Where to invest in Q2 2024? Four experts have their say

Our panel of four professional asset allocators give their outlook for equities, bonds, property and gold.

19th April 2024 08:50

by Jim Levi from interactive investor

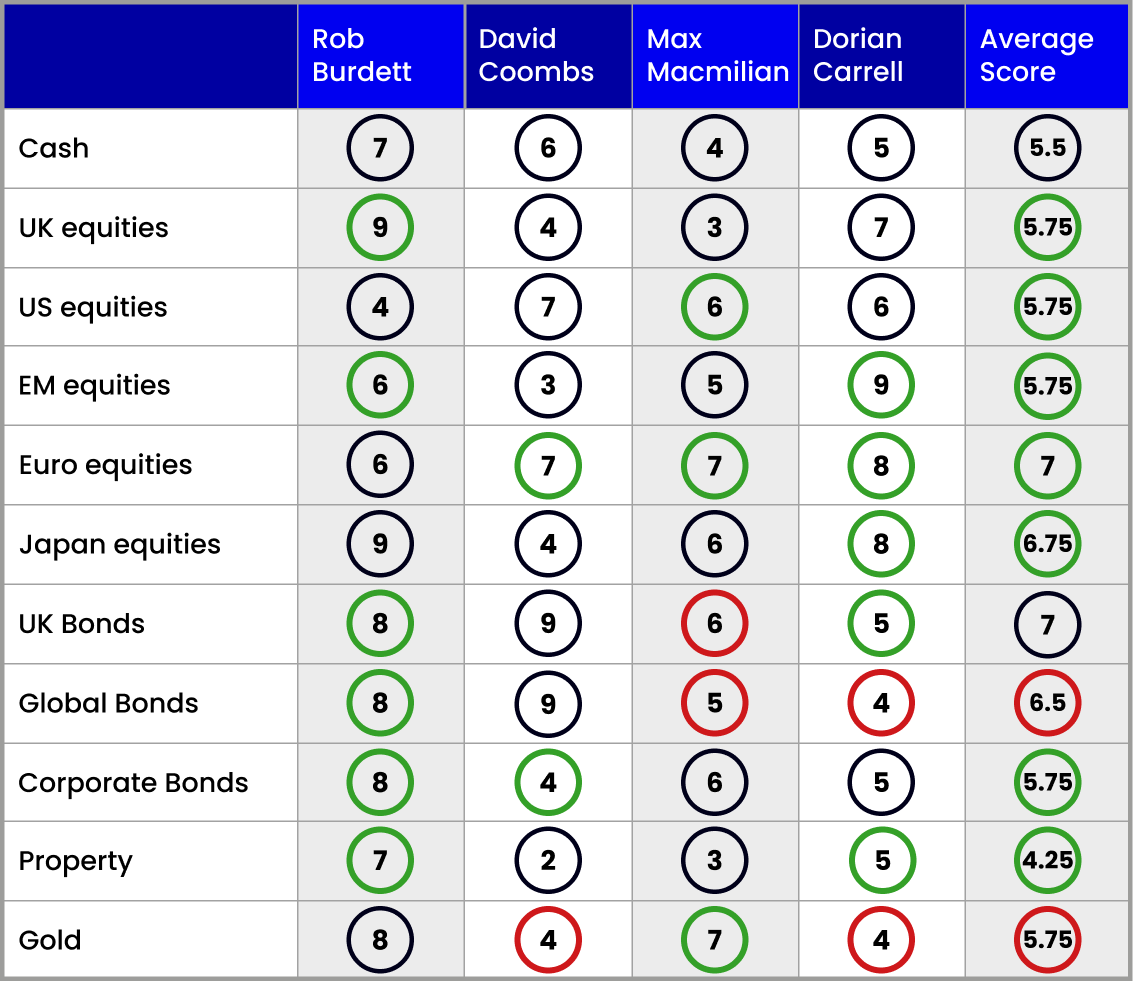

It is not that often that we find all four members of our panel of asset allocators agreeing with one another. But on European equities (ex-UK) they are all now singing from the same bullish hymn sheet.

At abrdn, Max Macmillan has done a remarkable volte-face, raising his score from 2 to 7. Dorian Carrell at Schroders has increased his score from 7 to 8. All four asset allocators hold overweight positions on European equities and the average score is now 7.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

Reasons why the pros are more bullish on Europe

It is not hard to see why there is such optimism. Financial markets seem now to believe the European Central Bank (ECB) will be the first central bank to begin the next round of eagerly awaited interest rate cuts. Inflation in the eurozone has now fallen to 2.4% compared to 3.2% in the UK and 3.5% in the US.

Traders in financial markets are now betting that ECB chief Christine Lagarde will trim 0.25 percentage points off the current 4% base rate in June, while they fear the US may not see cuts until the autumn. European equities have already been in lively mood since the beginning of this year with various indices showing gains of approaching 10% - not dissimilar to the gains on Wall Street seen so far this year.

“European equities’ big appeal is in the choice available including large multinationals on modest valuations,” says Carrell. Macmillan argues that “cyclical stocks are back in favour and manufacturing is recovering while the central bank is in a dovish mood - all factors favouring European equities”.

Gold rally causes some profit taking

However, grabbing more of the headlines lately is gold. The yellow metal has proved easily the outstanding asset class lately - gaining nearly $400 an ounce since the beginning of 2024 and climbing to all-time peaks. The four panel members are divided over how to react. David Coombs at Rathbones and Carrell think it may be time to take some profits and both have gone underweight (with a score of 5 being neutral).

Carrell admits candidly: “We are not sure how we are supposed to value gold.” He trims his score from 6 to 4.

There is an element of mystery about gold’s strong performance. Today’s background of falling inflation and a strong dollar might normally have prompted weakness in the yellow metal. But we are not living in normal times: the dangers of widening conflict in the Middle East and Eastern Europe may be enough to explain gold’s spectacular performance.

- Funds and trusts four professionals are buying and selling: Q2 2024

- Gold’s hitting new highs – why it’s rising and how to invest in it

Macmillan raises his score from 5 to 7, while Rob Burdett, who has just left Columbia Threadneedle Investments, keeps his gold score at 8. Macmillan notes: “We believe China is having quite a big influence on the gold price both from the central bank buying and from retail investors. China is still paying the price for its Covid policies with a weak currency, problems in property and a very uncertain equities market. So Chinese private investors are buying gold.”

Strong start to the year for investors going global

Global equities have just had their best first quarter for five years with Wall Street leading the way. The real momentum came from investors piling into major US tech stocks linked to the new boom in artificial intelligence (AI).

Star performer NVIDIA Corp (NASDAQ:NVDA), maker of key AI computer chips, has more than trebled in value in the past year. This vindicated Coombs’ consistent strategy of staying overweight in US equities.

He says: “Wall Street may not perform so well in the second quarter, but you have to be very brave to be underweight stocks like Microsoft Corp (NASDAQ:MSFT), Amazon.com Inc (NASDAQ:AMZN) and Alphabet Inc Class A (NASDAQ:GOOGL)(Google).

Burdett is the only panellist who is underweight US equities. “This is only because valuations are so high,” he explains. “The US is still the best-performing economy in the world and the most flexible. Even I do not want to score below 4 for the US.”

As with European equities, Macmillan has gone from bear to bull in US equities - raising his score from 3 to 6. He admits “We have capitulated on the idea that recession is the most pressing risk for the US, but we don’t mind changing our view. We consider ourselves to be flexible.”

Land of the rising returns

Over the past year, Japanese equities have been the best-performing equities sector with a rise of around 40%. On 22 February, the Nikkei 225 index broke through to an all-time high for the first time since 1989.

All this finally vindicates Burdett’s long-term enthusiasm for the sector whose performance so far this year has outshone all other equity markets. Can it continue its upward trajectory? Burdett thinks so and keeps his score at 9. “Valuations remain attractive compared with other markets,” he says.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- DIY Investor Diary: becoming an ISA millionaire was like completing a marathon

Burdett is not alone. Carrell has lifted his score from 7 to 8. Carrell remains overweight in all equity sectors but scores highest for emerging markets. “We are raising our score from 8 to 9 because of the opportunities that are being overlooked. We find companies on low earnings multiples where earnings in many cases are growing,” he says.

Coombs takes the opposite line and continues to largely avoid the sector keeping his score at 3. “I am not a massive fan of emerging markets,” he admits. “I don’t think the prospect a stronger dollar and of interest rates remaining higher for longer provides a particularly helpful background for emerging equities.”

UK market continues to divide the pros

There is a similar divergence of opinion over UK equities. Optimist Burdett says: “I keep reading articles about the death of the UK and I regard that as a contrarian signal. So I am raising my score from 8 to 9.” He admits UK equities have underperformed other markets so far this year but they are now showing “signs of life.”

However, while Macmillan may be now overweight equities in the US, Europe and Japan, he remains firmly in the bearish camp for UK equities in leaving his score unchanged at 3.

Coombs also remains underweight the sector. “The fear of oil giant Shell (LSE:SHEL) moving to a US listing, like travel group TUI AG (LSE:TUI) and others, overhangs the UK market. To my mind, the UK has now become more of a stock picker’s market rather than a market for asset allocators.”

The panel’s views on UK equities are reflected in their opinions on the property sector. Burdett continues to be the only optimist raising his score from 6 to 7, although he now has some support from Carrell who goes from underweight to neutral. But for both Coombs and Macmillan, property remains firmly out of favour.

Burdett is convinced the UK economy “is more robust than we thought and that is particularly true of the property sector where yields can be attractive.” He says if there has been a recession it has been a very mild and short-lived one.

Are delays over interest rate cuts misplaced?

Again, in government bonds, opinion is quite sharply divided. Macmillan has admitted he no longer thinks global recession is the most-pressing risk to financial markets. He now argues that the greatest risk is “inflation being too hot with interest rates staying higher for longer”, So he is softening his stance on government bonds by lowering his score for UK bonds from 8 to 6 and for global bonds from 7 to 5.

- Bond Watch: the gilt attracting more cash than any other investment

- Benstead on Bonds: these lower-risk funds are best income opportunity

Meanwhile, Carrell has gone underweight global bonds although he has edged up his score for UK bonds from 4 to 5. “The US economy shows very little sign of being stressed by the central bank’s monetary policy,” Carrell says. It supports his view that further US interest rate cuts may be put off until the autumn.

Both Burdett and Coombs remain strongly overweight in UK and global bonds. Burdett raises his scores for both from 7 to 8, while Coombs stays at 9.

Burdett says worries about inflation and delays over interest rate cuts are misplaced. “Markets seem to have been expecting inflation and interest rates to go smoothly up to the top of the hill and then smoothly down again,” he says. “History shows it just does not work like that and there are bound to be big hiccups on the way.”

Note: The scorecard is a snapshot of views for the second quarter of 2024. How the panellists’ views have changed since the first quarter of 2024: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett has been a professional fund buyer for over three decades. He recently left his role as head of multi-manager solutions at Columbia Threadneedle Investments.

Dorian Carrell is head of multi-asset income at Schroders.

David Coombs is head of multi-asset investments at Rathbones.

Max Macmillan is head of strategic asset allocation at abrdn.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.