UK bank shares and what happens now after SVB’s collapse

14th March 2023 12:52

by Graeme Evans from interactive investor

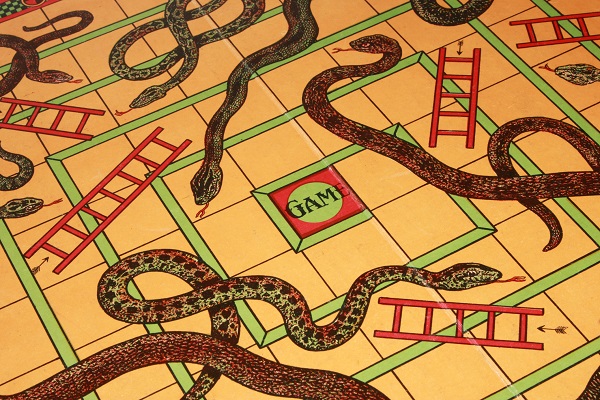

Owning UK bank shares since the financial crisis has resembled a game of snakes and ladders. Now, after SVB’s failure sent the sector tumbling, Graeme Evans searches for the next ladder.

Shares in NatWest Group (LSE:NWG) and Lloyds Banking Group (LSE:LLOY) are back near where they started the year after the London-listed banking sector lost 9% of its value in the Silicon Valley Bank sell-off.

The latest setback in the industry’s stop-start recovery since the 2008 financial crisis was particularly painful for followers of international-focused lenders, led by Standard Chartered (LSE:STAN) after the Asia-focused operator surrendered 12%.

Recent strong results and bid speculation means Standard is still 9% higher over the year, whereas Barclays (LSE:BARC) is 7% lower so far in 2023 after a decline of 10% since Thursday.

- Invest with ii: Open an ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

HSBC Holdings (LSE:HSBA), which yesterday spent £1 on the profitable UK operations of Silicon Valley Bank in a move that added £6.7 billion of deposits, lost 10% in the US-led sell-off but is 9% higher in 2023 thanks to the earlier support of some City best buy recommendations.

NatWest and Lloyds shares were buoyed at the start of the year by their robust loan books and promise of more bumper shareholder returns, but the pair are now just 3% and 4% higher for 2023 after losing over 7% since the US crisis began.

Outside the FTSE 100, the picture is bleaker for investors in Virgin Money UK (LSE:VMUK) as the challenger bank’s shares have lost a fifth of their value this year after a decline of 14% since last Thursday.

The sell-off has hit UK banks hard even though they have more diversified deposit bases than some of the more technology-concentrated US lenders. The bigger concern for European investors is that SVB Financial Group (NASDAQ:SIVB)’s demise shows the risks from tightening monetary policy and slowing economic growth are beginning to crystallise.

Analysts at Liberum pointed out yesterday that the increased competition for deposits means that the initial success banks had in keeping their deposit rates low will be harder to maintain. This will result in net interest margins being squeezed, particularly with interest rates now less likely to increase after the collapse of the US lender.

Analysts note that Silicon Valley Bank's uninsured deposit mix was one of the highest in the industry, and that made it especially vulnerable both to outflows and to mark-to-market losses when it attempted to meet those outflows.

- ii view: is Lloyds Bank share slump an opportunity?

- Must read: market reaction as HSBC rescues Silicon Valley Bank's UK arm

UBS strategist Caroline Simmons said: “For those wondering if something similar can happen in the UK - we deem that unlikely.

“UK banks have a more diversified customer base and offering. Importantly they also hold greater percentages of their deposit size at central banks. And they have more evenly matched loan-to-deposit ratios, meaning that while they can also suffer a deposit margin squeeze at higher interest rates, they also get to reprice their loans in step to offset it.”

She added that UK banks don’t have the same exposure to potentially needing to mark-to-market large quantities of bond portfolios as was the case in the US.

Simmons said UBS continues to see potential upside for UK lenders, with net interest margins nearing the top of the cycle but still healthy. Meanwhile, loan-loss provisions are still fairly high following the pandemic, cushioning against a potential rise in defaults.

Strong cash flows also allow banks to keep offering attractive dividends and share buybacks of approximately 10% of their market capitalization a year, over the next two years.

- ‘High risk? I don’t see it that way’: the investment secrets of an ISA millionaire

- 2023 Investment Outlook: stock tips, forecasts, predictions and tax changes

Simmons said in her weekly update that the UK equity market remains one of the Swiss bank’s most preferred equity regions with a forecast for the FTSE 100 to reach 8,300 by December.

As well as single-digit capital upside from here, there’s a 4% dividend yield and a 12 month forward price-to-earnings multiple of just 10.5x - lower than its historical average

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.