Why Warren Buffett sold Apple shares to buy this telecoms stock

The valuation is undemanding, while the yield of 4.5% is a great hedge against any fall in share price.

17th March 2021 09:57

by Rodney Hobson from interactive investor

The valuation is undemanding, while the yield of 4.5% is a great hedge against any fall in share price.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Famed investor Warren Buffett has bought heavily into Verizon Communications (NYSE:VZ). If you’re a fan of Buffett and his Berkshire Hathaway (NYSE:BRK.B) outfit, you could consider following his lead.

Buffett’s big sale, to pay for his Verizon stake, was Apple (NASDAQ:AAPL), a brave but lucrative move given that Apple stock is trading at five times its $25 value just five years ago. But then, Buffett often sets the agenda, as he sold near the recent peak of $140 from which Apple has been slipping.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Verizon is the largest wireless carrier in the US, with over 90 million phone customers spread across consumers, businesses and government agencies. In addition, it connects 24 million data devices. A smaller part of its business, accounting for just 12% of revenue, is fixed lines telecoms in the north-east of the US. There is also an online media and advertising arm, Verizon Media, formed from the acquisitions of AOL and Yahoo.

- What changes has Warren Buffett made to his investments?

- Ian Cowie: how I invest in the US in my ‘forever fund’

Berkshire Hathaway has disclosed that it holds a stake of 146.7 million shares in Verizon worth $8.6 billion. Buffett’s stock purchase has sparked a new wave of interest among small private investors in a company that they had tended to overlook over the past few years. Perhaps the large capital investment required to keep up with the rapid changes in wireless technology has distracted attention from Verizon’s reputation as a highly profitable outfit.

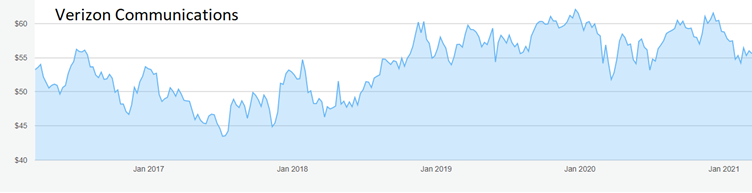

Source: interactive investor. Past performance is not a guide to future performance

That situation hasn’t really changed. The rollout of 5G wireless communications is no less expensive than previous generations of telecoms technology. However, the rewards from offering better and speedier connections to more customers could well snowball over the next couple of years and beyond, as customers are persuaded to concentrate the services they use with one supplier.

First, Verizon’s 5G offering could replace fixed line broadband connections quite rapidly over the next few years, with the convenience of bundled services bringing in extra revenue.

Second, those who receive a package of telecoms and media services via cable are likely to switch to wireless if, as is almost certain to happen soon, 5G wireless speeds prove faster. In the modern technology universe, we have often seen that today’s major breakthrough becomes tomorrow’s old hat, and the desirability of cable compared with old-fashioned copper telephone cables is fast fading in the face of high speed wireless.

Verizon lost 100,000 connections last year, but management is confident of reversing that trend and is forecasting 4% annual growth in revenue.

First-quarter figures due around 21 April will give a clue if that is being achieved. They need to be better than the rather mixed outcome for the previous quarter, as reported by Keith Bowman on the interactive investor website on 26 January. On the positive side, those figures did beat analysts’ expectations so Verizon could again surprise on the upside.

Analysts expect earnings per share to be nearly 2.5% higher than the similar three months of 2020, and that comparisons will pick up quarter by quarter so that the full year will see a 3.5% improvement, not far short of the board’s long-term target.

The shares have performed erratically, and at $56 are only marginally higher than they were in March 2016. They have briefly topped $60 in the meantime and have held above $50 for the past two-and-a-half years.

Verizon offers excellent defensive qualities should American stock markets run into a correction after the strong rally over the past 12 months, which has received an extra boost from the $1.9 trillion Covid relief programme agreed by President Joe Biden and Congress.

The price/earnings ratio is an undemanding 13 while the yield of 4.5% is an excellent hedge against any fall in the share price.

Hobson’s choice: Buy up to $58 but be prepared to wait patiently for capital gains. This is one for dividend seekers.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.