Why this $5bn stock is not just for vegans

A phenomenal rally post IPO unwound spectacularly, but this could be a buying opportunity.

6th November 2019 10:41

by Rodney Hobson from interactive investor

A phenomenal rally post IPO unwound spectacularly, but this could be a buying opportunity.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

It's easy to get carried away when newly floated companies soar in the first weeks or months after a stock market listing. Private and even professional investors can be sucked in just before the wheels come off the bandwagon. Patient share pickers can spot a better opportunity when realistic valuations are restored.

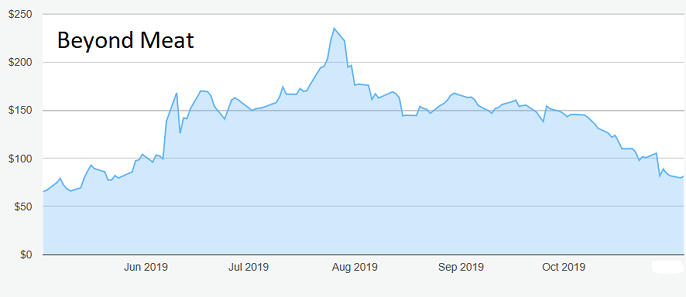

A case in point is Beyond Meat (NASDAQ:BYND), a California-based company that makes burgers from plant-based protein. The shares started trading on Nasdaq at $65.75 on May 2 this year and in less than three months they had nearly quadrupled at $235.

When the euphoria evaporated, investors started to question how on earth the company's advisors could have been so far out in their initial valuation. Perhaps they weren't. Early investors who had promised not to sell any more shares in the first 90 days of trading were able to cash in and the shares fell back as fast as they had risen. They now stand at just above $80. Quite a roller coaster ride in just six months.

Source: interactive investor Past performance is not a guide to future performance

It's a pattern that has been seen in many other flotations, though not always as dramatically. It happened in the UK with Royal Mail (LSE:RMG) and in the US with Uber (NYSE:UBER), both of which are now well below their flotation prices. Investors should bear in mind that a similar fate could yet befall Beyond Meat in the short term. Nonetheless, its long-term prospects are very encouraging and analysts have set target prices back above $100.

The company made its first net profit in the three months to 28 September, $4.1 million compared with a $9.3 million loss in the same quarter last year. Revenue more than tripled from $26.3 million to $92 million, prompting Beyond Meat to raise its revenue guidance for the full year from $240 million to a possible $275 million.

That target looks easily attainable given the growing demand for meat-free products, not only from vegetarians and vegans, but also from meat eaters who are increasingly concerned about the impact that raising livestock can have on the environment and also about animal welfare issues.

UK investors should not need reminding of the startling success of the vegan sausage rolls introduced in the UK by Greggs (LSE:GRG). In the US, Burger King introduced a plant-based burger in all its 7,200 outlets in August and, despite limited marketing spend, saw demand surge.

Beyond Meat's products are now sold in 58,000 shops and restaurants around the world. Outlets include the Tesco (LSE:TSCO) supermarket chain in the UK. Since the distribution network is already set up, much of any extra sales that can be generated will flow through to the bottom line.

As always, a great idea with huge growth potential inevitably attracts other entrants. There is no shortage of rivals making vegan alternatives to meat and competition is likely to intensify. However, those companies with a solid base and proven track record are ahead of the game. Beyond Meat has been going for 10 years now.

The stock could well benefit from the groundswell of enthusiasm for ethical investment that is starting to snowball. Since ethical objections can be raised against so many sectors or individual companies, a stock that is clear cut on the side of the good guys and has great growth potential is highly attractive.

As more companies are forced to move environmental issues up their agendas and investing in ethical companies becomes more profitable, ethical investing will become mainstream rather than being scorned as the playground of financially illiterate do-gooders.

Hobson's choice: This is not a buy for those who invest only in dividend-paying stocks as it will be some time before past losses are recovered, and expansion will soak up cash generated. However, investors could have the opportunity to get in at just the right moment. Buy below $89.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.