Two standout shares I’d snap up

Overseas investing expert Rodney Hobson examines two different companies that not only beat second-quarter earning expectations, but offer a rosy picture over the rest of 2023.

9th August 2023 10:28

by Rodney Hobson from interactive investor

Among the welter of companies reporting second-quarter figures, two quite different ones stood out for not only beating expectations but also for offering a rosy picture over the rest of the year. Neither companies’ shares have fully reflected the better prospects.

- Invest with ii: Most-traded US Stocks | Buy International Shares | Interactive investor Offers

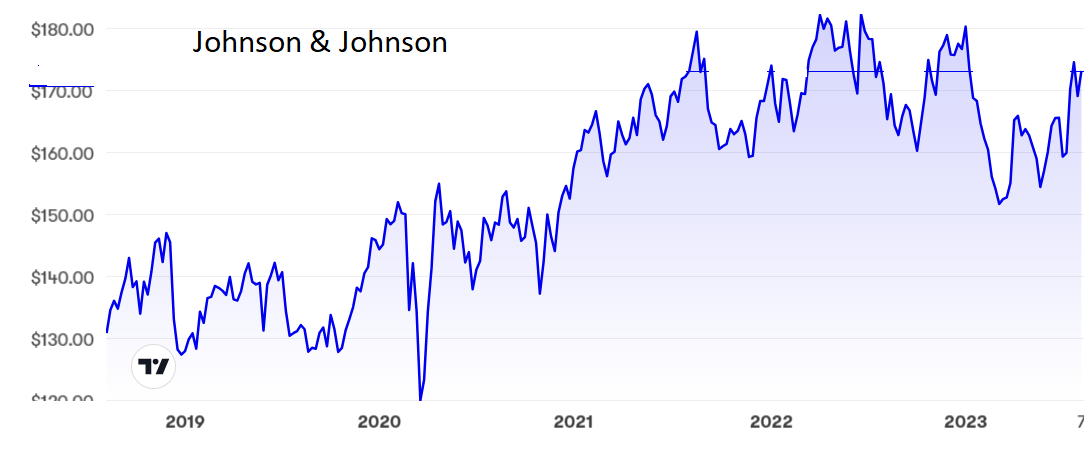

One of the most upbeat results statements in the latest round of figures from American companies came from pharmaceuticals and consumer goods giant Johnson & Johnson (NYSE:JNJ).

Second-quarter sales rose 6.3% to $25.5 billion, while net earnings were up 6.9% at $5.14 billion, both figures well up to or slightly better than analysts’ expectations. The performance was good enough to prompt the company to edge up its full-year guidance for sales, and also for earnings per share to reach at least $10.70. The quarterly dividend has been increased from $1.13 to $1.19.

J&J is focusing on two strands: pharmaceuticals and medical technology, no bad thing given that it has been juggling a somewhat disparate range of products. The latest move is to split off at least 80% of Kenvue, its former consumer goods arm, in which J&J still holds 90%.

- Keep hold of these shares for dividends and growth

- How Nasdaq-100 ‘special rebalance’ has impacted the big seven tech stocks

The medical devices side was badly affected by the pandemic but is bouncing back and will benefit from the concentration of attention.

Source: interactive investor. Past performance is not a guide to future performance.

However, life is never easy for health-related companies. On the plus side, there is strong demand for cancer treatments and newer cancer drugs should add a further boost, although one can never be sure that new drugs will live up to early promise. The blockbuster arthritis treatment Stelara has patent protection for now but cheaper rivals could be on the horizon in a couple of years’ time.

Then there is the massive litigation over J&J’s baby talcum powder, with nearly 40,000 lawsuits alleging the product caused cancer. J&J strenuously denies this but litigation in the United States is expensive and uncertain and the company has already set aside $8.9 billion to make the problem go away. With still no guarantee that it will do.

J&J shares shot up from $159 to $174 on the results but have since slipped back a little. The price/earnings ratio is challenging at 34, while the yield is a respectable 2.65%.

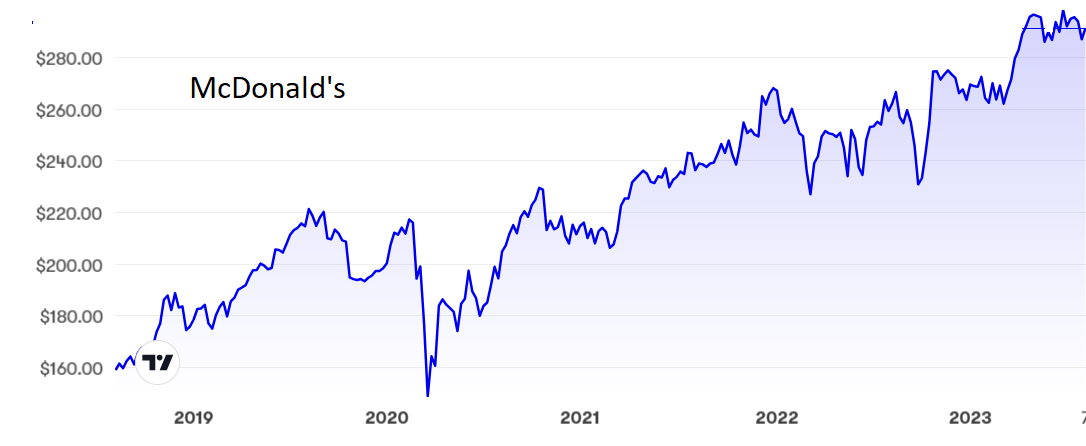

Fast food chain McDonald's Corp (NYSE:MCD) also beat profit expectations as it attracted more customers despite raising prices to offset inflation. Net income nearly doubled to $2.3 billion in the second quarter with total revenue up a less impressive but still respectable 14% to $6.5 billion.

Source: interactive investor. Past performance is not a guide to future performance.

Sales rose strongly across the world, with Germany and the UK narrowly topping the leaderboard. With inflationary pressures easing on ingredients and labour costs, the rise in revenue will tail off over the rest of the year but so will the squeeze on profits. In fact, as McDonald’s will no longer be forced to ramp up prices, it could well attract even more diners. In any case, costs are already falling, down 15% in the second quarter. The chain may be able to reduce prices in the current three months.

The stock market anticipated the better prospects with a strong rise in the share price from $260 in March to nearly $300 in May but the latest figures have produced only a muted response. At around $290 the p/e is 27 and the yield is just over 2%.

Hobson’s choice: I have recommended J&J shares several times, arguing that there is a floor at $160 and that they should regain their previous peak of $180. That stance is still in place.

The healthier eating campaign is clearly having little or no effect on McDonald’s. In any case, investors are more interested in whether the shares, not the meals, are tasty. I rated the shares a buy in May but took the precaution of suggesting that investors could wait for the price to slip back, which has now happened. Buy.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.