Watch out for currency risk with these funds

23rd May 2022 14:46

by Douglas Chadwick from ii contributor

Funds that specialise in this area of the stock market have been star performers so far in 2022, but Saltydog analyst points out a stronger pound threatens gains.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Last week, I wrote about the concerns we had over the energy and natural resources funds that we hold in our demonstration portfolios, Tugboat and Ocean Liner. Not much else is going up at the moment, so they account for a relatively large proportion of the amount that we have invested.

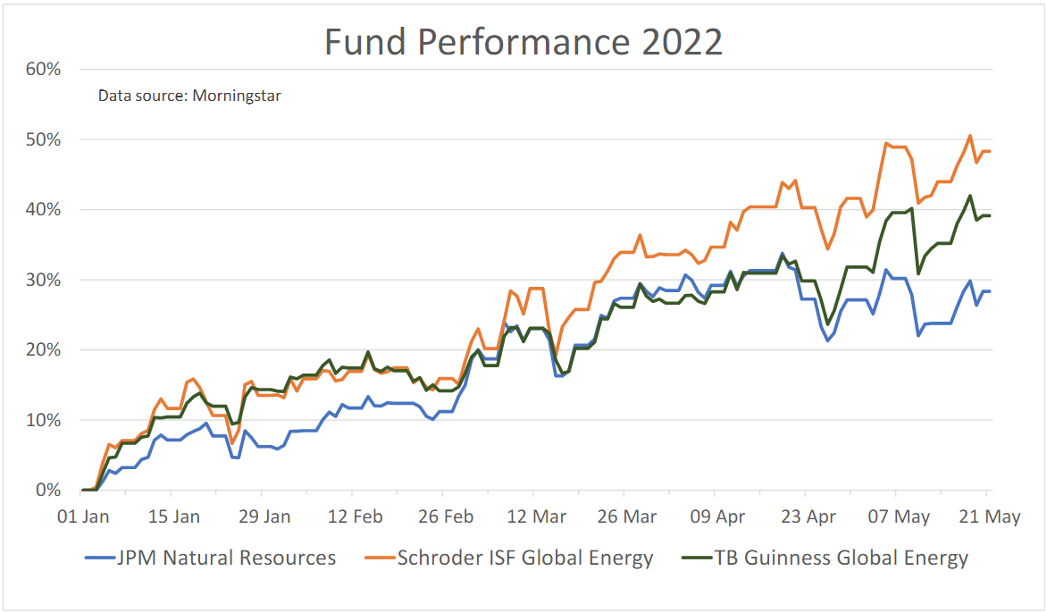

The three funds in question are Schroder ISF Global Energy, TB Guinness Global Energy and JPM Natural Resources. The previous week they had all suffered a one-day drop of over 4% and we were not sure if it was temporary, or the start of a more serious correction.

Fortunately, they recovered and the two energy funds went on to new highs. It looks as though their upward trend continues but it has not been plain sailing.

Past performance is not a guide to future performance.

The reasons supporting their current strength remain valid. During lockdown the demand for energy decreased, and so production was cut back and reserves depleted. As demand has started to increase, there is now a shortfall pushing up prices. The war in Ukraine has made the situation worse.

However, these circumstances could easily change. At some point, hopefully sooner rather than later, the war will end. At that point, depending on the political circumstances, sanctions may be relaxed and Europe could start using Russian oil and gas again. There are also several of the large oil-producing countries, such as Saudi Arabia, the United Arab Emirates and Iraq, that could easily increase production. At the same time, increasing prices make alternative options like fracking more viable.

- How Saltydog invests: a guide to its momentum approach

- The top 20 funds so far this year

- This fund sector is bouncing back: how best to take advantage

Although demand for oil and gas may continue to increase in the short term, as the world economy recovers from the Covid-19 pandemic, governments around the world are committed to reducing the reliance on fossil fuels in favour of nuclear and renewable energy.

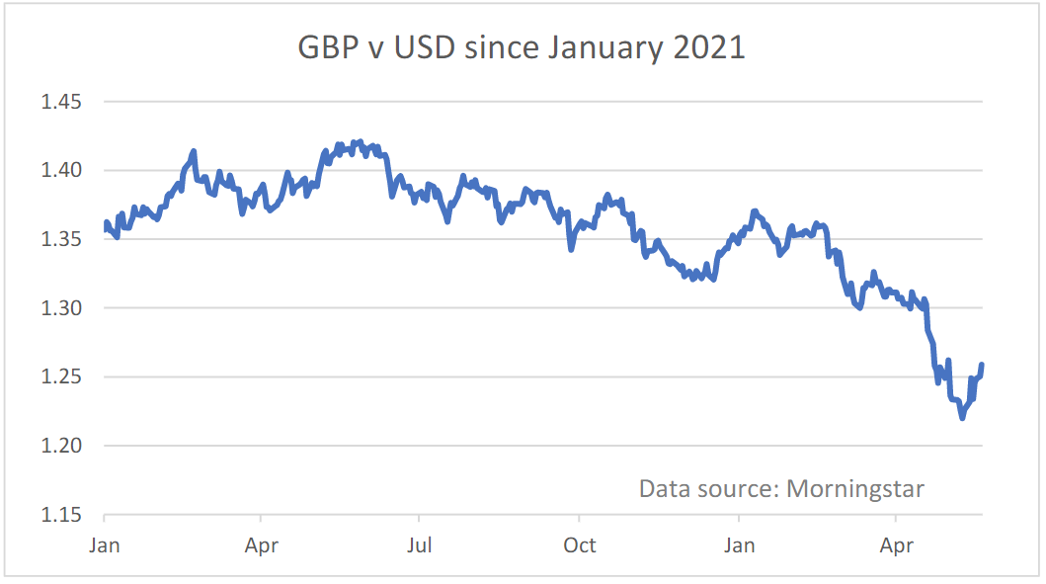

As UK investors, we also need to be aware of a currency risk. These funds invest in large international companies with most of their revenue coming from outside the UK, and much of it will be denominated in US dollars. Over the last year, sterling has weakened against the dollar, which would have given an additional boost to these energy funds. Recently, the pound has started to strengthen. If this continues, then it will have the opposite effect.

Past performance is not a guide to future performance.

For the time being, we are sticking with these funds but will be reviewing them each week. Hopefully, they still have further to climb, but at some point they will run out of steam and we need to be ready to act.

The JPM Natural Resources fund has not done quite as well. It still has not got back to where it was when it peaked in April, but is not far off, and so we are giving it the benefit of the doubt for now.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.