Two UK funds we’ve added to

Saltydog Investor is capitalising on momentum in UK shares after a prolonged period out of favour.

11th June 2025 10:07

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Momentum is building in the UK stock market. A few weeks ago, when we were reviewing the leading sectors in April, I highlighted some UK funds that looked as though they definitely had wind in their sails.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Soon after, our demonstration portfolios invested in the JPM UK Smaller Companies fund.

For UK-based investors, there are several advantages to investing in funds that focus on the UK market. One of them is familiarity. Domestic investors are typically more in tune with the UK’s economic environment, political developments, and leading companies. This local knowledge can help improve confidence and decision-making.

UK-focused funds also reduce currency risk. When investors hold overseas assets, returns can be affected by exchange rate movements, for better or worse. By contrast, UK equity funds that invest in sterling-denominated assets provide a more direct link between company performance and investor returns. That said, it’s worth noting that many of the largest UK-listed companies, which dominate the FTSE 100, generate a significant proportion of their revenue overseas.

The UK market also offers breadth. It includes global multinationals, innovative smaller companies, and a wide range of sectors from consumer goods to healthcare. Fund managers with a UK focus tend to have a solid grasp of the market, and better insights into smaller, less-covered companies, where information is harder to find.

Investing in UK funds can also help support the domestic economy. While diversification remains important, there’s a strong case for maintaining meaningful exposure to your home market, especially when valuations appear attractive and economic conditions are improving. It almost feels patriotic.

- Active and passive pairs for different regions

- UK funds have wind in their sails

- ‘Distressed’ UK value investments that could triple

UK markets have had a mixed start to 2025, but recent data suggests a possible change in direction. Although the larger companies led the way earlier in the year, the past couple of months have seen medium and smaller businesses start to outperform.

In the first quarter, the FTSE 100 rose by 5.0%, supported by global-facing companies and sectors such as energy and commodities. In contrast, the FTSE 250, typically more focused on the domestic economy, fell by 5.6%.

More recent performance data paints a different picture. In April, the FTSE 250 rose by 2.1%, while the FTSE 100 fell by 1.0%. That trend continued in May, with the FTSE 250 gaining 5.8% compared with a 3.3% rise in the FTSE 100. These figures suggest that investors may be starting to take a fresh look at areas of the UK market that have lagged in recent years.

The economic backdrop has also improved. UK GDP grew by 0.7% in the first quarter, outpacing both the eurozone and the US. Growth forecasts for the year range from around 0.8% to 1.5%. Inflation appears to be heading in the right direction, and there is growing expectation that interest rates could continue to fall in the second half of the year. If that happens, it would typically be more favourable for mid- and small-cap companies, which are more exposed to domestic demand and often more sensitive to changes in borrowing costs.

Valuations across the UK market remain below historical averages. After a prolonged period of underperformance and outflows, this could be a good time to invest. We now have a stable government, interest rates are falling, inflation is stabilising, and growth is returning.

- Fund managers’ favourite UK smaller companies

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

There have also been some notable geopolitical developments. In May, the UK signed new trade agreements with the EU, India, and the US. These are expected to support exports and improve business sentiment, particularly in industries affected by tariffs and supply chain issues. While the immediate market impact may be limited, they could help underpin confidence in the broader economic outlook.

Last month, the Technology & Technology Innovation sector was the top performer, with a one-month gain of nearly 9%. However, the UK Smaller Companies sector was not far behind, rising by more than 7%. The other UK equity sectors also did well: UK All Companies and UK Equity Income both gained more than 5%.

In our demonstration portfolios, we now hold the Artemis UK Special Situations fund, as well as the JPM UK Smaller Companies fund, and we added to our holding last week. Both funds featured in our latest sector shortlists.

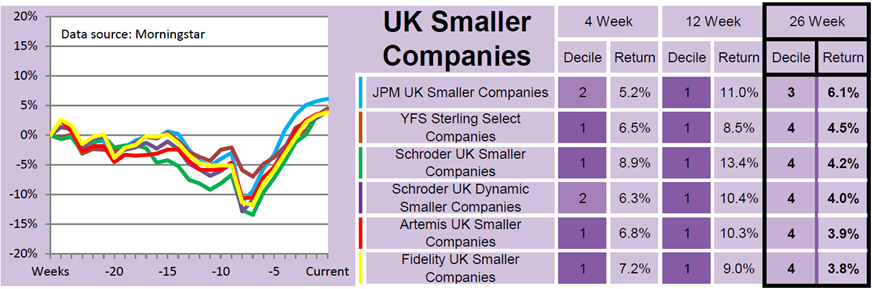

From the graphs below, you can see that the UK Smaller Companies funds were trending down for the first four out of the last six months. However, in the past eight weeks they have rallied.

Past performance is not a guide to future performance.

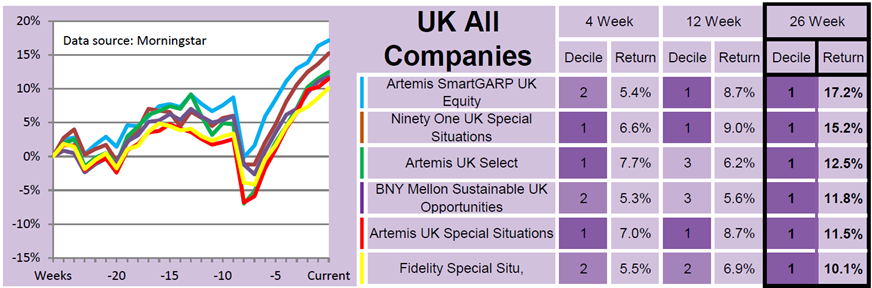

The picture is slightly different in the UK All Companies sector. These funds started the period strongly, suffered a sudden drop, and then recovered.

Past performance is not a guide to future performance.

Over six months, the leading UK All Companies funds have outperformed the UK Smaller Companies funds. However, over the past four weeks, the Smaller Companies funds have edged ahead, and could potentially have more ground to make up.

We have got both sectors covered in our demonstration portfolios, and hope that they continue on their upward trajectory.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.