Where to invest in Q4 2021? Four experts have their say

19th October 2021 12:41

by Jim Levi from interactive investor

Our panellists are well aware of the risk that stock markets may soon suffer a relapse.

It is now clear the global recovery from Covid will be anything but straightforward. Bottlenecks and supply chain problems galore accompanied by acute labour shortages, soaring energy and shipping costs may even tip some countries including the UK into stagflation.

“This has all come about because the world economy has gone from zero to 100 miles per hour in very short order,” says Abrdn’s Richard Dunbar.

He adds: “It would be unreasonable to expect the transition to be a smooth one. Even so, the problems of recovery are proving greater than expected and they are persisting longer than expected. Inevitably growth expectations are being lowered.”

- Funds and trusts four professionals are buying and selling: Q4 2021

- Most UK equity income trusts are on a discount, which is the best value?

Keith Wade at Schroders describes the recovery as “very unbalanced”. He points out that recovery in the US has been focused on durable goods spending. “It has now gone well beyond the levels achieved before the pandemic,” he says. “It means shipping, other transport and manufacturing are having a boom while the service industries are still catching up.”

‘Our feeling is we are heading into choppy waters’

Where does all this leave the stock market? For the past three months, nearly all the leading equity markets apart from China and Hong Kong have been treading water at not far below peak levels and may appear to be ignoring all the ominous background noises. Our panel are well aware of the risk that equities may soon suffer a relapse.

“Our feeling is that we are heading into choppy waters and we know equities have not had any kind of serious correction since March 2020,” says BMO’s Rob Burdett.

He adds: “Central banks are trying to get away with the confidence trick that inflation is transitory. But there is a reasonable case for thinking that shipping costs, for example, may remain high for quite a while. There is a shortage of ships but it takes three years to build a new one.”

Central bankers have limited powers to control inflation

According to Rathbones’ David Coombs, the Bank of England and other central banks now realise they have limited powers when it comes to controlling inflation.

“They cannot control shipping costs, fuel prices, the wages of HGV drivers or other bottlenecks,” he says. “The danger is they may overreact to the situation and be too heavy-handed.”

Dunbar believes the central banks “do have to work out what is causing inflation. For instance, does raising interest rates make any difference to the problem of hiring more lorry drivers?”

How the pros are reacting to the changing climate

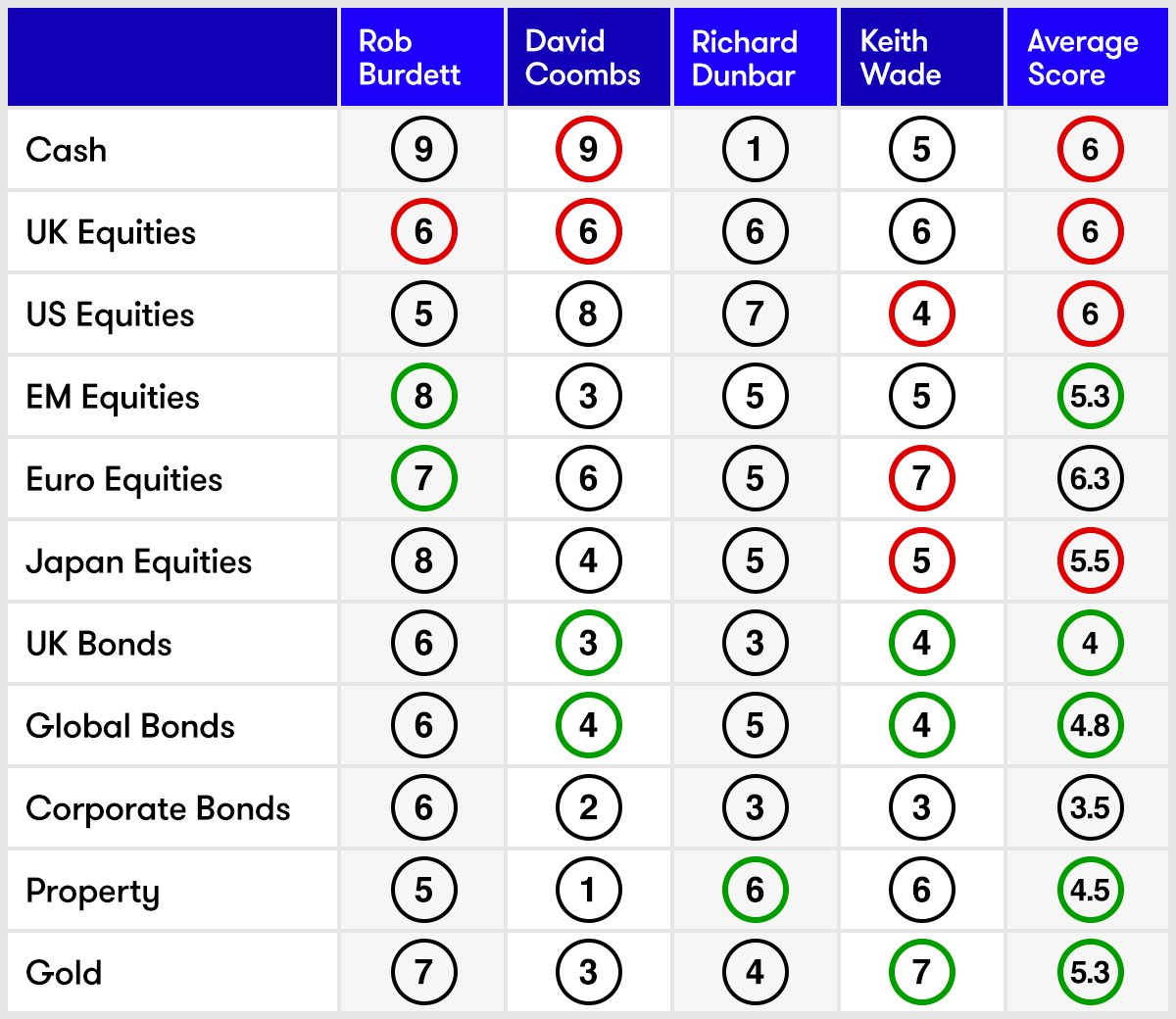

Our panel members are as usual reacting in their own idiosyncratic ways to the changing climate. Schroders’ Wade has decided to go underweight in US equities. “It is a brave call,” he admits.

“But we are heading for a difficult period with the US Federal Reserve planning to tighten policy. We may not have noticed it but global equities have already been re-rated during the summer as corporate earnings have been so strong with the recovery from the pandemic, while major markets have scarcely moved,” he points out.

Wade remains overweight in UK and European equities but has lowered his scores for Europe and Japan as well as for the US. “Our concern is that if we do have more inflation, that could soon begin to have an impact on earnings expectations,” he says. “That might be the trigger for a fall in equity prices.”

Wade adds that he thinks inflation, or stagflation, is going to have more of an impact on growth than the markets are expecting.

While Wade keeps a cash score at 5, both Burdett and Coombs have their cash positions at near the maximum. Both think a significant correction could be on the cards. But both see any such setback as a possible buying opportunity. It certainly was when markets relapsed at the start of Covid in March last year.

Panel split over US equities

Coombs may be anxious about stock market prospects but he keeps his US equities score at a bullish 8 - a rather different approach to Wade. “The US is where I find growth and quality. I am still a buyer when Wall Street has its down days,” he explains.

The US also remains Dunbar’s favourite sector. Burdett is neutral on US equities (with a score of 5), but is placing his bets on both Japan and emerging markets with scores of 8 on both sectors. “Our emerging markets score goes from 6 to 8 and reflects our belief that the recent shake-out in China makes that market look cheap and other Asian markets look attractive” he says.

Burdett also remains a stalwart supporter of Japanese equities. He believes they provide “safe-haven” qualities when the outlook becomes uncertain.

Dunbar proves to have a steady hand on the tiller. Although he remains concerned about the effect of the immediate supply chain hiccoughs in the recovery, he is sticking with his longer-term view that global growth will remain above average for the next three years - and thereby providing many attractive investment opportunities.

“I am happy to be slightly overweight in the US and UK equities while staying neutral elsewhere,” Dunbar says. “It gives me a mix of value and growth stocks.”

All the panel are overweight UK equities

Like Dunbar, the rest of the panel remain overweight in UK equities. With both Burdett and Coombs shaving their exposure, all panel members now score a six.

This may seem generous given that IMF and other forecasts suggest the UK will face greater pressures from labour shortages and fuel costs than other countries. But with sterling weakening lately, the view from outside the UK is that our domestic equities are cheap.

Burdett hears reports from fund managers that “for the first time in years they are getting enquiries from overseas investors about putting money into UK equities”.

Meanwhile, Wade notes how UK companies such as Meggitt (LSE:MGGT) and Morrisons (LSE:MRW) have become the target for overseas and private equity bidders. “Private equity has now become a popular area for institutional investors,” he says. “What encourages me is the number of private equity firms now setting up in the UK.”

- Andrew Pitts’ trust tips: Nick Train available on a rare discount

- Jeff Prestridge: Baillie Gifford’s rare and powerful statement

The average score for European equities remains at 6.3 - making it the most popular investment sector by a whisker. While Wade has trimmed his score here to 7, Burdett has edged up his score to 7 hoping European equities are due to benefit from the region being at a later stage on the recovery road than either the US or the UK.

While average scores for the UK, US and Japan have been trimmed a little, the average score for emerging markets has been given a slight boost by Burdett’s bullish noises on a stock market recovery in China, which has been negatively impacted by recent regulatory crackdowns.

Creeping back into bonds

Elsewhere, panel members are creeping back into UK government bonds to balance the risk of a setback in equities. But enthusiasm is muted and only Burdett is overweight.

Corporate bonds remain out of favour with three panel members because investment-grade bond yields offer too narrow a premium over government bonds.

However, there is some support for the high yield end of the market and for emerging market bonds.

Switching asset classes to the property sector continues to recover favour with the panel, apart from Coombs with the lowest possible score.

- Ian Cowie: this data backs up why I prefer trusts over funds

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Dunbar has raised his score from 5 to 6 to match Wade’s score. “An important signal for the property market is that we are starting to see more transactions again and we are able to find good assets giving decent returns and a bit of protection against a rise in inflation,” Dunbar explains.

Coombs is, again, the odd man out on gold. “Gold does not tend to like rising interest rates,” he explains. Wade disagrees, and raises his score from 5 to 7 on the belief that it could prove a safe haven in times of turbulence and uncertainty.

Note: the scorecard is a snapshot of views for the third quarter of 2021. How the panellists’ views have changed since the second quarter of 2021: red circle = less positive, green circle = more positive. Key to scorecard: EM equities = emerging market equities. 1 = poor, 5 = neutral and 9 = excellent.

Panellist profiles

Rob Burdett is co-head of multi-manager at BMO Global Asset Management and a research team leader.

David Coombs is head of multi-asset investments at Rathbones.

Richard Dunbar is head of multi-asset research at Aberdeen Standard.

Keith Wade is chief economist and strategist at Schroders.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.