UK economy shrinks by a fifth – will easing lockdown kick-start growth?

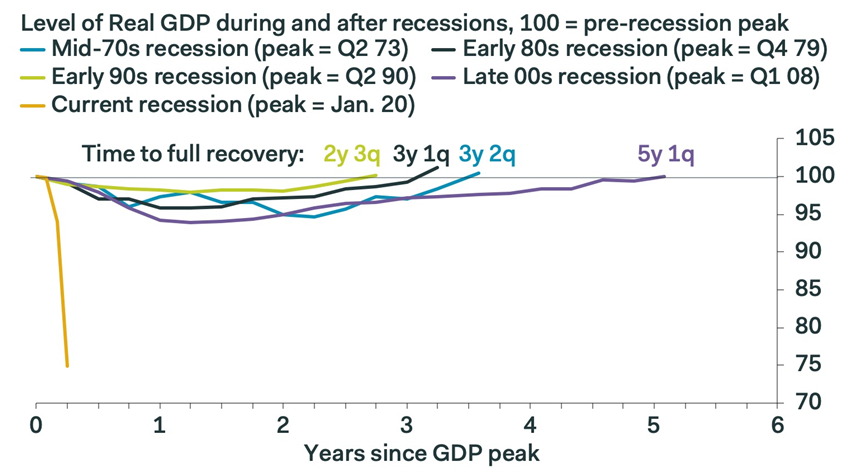

GDP has slumped to a much greater extent than in previous recessions.

12th June 2020 11:17

by Tom Bailey from interactive investor

GDP has slumped to a much greater extent than in previous recessions.

The UK economy shrank by over a fifth in April, according to the latest figures from the Office of National Statistics. The figures showed that GDP fell by 20.4% month-to-month in April, much more than the -18.7% being forecast by economists.

A serious decline in GDP had been widely expected. As Robert Alster, head of investment services at Close Brothers Asset Management, notes: “April’s GDP figures are shocking, and are certainly cause for concern. However, following a shutdown of retail, manufacturing, and industrial production, the rear-view mirror was always going to reflect a difficult environment.”

The recent rally in equity markets skewed widespread perception of the actual damage being done to the economy, notes Alastair George, investment strategist for Edison Group. He says: “The risk has been that central banks have almost been too effective in supporting markets, masking the economic cost of lockdowns as well as dimming employment and training prospects for younger people less at risk from Covid-19. These will be important figures to frame the debate on the government’s lockdown policy for the remainder of the year.”

According to Pantheon Macroeconomics, April’s large slump in GDP means that measured from January's peak, GDP has slumped by a massive 25.2%. They note: “This collapse greatly surpasses the 6% peak-to-trough decline in GDP seen in the 2008-to-09 recession, which previously was the deepest in post-war history.”

When will the economy recover?

The good news is that the UK economy has likely already hit its low point for the year, argues Pantheon Macroeconomics. They point out that the government’s announcement that all employees unable to work from home should return to work has helped to kick-start a recover in the industrial and construction sectors.

The economics consultancy notes: “A variety of unconventional indicators of economic activity - such as energy consumption, online search data and vehicle miles - suggest economic activity is recovering, while surveys of retail sales improved greatly in May.”

Ed Monk, associate director for Personal Investing at Fidelity International, says the economy should continue to recover. He notes: “With social distancing measures starting to relax, businesses slowly returning to work, and moves to reopen non-essential shops from Monday (15 June), the economy is gradually reopening and the growth number will hopefully spring back in the months ahead. The question is by how much, and the ability of companies to stay afloat and retain staff is now key.”

Pantheon Macroeconomics, however, strikes a more pessimistic tone, warning that the UK economy will likely “remain a shadow of its former self later this year.” They argue that the UK economy will continue to suffer from lower levels of employment, lower investment and households prioritising savings over spending.

Alster notes that the risk of Brexit is also hanging over the UK economy and likely to restrain any recovery. He says: “The journey to recovery will not be easy. The OECD has expressed serious concerns about Britain’s ability to bounce back from the economic hit, worsened still by the ongoing Brexit negotiations which will come to a head at the end of the year.”

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.