Utilico Emerging Markets investment trust half-year report

22nd November 2022 14:14

by Jemma Jackson from interactive investor

interactive investor comments on the update from the Super 60 rated investment trust.

- The board reported an increase in dividends per share to 4.15p (a 3.8% increase). Earnings per share increased 13.1% to 6.83p

- NAV Total return per share for the period was -2.8%, versus a falling benchmark of -7.6% for the six-month period. The macro environment has been incredibly challenging but the trust’s performance has held up better than its benchmark and has seen revenue earnings rise

- Gross assets of Utilico fell from £522 million from £570 million

- Geographical allocations stayed consistent, with the exception of Brazil and India allocations which increased, partly due to market rises

Management

Utilico Emerging Markets (LSE:UEM) Investment Trust is an ii Super 60 rated trust, which offers investors exposure to infrastructure and utility investments, predominantly in the Asian, Latin American and Emerging European and African markets, with flexibility to invest worldwide. Charles Jillings heads up the trust and seeks out under-valued companies with unrealised growth prospects. Jillings brings the trust many years of corporate finance and asset management experience, with over 30 years of working in international financial markets and seeks to invest in established companies with sustainable cash flows.

Portfolio

Regional Exposure: as mentioned, Utilico is free to invest in a flexible manner with regards to regional allocation. While most regional allocations stayed consistent during the six-month reported period, allocations to Brazil and India saw increases to make up 22.4% and 13.8% of the portfolio’s assets respectively. These increased allocations were in part due to market upticks as these are two economies that have performed strongly in the YTD period, with MSCI Brazil and MSCI India indexes up 42% and 9% respectively, where most other major economy indexes made losses.

Unsurprisingly, given the broader market downturn in China, losses over the year-to-date period for Utilico, according to Morningstar data, have largely come from Utilico’s exposure to China, which makes up circa 14% of the portfolio as at the end of October 2022. For example, holdings in China Everbright Greentech (SEHK:1257), China Everbright Environment Group (SEHK:257), and China Gas Holdings (SEHK:384), all have posted losses of near 50% YTD. While management view China’s zero-Covid policy as a concern and a drag on returns from the region, many now share a hope that reversal of such policies could drive a welcome surge in demand, according rises in commodities and trade and reversal of such losses.

Currency: as has been the story for many funds/investment trusts this year, currency volatility has been another challenge for managers to navigate. The weakening of the pound through the first three quarters of 2022 and concurrent relative volatility of many emerging market currencies has meant that Utilico had a tough job in managing FX exposure since the start of the year. Utilico finished the six months to September 2022 with a marginal foreign currency related loss of £0.6 million, highlighting the foreign exchange risk associated with EM investment.

Performance

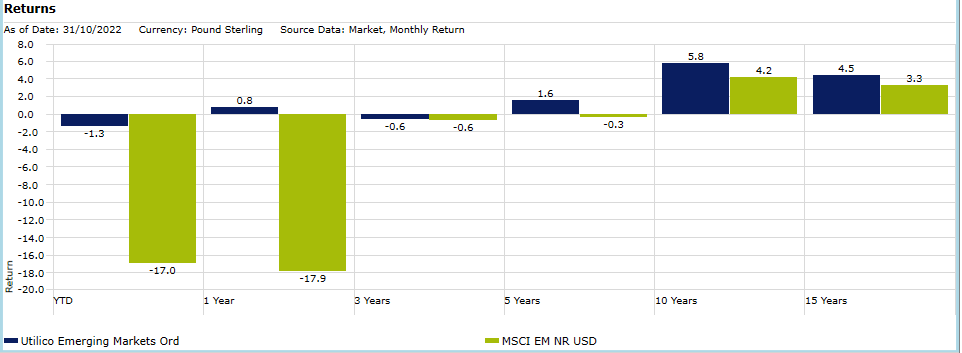

Returns: the trust has reported a NAV total return of -2.8% for the six months to September 2022, versus a fall of the MSCI EM benchmark of -7.6% over the same period. While short and long-term returns for Utilico do display a heightened level of volatility when compared to the trust’s benchmark MSCI Emerging Markets index and versus peers, much of the downside volatility suffered by peers has been avoided through the recent market downturn, with max drawdowns just 50% of those experienced by the benchmark MSCI Emerging Markets index through 2022. Since the turn of the year, Utilico’s share price return to investors (albeit negative) of -1.3% has served investors far better than the circa -17% loss seen by its benchmark index, and over 10 years, Utilico’s annualised return of near 6% beats its benchmark by circa 1.6% (data to October 2022 end).

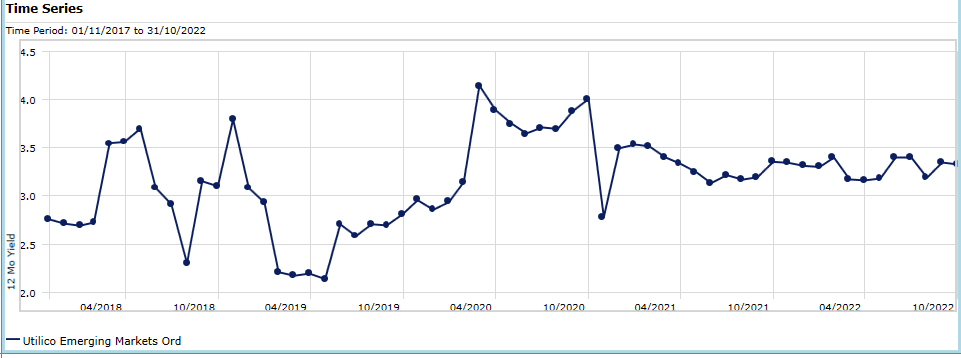

Dividends: management reported an increase in earnings per share of 13.1% vs the half year to September 2021. Accordingly, the dividend per share increased by 3.8% to 4.15p. Current investors will be encouraged to know that this is dividend is covered fully by income. Many investors will be attracted to Utilico versus other emerging markets trusts by the yield. The 12-month yield of the trust of 3.3% puts the trust close to the top of its AIC sector peer group of Global Emerging Market trusts.

Discount

The trust has displayed volatility with regards to its discount to NAV, which has fallen over the past year from an average of circa -11% at the start of the year, reaching a depth of -17% at the end of October. The current discount at last market close (21/11) of near -15% means the trust is trading lower than its 12-month average of closer to -11%. Over the past six months, the trust has employed share buybacks to the tune of nearly £19 million, although this is enacted first and foremost as an investment decision, rather than purely with discount control in mind.

Summary

Dzmitry Lipski, Head of Funds Research, interactive investor, says: “In the context of tough macro-economic conditions for developed and emerging markets alike, while Utilico’s returns for the past six months are not positive, the trust has held up better than many peers and has far outstripped its benchmark index. Investors with appropriate risk appetite may well be attracted to emerging markets in order to gain exposure to a potentially higher rate of GDP growth than experienced in developing markets. For those who understand the often enhanced currency, liquidity and political risks associated with emerging market investment, Utilico may pose a good option for both capital appreciation and attractive yield in this space, offering access to established, cash-producing assets in the infrastructure and utilities sectors across a range of emerging market countries.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.