Why this iconic American stock is full of beans

Loved in UK homes and recovered from the Covid crash, it is a favourite of our overseas investing expert.

13th May 2020 10:16

by Rodney Hobson from interactive investor

Loved in UK homes and recovered from the Covid crash, it is a favourite of our overseas investing expert.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

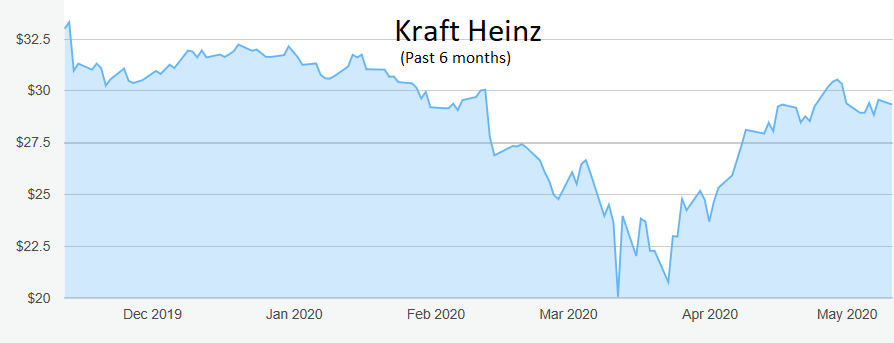

Hats off to Miguel Patricio, who took over as chief executive officer of food and beverage giant The Kraft Heinz (NASDAQ:KHC) less than a year ago. Not only has he halted a long slide in the share price, he has seen the stock bounce back fully from the Covid-19 slump.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

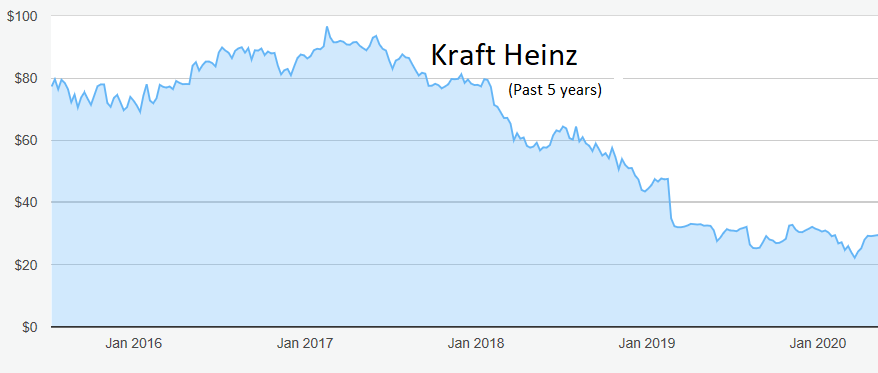

Once a company starts on the slippery slope it is hard to find a lifeline to cling to. And this company had been struggling since rival food groups H J Heinz and Kraft Food Group merged in 2015 to create the fifth-largest food and beverages company in the world and the third-largest in North America.

Source: interactive investor. Past performance is not a guide to future performance.

Products are sold in nearly 200 countries and a distribution network in Europe and emerging markets accounts for about a fifth of total sales. Yet its global range of grocery products including condiments and sauces, cheese and dairy, meals, meat and beverages has lost sales to rivals offering healthier options or cheaper alternatives.

It is all summed up in the self-defeating TV advertisements for Heinz tomato ketchup. The stuff is of such high quality that it is too thick to slide out of the bottle. So people buy runny stuff you can actually get onto your plate.

The big challenge for Patricio is to end a cycle of falling sales, prompting cuts to advertising budgets, leading to more falls in sales. The previous regime tried price reductions that affected profits and job cuts that hurt morale.

Results for 2019 were admittedly disappointing, with a 4.9% fall in net sales for the full year and 5.1% for the fourth quarter. However, 2020 has started on a more promising note thanks to stockpiling by shoppers as the coronavirus epidemic started to bite.

Sales in the first three months of the year were ahead of expectations at nearly $6.2 billion, with comparable sales up 6.2%.

Gains came not only in terms of higher volumes but also through stronger sales of more expensive items. This rate of sales growth is likely to be repeated in the second quarter.

On the downside, the higher sales are still not translating into higher profits. The scramble to meet demand pushed up costs, so profits fell from $405 million in the first quarter of last year to $378 million this time.

- Turnaround time for struggling food giant

- Which phase of the bear market are we in?

- Want to buy and sell international shares? It’s easy to do. Here’s how

Patricio’s early moves have been focused on making the supply chain, from procurement through manufacturing to distribution, more efficient. He wants a tighter grip on costs within the chain.

Marketing spend will be concentrated more on lines with wider profit margins. Greater emphasis is being placed on online sales.

The policy of slashing prices has been reversed, with prices up an average of about 1.6% in the latest quarter.

Greater attention now needs to be allocated to disposing of less popular lines in order to reduce the heavy debt pile of just under $30 billion, and allow greater resources to be put behind the most promising products. Patricio is quite rightly avoiding any rush towards a clearout at distressed prices.

Meanwhile, Kraft Heinz is taking its first small steps towards improving its green image by scrapping its plastic-wrapped multipacks, apparently prompted by Tesco (LSE:TSCO).

More than 100 million Heinz products are sold by this method through the UK supermarket. Heinz is now looking at similar initiatives with other retailers in a move that could reduce an unnecessary cost.

The struggles of the company have been reflected in the share price, which peaked at $96.65 in February 2017 before beginning a long slide. Better times for shareholder could be on their way.

Source: interactive investor. Past performance is not a guide to future performance

Hobson’s choice: Last July, with the shares just above $30, I advised buying up to $32. Since then they have been as low as $20 in mid-March, but they are almost back to $30, where they offer a yield of 5.4% despite a one-third reduction in the dividend. The recommendation stands.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.