Why we sold our energy funds

27th June 2022 12:43

by Douglas Chadwick from interactive investor

After a riding out previous falls in energy and resources funds, Saltydog has now completely sold out of the sector.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Most of the funds we analyse are now showing losses over the past six months. More than half are down by 10% or more, and the worst ones have lost more than 40% of their value.

There have been a few standout funds, but even they are starting to struggle.

The most dominant trend this year has been the rising price of commodities, and of energy in particular. This has led to record levels of inflation, which is reflected in the cost of what we buy in the supermarkets and the price of petrol at the pumps. As anyone who runs a car will know, the price of petrol has skyrocketed in recent months.

There was a surplus during lockdown, and I can remember the price getting as low as £1 per litre. But prices started rising in the second half of 2021 and have been going up ever since. According to the RAC, average petrol costs are currently £1.90 per litre and diesel is £1.98.

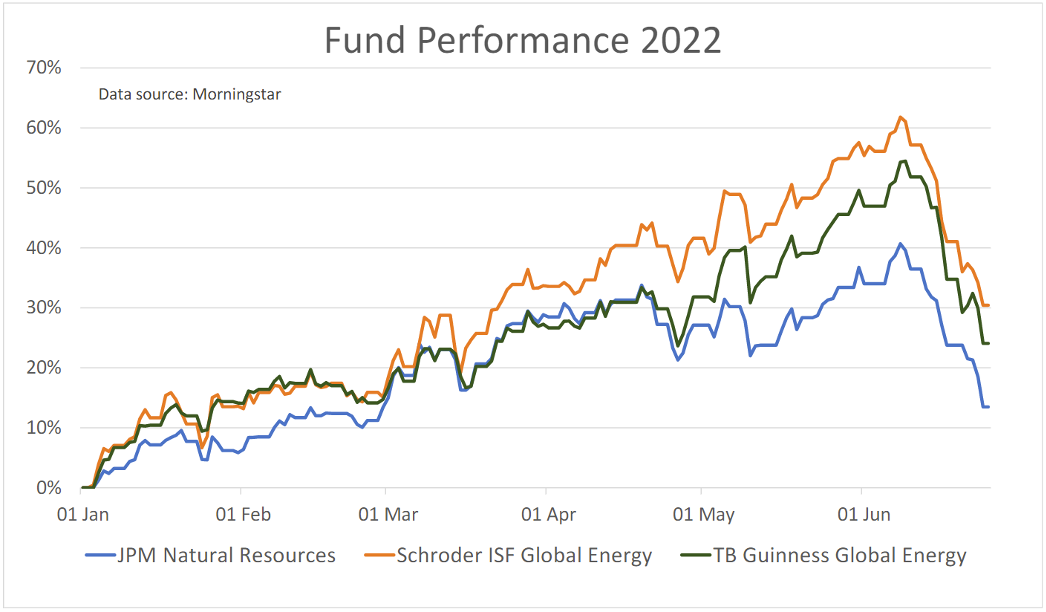

Funds investing in oil, gas and other commodities have regularly featured at the top of our performance tables. There are three that our demonstration portfolios invested in. They are JPM Natural Resources, TB Guinness Global Energy and Schroder ISF Global Energy.

As you can see from the graph below, all three funds have followed a similar pattern.

Past performance is not a guide to future performance.

They can be volatile and even before this month we experienced some significant falls.

Between 18 January and 24 January, the Schroder ISF Global Energy fund fell by 8%. Then between 11 March and 15 March it lost 7%. Towards the end of April (21 to 26), it dropped another 7% and then in May it lost 6% between the 5th and the 10th. After each of these falls it recovered fairly quickly and by 8 June was showing a year-to-date gain of 62%.

We rode out the previous falls, but last week decided that it was time to take some profits. We sold all three funds in our Tugboat portfolio and reduced them in the Ocean Liner.

Even after the latest correction, the Schroder ISF Global Energy fund is still the best-performing fund over the last six months, followed by the TB Guinness fund. JPM Natural Resources is not far behind.

The big question is whether they have now stopped falling, or whether they have further to go.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.