Two portfolios racing toward positive territory for 2020

Saltydog analyst’s forward-thinking portfolios got into cash early and are now buying sensibly.

1st June 2020 13:01

by Douglas Chadwick from interactive investor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Saltydog analyst’s forward-thinking portfolios got into cash early and are now buying sensibly.

Tech stocks lead the recovery

After a difficult first quarter of the year, stock markets around the world started to recover in April and most also made gains in May.

At the end of March, the FTSE 100 was showing a year-to-date (YTD) loss of 25%. It then went up 4% in April and 3% in May, but it’s still down 19.4% since the beginning of the year.

The FTSE 250 index fell further and went into April more than 30% lower than it was at the start of January. By the end of the month it had recovered by 9% and it went up a further 3.6% in May.

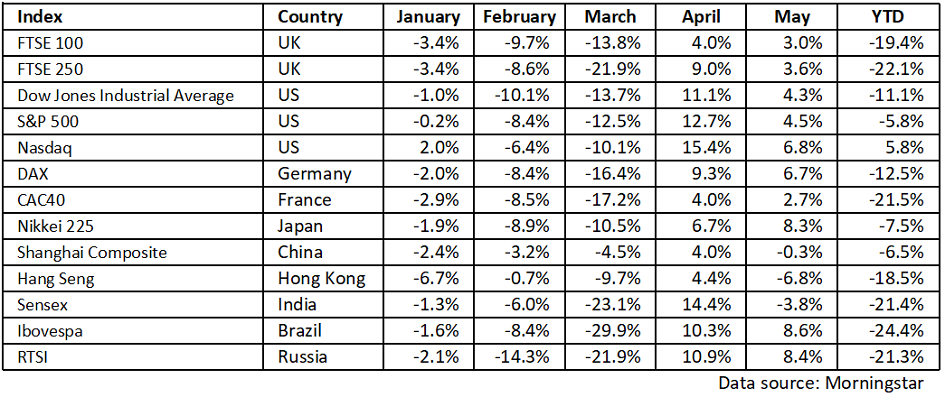

The table below shows the performance of some of the world’s leading stock market indices so far this year.

Apart from the Nasdaq, they all went down in January.

The Nasdaq Composite is an index of more than 3,000 stocks listed on the Nasdaq exchange that includes the world’s leading technology and biotech companies. It is the benchmark index for US technology stocks.

All indices fell during February and March, and many by 20% or more. The Shanghai Composite dropped the least, only going down 8%, and the next best was the Nasdaq, down 16%. The worst was the Brazilian Ibovespa which lost over a third of its value.

In April, when all markets started to recover, the Nasdaq led the way gaining 15.4%, and it’s gone up a further 6.8% in May.

It is the only index in the table that has fully recovered from the coronavirus crash and is now ahead of where it was at the start of 2020.

- Ian Cowie: tomorrow’s big winners in Asia

- Prospects for UK bank shares

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

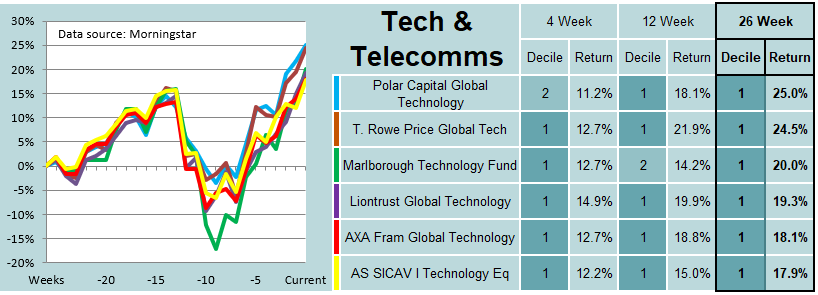

In our latest Saltydog analysis, the ‘Technology & Telecommunications’ sector leads over four, 12 and 26 weeks. The leading fund, based on its performance over the last 26 weeks, is Polar Capital Global Technology, up 25%. It’s also one of the funds that we are holding in our demonstration portfolios.

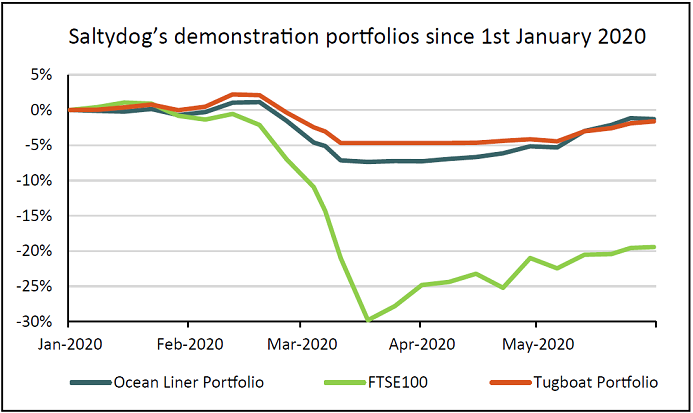

Both of our portfolios (the more adventurous Ocean Liner portfolio, and more cautious Tugboat portfolio) had a reasonable start to the year, but then dropped at the end of February/beginning of March when stock markets around the world started to fall.

As active investors, we reacted and headed for safety and so avoided the worst of the crash.

During the last couple of months, we have been stepping back into the markets and the portfolios are now heading back to where they were in January.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.