Which ‘all-weather’ funds have performed best?

A Morningstar analyst compares the performance and approach of three cautiously managed funds that aim to protect capital when stock markets sell off sharply.

24th October 2023 09:30

by Morningstar from ii contributor

Morningstar’s research analysts recently looked at whether alternative strategies had a future given the recent closure of two of the best-known strategies in this space: abrdn Global Absolute Return (GARS) and Invesco Global Targeted Return (GTR). It’s fair to say that investors have been disappointed by the returns of these strategies for some time now, as evidenced by the fact that there have been persistent outflows from the sector since 2018.

- Invest with ii: Accumulation or Income Funds | Top Investment Funds | Open a Trading Account

So-called liquid alternative strategies gained popularity in 2008 in the midst of the turmoil created by the global financial crisis when asset managers sought to offer investors access to some of the strong returns on offer at the time generated by hedge fund managers. These funds used a mix of investment strategies, securities and techniques that differed from traditional long-only exposure to asset classes such as equities or bonds, in a familiar mutual fund or exchange-traded fund (ETF) form. The new funds offered redemption on a daily or weekly basis to bolster investor confidence in the strategies’ liquidity.

These strategies have, however, faced many challenges in recent years and have failed to deliver on their promise of delivering inflation-beating returns in all market environments. There are many reasons for their lacklustre returns or indeed their inability to always deliver on the promise of absolute returns, not least of which is the fact that we have until recently been in an extended period of low interest rates.

While alternative funds may take a while to regain investor confidence and the popularity seen in the period immediately following the aftermath of the 2008 financial crisis, there will always be room for products that are suitable for cautious investors or those wishing to de-risk their portfolios.

We consider three options (Capital Gearing (LSE:CGT), Trojan and Pyrford Global Total Return (Sterling)) and compare how they differ both in structure and performance to alternative funds such as the two listed above. As with the liquid alternative funds, these funds too aim to preserve and grow shareholders’ real wealth over time, but unlike liquid alternative funds tend to do this through investment in more traditional assets, including equities, cash and bonds.

Capital Gearing Trust, one of interactive investor’s Super 60 investment ideas, allocates capital across a mix of equities, corporate and government bonds including index-linked, and cash. Equities are usually accessed through investment trusts and ETFs, but direct equities are also held. Investment trusts are also used to access a range of alternative areas such as real estate, infrastructure, and commodities. Gold has tended to be only a small allocation.

- DIY Investor Diary: how I invest to preserve wealth

- Where to invest in Q4 2023? Four experts have their say

Sebastian Lyon, manager of the Trojan fund, focuses on investments in companies that have the potential to generate healthy cash flows over the longer term. Asset allocation is an important part of his overall framework, both to protect capital in times of stress and also to take advantage of opportunities when presented. He may invest in equities, government bonds, inflation-linked bonds, and precious metals (mainly gold), and uses cash actively.

Finally, the Pyrford fund applies its conservative approach to the following return drivers: asset allocation, bond duration and country selection, equity country and stock selection, and currency. The team are highly risk-aware and only a narrow group of high-quality assets are considered investable. Sovereign bonds must carry a rating of AA or higher, corporate bonds are avoided, and global stocks must have resilient business models with cash flows easily forecastable.

While none of these funds are immune from risk and potential losses during periods of market weakness, they have offered significant protection from the worst of equity market losses, and, equally importantly, have been able to grow investors’ capital during periods of market strength too.

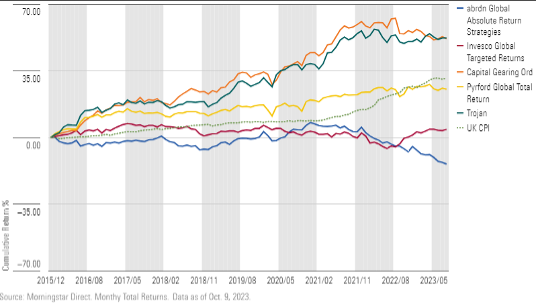

All three have achieved significantly greater performance for the period since the end of 2015 than the two alternative funds, as depicted in the chart below. Trojan and Capital Gearing have also delivered comfortably on their objective of growing investors’ real wealth over time with returns far in excess of inflation, while Pyrford’s objective on this front has fallen slightly short.

Past performance is not a guide to future performance.

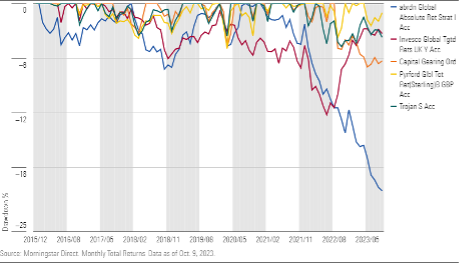

When we consider Chart 2, the next chart below, we are measuring the peak-to-trough drawdown experienced by each of the five funds and here we see that the liquid alternative funds, despite their absolute return objective, have been significantly less successful with respect to protecting investors’ capital than the three “vanilla” multi-asset funds that have also set their stall out to achieve this objective.

Past performance is not a guide to future performance.

In conclusion, we reiterate that it’s a long road back for alternative strategies to regain investor confidence and the popularity they experienced at their peak. However, there continue to be strong, viable options available to cautious investors that can offer them both protection from periods of market weakness, as well as the opportunity for long-term capital growth.

Ruli Viljoen, head of manager selection, Morningstar Investment Management Europe Ltd.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.