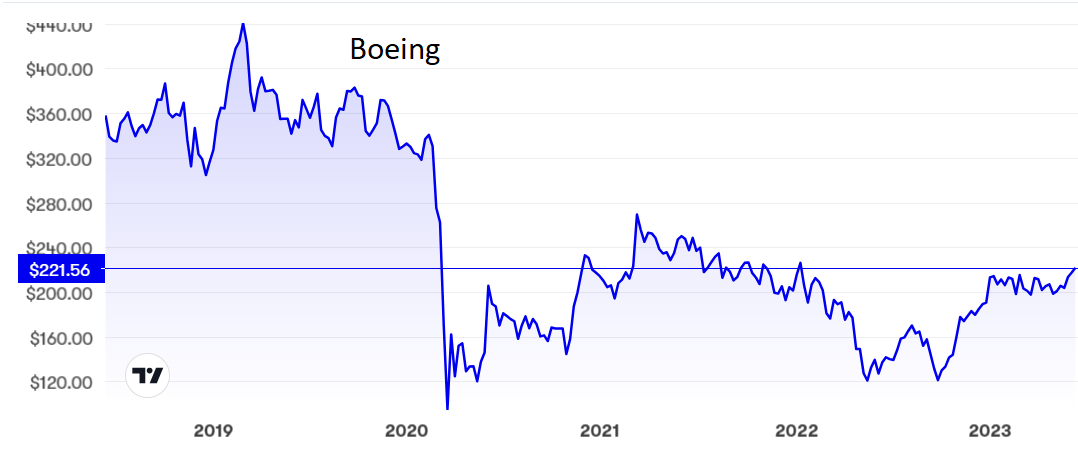

Source: interactive investor. Past performance is not a guide to future performance.

Boeing shares understandably fell off a cliff when the pandemic put a stop to most air travel and they have never since approached the peak of $440 set in 2019. They now stand around $220 but could be hitting a ceiling, while the potential floor is way down at $120. Boeing does not pay a dividend so there is no yield.

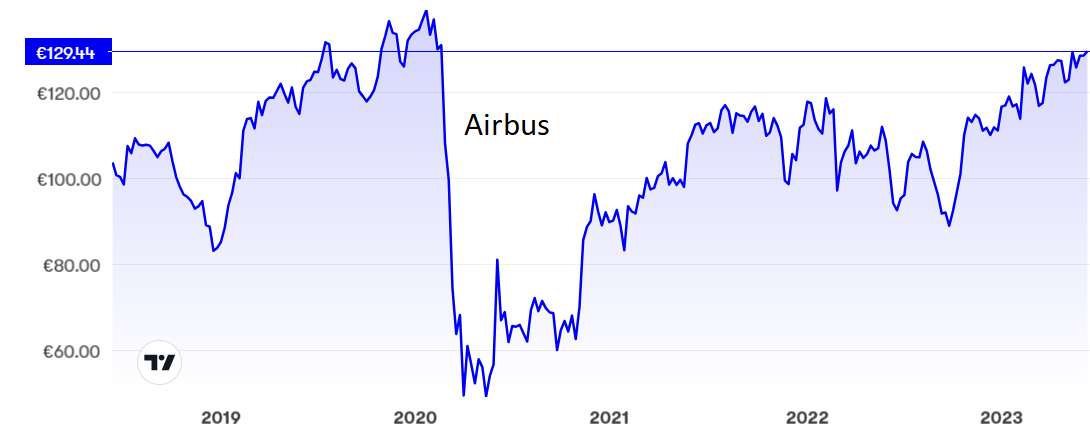

Arch rival Airbus SE (EURONEXT:AIR) has performed much better, a fact that is reflected in a share price that has almost returned to its pre-pandemic high of €139. Airbus is at least profitable, although the price/earnings (PE) ratio is challenging at 29 and the yield far from overwhelming at 1.4%.

Source: interactive investor. Past performance is not a guide to future performance.

Airbus delivered 63 commercial jets in May, its best performance for any month so far this year, despite also suffering from a shortage of parts. There is scope to step up production further as it is currently falling short of its annual target of 720 planes.

Hobson’s choice: Until Boeing can demonstrate that it can make consistent profits there is no attraction in the shares. Recent mild strength in the share price provides an opportunity to sell and take profits or cut losses. Airbus remains the better prospect. Its shares are worth at least a hold and it is not too late to consider buying even though the best chance has gone.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.