Barbie and Ken movie hype is just the beginning for Mattel

12th July 2023 10:35

by Rodney Hobson from interactive investor

The world’s most famous dolls live in a perfect world, and investors who just backed their human owners with real money are sitting pretty. Investing expert Rodney Hobson gives his opinion on the plastic pair.

Barbie and Ken are having the time of their lives in Barbie Land until they discover the joys and perils of living among humans in a fantasy comedy film to be released later this month. Those of us living in the real world must negotiate the joys and perils of investing in Mattel Inc (NASDAQ:MAT), the toy company that owns the rights to two of the most famous dolls in existence.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Do not underestimate how much is riding on this heavily hyped-up film. It has cost $100 million to make, stars Hollywood A-listers Margot Robbie and Ryan Gosling, and is to be distributed by equally famous film maker Warner Bros. Discovery (NASDAQ:WBD), which also has a lot riding on the success or otherwise of this venture.

Barbie’s favourite colour, hot pink, is being heavily promoted, not only in fashion – watch out for a rash of pink gingham dresses and Ken shirts – but also in gaming consoles, swimming pool floats and even Airbnb rentals. We are led to believe, rather fancifully, that the production sparked a shortage of pink paint. More than 100 outside companies have signed some form of collaboration with Barbie and Ken.

- Will this results season be a catalyst for cyclical stocks?

- Warning creates good entry point at this industry giant

- Investors expecting to make returns comfortably ahead of inflation in 2023

So well-known are the doll couple that observers may wonder why all this hype is necessary, but the romantic duo have come in and out of favour more than once and the brand is seen by many children and their parents as old-fashioned, no longer reflecting the world that youngsters live in. In fact, it is Hot Wheels, a range of die-cast vehicles, that is currently the big seller for Mattel.

Barbie is not the only big name controlled by Mattel. The doll and her boyfriend Ken sit on the toyshop shelves alongside the Fisher-Price educational range plus Polly Pocket and Thomas the Tank Engine. If Barbie shines on the silver screen, Mattel has 13 other brands lined up for films, television shows, live experiences and digital gaming.

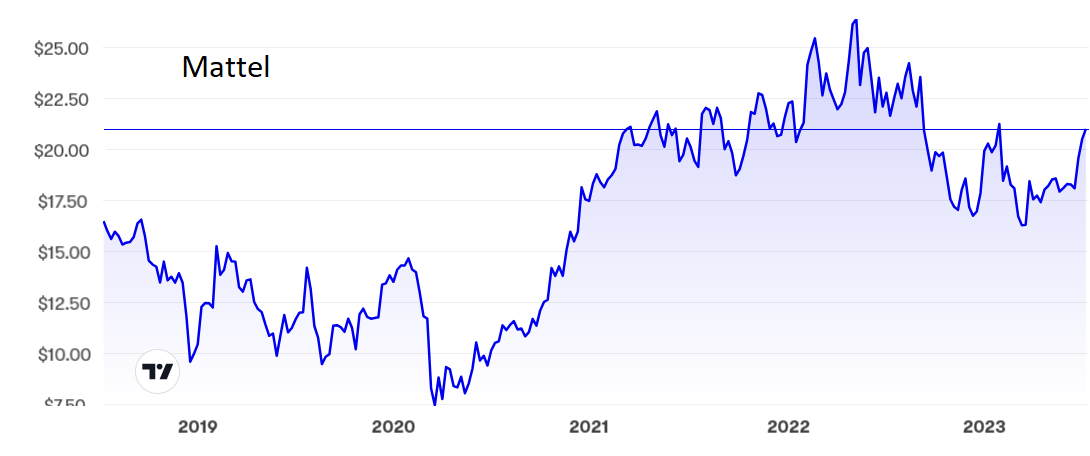

Source: interactive investor. Past performance is not a guide to future performance.

Sales of Mattel toys are aimed at a wide range of ages, from pre-school to early teens. The company has flexible options, manufacturing through partners as well as in-house and selling through retailers and direct to consumers.

It really does look to be a recipe for success. Yet Mattel shares have meandered erratically sideways for the past two-and-a-half years after recovering well from the stock market’s pandemic slump. The peak of $28 was set just over a year ago; a recent low of $16.25 was set in March this year before a recovery to the current level just over $21.

- A buying opportunity for fans of high yielding recovery stocks

- Have the big super-trends for the next decade changed since Covid?

Results for the first quarter have not helped much, affected as they were by retailers de-stocking in the face of consumers cutting back on discretionary spending. This is an issue that has also affected rival Hasbro Inc (NASDAQ:HAS).

Both Mattel and Hasbro recorded losses in the first quarter and, although the process will also have affected second-quarter sales, it should be ending round about now. Shareholders will probably have to brace themselves for another set of disappointing figures before better results start to come through, whether or not Barbie and Ken become film stars.

Hobson’s choice: I drew attention to Mattel last August when the shares were around $22, suggesting they were worth buying up to $25. I still think the shares rate a buy, but currently at a slightly lower price.

However, investors should bear in mind that the price/earnings ratio is pretty challenging at 28, while there is currently no dividend – which is why so much is riding on the success of this month’s screen release. Let’s hope it doesn’t end with Ken running off with Sindy.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.