WH Smith rallies, while records fall in US and at Hays

30th August 2018 11:02

by Lee Wild from interactive investor

US markets may still be volatile, but Lee Wild reports records both on Wall Street and at recruiter Hays. WH Smith is firing on all cylinders, too.

There's life in this bull market yet if this week is anything to go by. Coming off the back of a strong results reporting season, and with data showing the US economy in great shape, the S&P 500 is making record highs for fun.

Talk of a new trade agreement with Canada just days after Trump signed a "really good" deal with Mexico is the catalyst for the latest rally.

A potential escalation of the trade war with China remains an overhang, and there is substantial risk here, but if Trump can work with his arch enemy Mexico, there's hope he can do the same in the Far East.

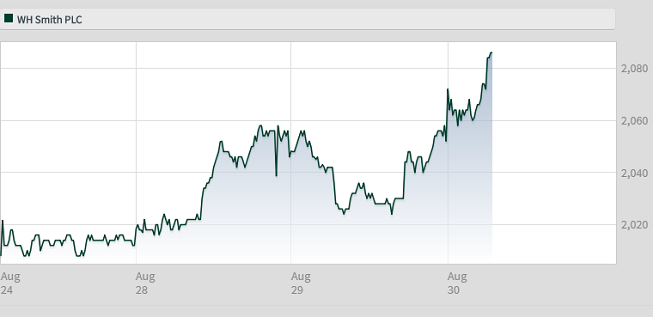

WH Smith

WH Smith kept its fourth-quarter trading update brief but manged to say everything the market wanted to hear.

Despite a lack of detail, we do know that the important travel business is still growing fast, is opening new stores, and that cost cuts have improved margins at the High Street chain.

Smiths' share price has come off the boil this year but is still not cheap. A deeper dive on the business and a forward-looking statement at the full-year results in October could be the catalyst for further gains.

Source: interactive investor Past performance is not a guide to future performance

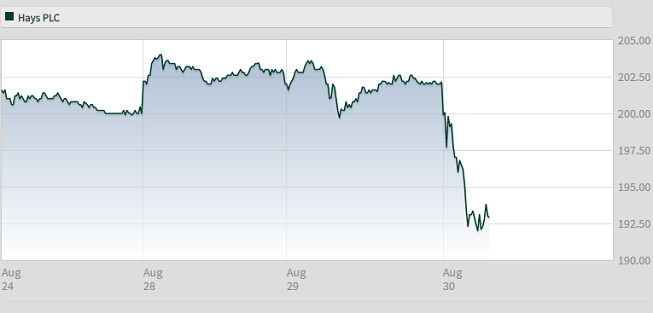

Hays

A bullish update in July was not the main course, it seems. Hays has followed up exciting fourth-quarter figures with forecast-beating annual results - £242 million operating profit versus £241 consensus - and another special dividend which justifies optimism around the business right now.

The numbers impress almost everywhere you look. There was strong growth in net fees across the board with records in 22 countries, although it's the overseas operations that have really taken off. Japan, Hong Kong and China were the driving force behind 51% profit growth at the Rest of World division. Brexit and fears around the economy are clearly affecting the UK, but even here there was modest growth in both net fees and profit.

This year may not be a one-off either judging by the optimistic tone. Conditions in nearly all its markets remain positive and there is still plenty to go for, especially in Germany, France and the US. Management just completed an ambitious five-year strategy, and there are plenty backing them to achieve much in their 2022 plan.

Importantly for income investors, Hays is throwing off so much cash it is able to fund a second special dividend of 5p a share, which nudges the dividend yield above 4%. Shareholders should get used to this if the company keeps generating this level of free cash.

Source: interactive investor Past performance is not a guide to future performance

Despite doubts about the sustainability of global economic growth, there seems more reason to be optimistic right now, and Hays lets the numbers speak for themselves. It's generated year-on-year growth for 21 consecutive quarters and is breaking records worldwide. Next year should be solid too, although will be a big ask to generate the same kind of growth in 2019.

Hays would run into trouble if the global economy hit a rough patch, but it would take time to feed through, and there are no signs of any trouble outside of the UK in these results. A share price that's doubled in two years and still trades near a 16-year high explains some profit-taking early Thursday.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.