Why we just bought this top tech fund

After selling one tech fund, Saltydog analyst names another just added to his most cautious portfolio.

20th January 2020 12:38

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

After selling one tech fund, Saltydog analyst names another just added to his most cautious portfolio.

Navigating stormy waters

Although 2019 was a good year for stocks, some commentators are saying a ‘bumper’ year, it does need to be seen in context.

The year before was the worst year that UK investors had seen since the financial crisis, and so most of last year’s gains were just making up for ground lost in 2018.

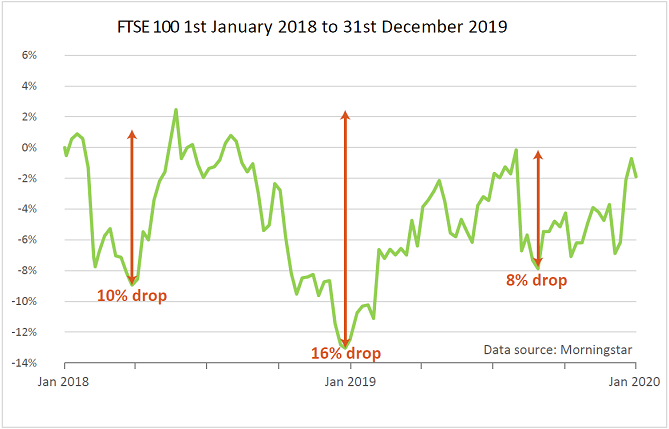

At the end of 2019 the FTSE 100 was actually lower than where it was at the beginning of 2018, having seen three significant sell-offs.

Between the 17th January 2018 and the 28th March 2018, the index dropped by 10%. By the 23rd May it had recovered and set a new all-time high, but by the 27th December had fallen 16%. At that stage it was actually 5% lower than it was at the end of December 1999.

The first half of 2019 went reasonably well, although there was a minor wobble at the end of April/beginning of May, but by the end of July the FTSE was back to where it had been at the beginning of 2018. It then dropped 8%, before recovering in the lead-up to Christmas.

The FTSE 100 index does not include any reinvested income, which would have lifted the total return over this period to nearer 7%, but it does show just how volatile the market has been.

At Saltydog Investor, we believe that avoiding losses is as important as making gains. Over the last couple of years, the drops have been relatively short lived, but that’s not always the case. In the last 20 years there have been two crashes that could have halved the value of your stock market investments, and it would have taken years to recover.

As momentum investors we’re not trying to predict the future and get ahead of any market movements, but we can react and hopefully miss out on the worst of the drops.

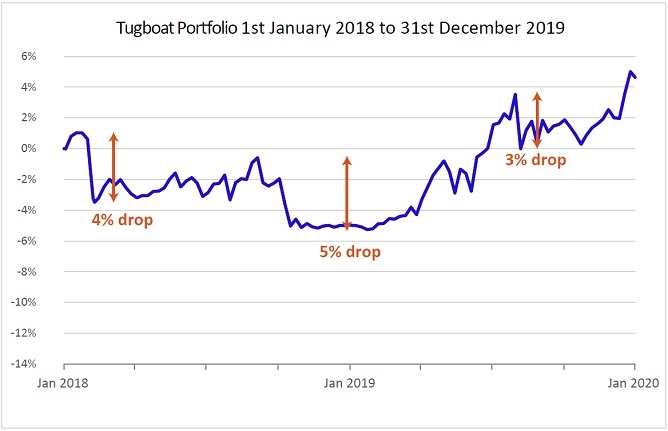

Here’s a graph showing our most cautious portfolio, the Tugboat, from the beginning of 2018 to the end of last year.

Source: Saltydog

Like the FTSE 100 it also fell early in 2018 but went down 4% instead of 10%. Later in the year it dropped 5%, when the FTSE 100 was down 16%, and last summer it only fell 3%, compared with the FTSE 100 which went down 8%.

From the graphs it is also clear to see that if one of these rogue rollers had turned into a financial tsunami, then our Tugboat was in a position to sail on relatively unhindered until the storm subsided.

In the second half of last year we saw the pound strengthening against the dollar, which had a negative effect on funds overseas. We were worried that after the election sterling may continue to gain in value and so reduced or sold any funds which we thought might be affected.

The pound did briefly rise to $1.35 but has subsequently dropped back to around $1.30.

About this time last year, the Tugboat invested in the Fidelity Global Technology fund which we held until December, when we sold it because of our concerns over its exposure to currency movements. At the time it was showing a gain of over 19%.

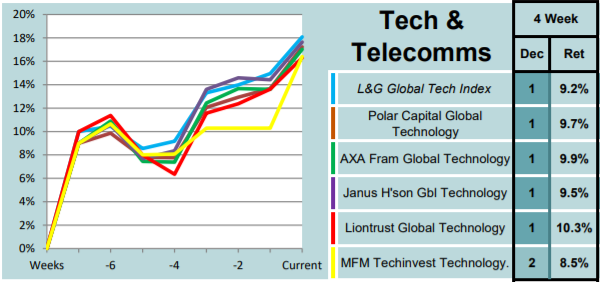

Last week, we invested in another fund from the ‘Technology & Telecommunications’ sector.

Our latest Saltydog analysis has shown that the sector has been performing well in the last month, and there are a few funds that have gone up by more than 9% in the last four weeks.

Source: Morningstar

We invested in the Janus Henderson Global Technology fund which features in our short-term table, where we rank funds based on their performance during the last four weeks, and also appears in the six-month table where we consider a longer timeframe.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.