Accumulation vs income funds: which is better?

Learn the differences between income and accumulation (growth) funds, and which can be better for your ISA or SIPP.

Income or growth funds: what’s the difference?

- Income funds pay any profits directly to the investor as cash. These funds will use the initials ‘Inc’ for income or ‘Div’ for dividend in the fund name.

- Growth funds automatically reinvest any profits back into the fund. This helps the fund grow over time. These funds use the initials ‘Acc’ for accumulation in the fund name.

Some growth funds do pay a small amount of income and will use both ‘Inc’ and ‘Acc’ in their fund name such as Morgan Stanley Glb Brands Eq Inc I Acc.

Choosing between income or accumulation funds - it all depends on your needs

The income share class is suited to those who want to draw an income, for instance those using their investments to help fund their retirement.

In contrast, the accumulation share class is better suited for those who do not need an income and are focused on building up their ISA and/or SIPP.

Those who pick the accumulation share class will benefit from the effect of compounding - which means in effect that they get returns on their returns. The difference will be reflected in the price of the fund units – the accumulation share class will have a higher price than the income share class to reflect that dividends have been reinvested.

Those approaching retirement who want to draw an income when they retire but hold the accumulation share class can switch to the income share class.

Some investors may prefer to manually reinvest the income generated, perhaps into another fund, but there is a risk that less engaged investors who take this path will forget to do anything and unwittingly build up their cash balances.

The power of compounding

Whether you prefer to invest in funds, shares or simply passively invest in a stock market index, there is one thing that you should not underestimate: the power of compounding, achieved through investing for the long term.

In a nutshell, compounding refers to the way investment returns themselves generate gains. For instance, if you invest £1,000 into a fund that gains 5% over one year, you will earn £50. Assuming that you don’t withdraw any money, the next year you will earn 5% on £1,050, which is £52.50. This does not sound like much of an uplift, but as each year passes, the compounding effect multiplies.

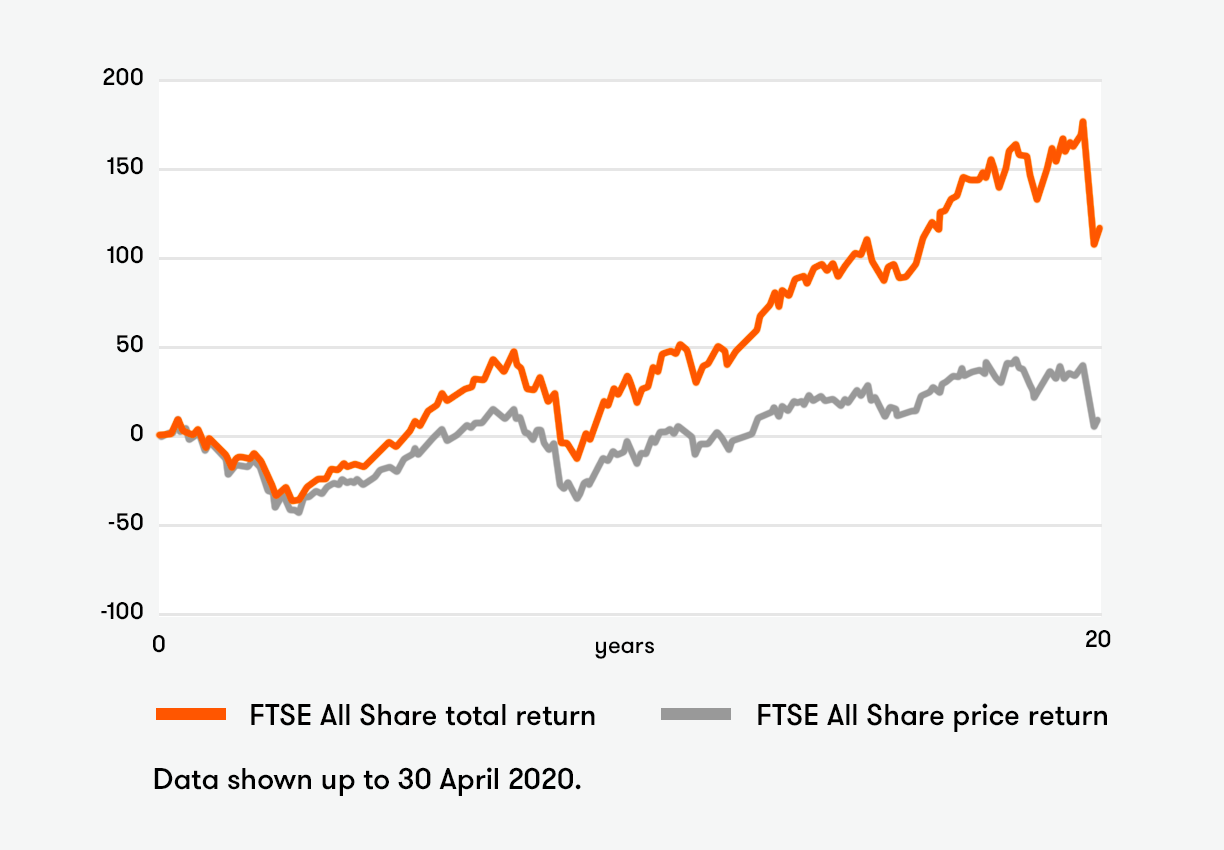

The effect becomes even more powerful when dividends are also reinvested and allowed to compound. Over the long term, dividend reinvestment is where the vast majority of the stock market’s returns come from.

Our chart highlights this in showing how the FTSE All Share index has fared over the past 20 years with dividends reinvested (total return) and no income reinvested (price return). The difference is stark: 116.1% versus 8.7%.

One of the key takeaways for beginner investors looking to improve their odds of stock market success, therefore, is to invest for the long term and reinvest both capital gains and income. Those who do will reap the rewards of compounding.

Accumulation versus income share class: a worked example

To help explain the differences between the two share classes we have used the example of the Schroder Income fund, one of our Super 60 funds.

Data from FE Analytics shows how the fund’s ‘Z’ accumulation and income share classes have fared over the past 20 years up to the end of April 2020– based on a £10,000 lump sum. The accumulation share class would have turned the £10,000 into £36,170, while the same sum into the income share class (factoring in the income returned to investors) would have grown to £28,914. This shows the power of compounding.

Differences between income and growth funds

Income funds

Fund managers who run income funds invest in companies that return cash to shareholders in the form of dividend payments.

The yield of a fund is a percentage figure that indicates how much income the underlying investments in the fund have generated over the last 12 months, relative to the fund’s current unit price or share price. The fund yield will vary depending on variations in its price.

Growth funds

Growth fund managers back businesses that have the potential to grow faster than the market. Some fund managers who specialise in the area focus their sights on small companies that can grow their market share exponentially over the long term because they are starting from a low base.

Growth fund managers tend to prioritise businesses that reinvest profits back into the business (rather than pay dividends), to boost growth organically or enable the acquisition of other companies.

Which should you pick for your ISA or SIPP?

This depends on your needs. An Income fund portfolio would suit an ISA investor who plans to boost their income. This does not apply to a SIPP, because you cannot access the money until you retire.

Accumulation funds on the other hand may suit both. They are suited for people who simply want to build up their investments.

Income vs accumulation taxation differences

Tax on distributions

The distributions from income and accumulation units only differ in how they are received, with the income funds distributing the cash to investors and the accumulation funds reinvesting the dividend. The taxation of distributions from the equivalent income and accumulation classes of the same fund would be treated the same for tax purposes in the eyes of HMRC.

HMRC gives the following reasoning for this here: “The reason for this treatment is to ensure that tax is not a factor which might distort investors’ choices; it also prevents investors delaying payment of income tax through long-term accumulation of income.”

Tax on dividends

Those who have investments held outside an Isa or Sipp, where there are no tax advantages, need to bear in mind the dividend tax allowance (which for the 2020/21 tax year stands at £2,000) and capital gains tax allowance (£12,300).

On dividends received above the £2,000 threshold, basic rate taxpayers pay 7.5% tax and higher rate taxpayers pay 32.5%. Additional rate taxpayers will be charged 38.1% tax on dividend income over the allowance.

In contrast, if they exceed the capital gains tax allowance, basic rate taxpayers pay 18% tax and higher and additional rate taxpayers pay 24%. (The only exception is for second properties, including buy-to-let investments. Capital gains on these investments are taxed at 18% for basic rate taxpayers, and at 28% for higher and additional rate taxpayers.)

How to invest in funds with ii

2.

Choose your fund(s)

Our Super 60 investment list features a range of accumulation and income funds.

Need help choosing? Our Quick Start Funds include Vanguard LifeStrategy funds, which are accumulation funds chosen by our experts.

3.

Choose how you want to invest

We've made it simple:

- Top up monthly with our regular investing service and pay no trading fees.

- Or buy & sell investments as and when you choose. Your first trade each month is free.

Important information

The price and value of investments and their income fluctuates, so you may get back less than the amount you invested. If you are unsure about the suitability of a particular investment or think that you need a personal recommendation, you should speak to a suitably qualified financial adviser.

The information we provide in the ii Super 60 is an opinion provided by ii or one of its partners on whether to buy a specific investment. Please note that none of the opinions we provide is a personal recommendation.

Remember that each fund is unique and exposed to different levels of risk. While some are relatively low risk, others can be very risky and will only be appropriate for more sophisticated investors.

There may be a fund manager charge, which is a percentage of the value of your investment. This can differ depending on the fund.

We charge a monthly flat fee to cover the cost of our services, including the administration of your funds.