Will near-term noise ruin this long-term investing case?

A Kepler analyst considers the effect of short-term headwinds, including tariffs, amid investment trust opportunities in one region.

2nd May 2025 14:00

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Japan’s equity market is undergoing one of its most significant transformations in decades – a Shogun-era drama reimagined through modern reform, where shifts in monetary policy, wage growth, and corporate governance reforms collide in a rich tapestry of risk and reward.

Like wandering ronin of old, investors now navigate unfamiliar terrain: negative interest rates are gone, deflation may finally be ending, and companies with substantial cash reserves – once reluctant to deploy capital – are unlocking value by putting balance sheets to work, improving valuations, driving growth, and raising corporate standards.

These structural tailwinds are strengthening Japan’s long-term investment case, creating a new narrative that extends beyond short-term speculation to something more enduring. We believe this is the most supportive backdrop for Japanese equities since the country’s global dominance in the 1980s.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

But even as optimism swelled, recent macro headwinds – trade tensions with the US, currency volatility, and uncertainty around Bank of Japan (BoJ) policy – have reignited investor caution. The strength of Japan’s resurgence is once again being questioned, and many see its momentum stalling under the weight of global economic pressures. As with any ronin tale, peril walks beside potential – and recent volatility has tested the resolve of those drawn to Japan’s reform-driven story.

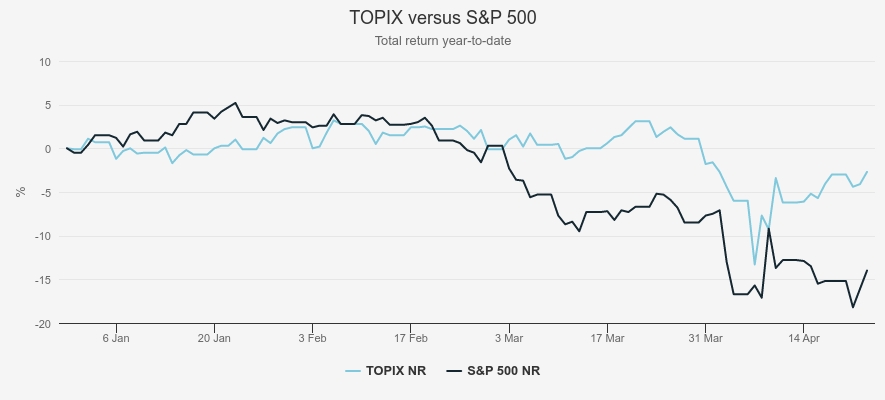

While Japanese markets have held up better than the US in relative terms in the turmoil following Trump’s tariff announcements, recent volatility has been a sharp reminder for investors that even the most promising narratives can be knocked off course. The chart below, shown in GBP, highlights the outperformance, but it’s worth noting that currency movements have had some impact, with yen strength softening the blow for sterling-based investors. Currency swings, inflation uncertainties, tariff tensions, and shifting expectations around BoJ policy have raised concerns that foreign capital could retreat or that economic recovery could falter, just as momentum was truly beginning to build.

PERFORMANCE COMPARISON

Source: Morningstar. Past performance is not a reliable indicator of future results.

Yet, we think this is still a market in motion. And while we explore the implications of these risks in detail below, it’s worth stepping back to remind ourselves why the story was so compelling in the first place. We think that much of this optimism in Japan is still merited, and the long-term thesis remains intact – temporarily obscured perhaps, but not broken. For those willing to look through the short-term storm, we think Japan’s evolving landscape still presents compelling potential – from small-cap innovators and reform-driven corporates to income-generating stalwarts and geopolitical beneficiaries.

The winds of change

Japan’s investment backdrop is shifting, with corporate governance reform emerging as a cornerstone of its economic revival and stock market resurgence. Whilst these reforms have been in motion for over a decade, it’s their acceleration over the past two to three years that has truly captured investor attention.

For decades, Japanese companies hoarded cash, maintained opaque cross-shareholdings, and prioritised internal corporate harmony over shareholder returns, but that’s changing. The Tokyo Stock Exchange’s (TSE) 2023 report linked weak capital efficiency to poor valuations and called on companies trading below a price-to-book (P/B) ratio of 1.0 or with return on equity (ROE) below 8% to “comply or explain.” In a market long defined by consensus and conservatism, this move was seismic. Monthly updates and public naming of underperformers introduced a new level of transparency and accountability.

Whilst reforms will continue to evolve, the initial response has been striking. Many firms are now actively optimising balance sheets and returning capital to shareholders. Since 2022, dividends and buybacks have surged to record levels. In 2024 alone, buybacks exceeded ¥18 trillion (around £94.8 billion) – more than double the previous year – fuelled by corporate ambition and pressure from activist shareholders.

Nearly 70% of companies on the TSE Prime Market (the Tokyo Stock Exchange’s top-tier market segment) have now disclosed concrete plans to enhance shareholder value – whether through business restructuring, unwinding cross-shareholdings, or more dynamic capital allocation. M&A activity has also surged, reaching its highest level since 1985 as companies use consolidation to unlock value.

Some companies aren’t just complying – they’re embracing reform as a strategic edge. Trusts like CC Japan Income & Growth Ord (LSE:CCJI) are well-positioned to benefit. Manager Richard Aston focuses on leveraging the significant upside potential in companies undergoing governance-driven change. Recent portfolio additions like JAFCO, Japan’s leading venture capital firm, and Dexerials, a materials manufacturer, exemplify this, both showcasing greater capital efficiency and improved shareholder returns.

Schroder Japan Trust Ord (LSE:SJG) is another trust capitalising on this evolving landscape. Manager Masaki Taketsume employs a high-quality, yet valuation-sensitive approach, leaning towards undervalued companies with strong franchises that have significant turnaround potential. Recent investments in Sanki Engineering and Niterra – once trading at depressed valuations – have begun to rerate on the back of improved capital efficiency and rising returns.

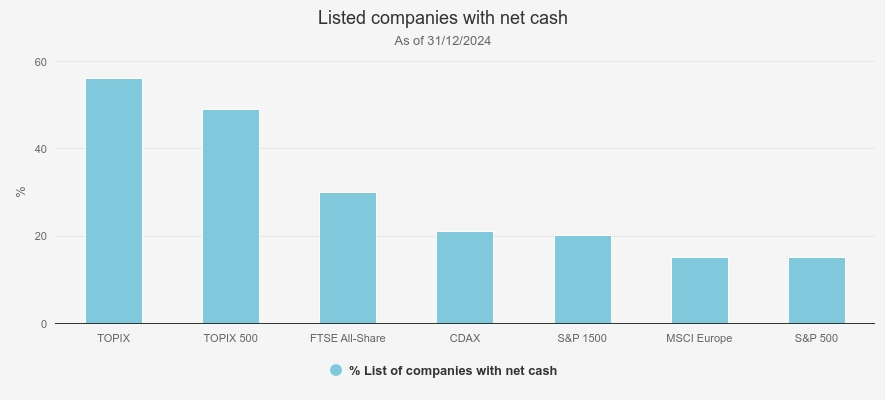

Japan’s dividend culture is evolving too. Governance reforms and shifting corporate priorities are making the market increasingly attractive for income-focused investors. Around 56% of listed companies still sit on net cash – far higher than in other developed markets – leaving significant headroom for future dividend growth. These dynamics, in our view, support strategies like CCJI and SJG, which favour companies with sustainable, yet growing capital and income potential.

LISTED COMPANIES WITH NET CASH

Source: Daiwa based on FactSet, MSCI, FTSE, Bloomberg data

Another sign of real change: for the first time in years, the number of listed companies in Japan is shrinking. In 2024, 94 companies de-listed, reducing the total TSE listings. This trend reflects both government pressure to eliminate parent-subsidiary structures and rising bankruptcies as ‘zombie’ firms – long sustained by ultra-loose monetary policy – start to fall away. With the TSE set to introduce stricter liquidity and governance rules by 2026, pressure on listed firms is only increasing.

That said, there’s still work to do. Many smaller companies have yet to comply or commit to meaningful reform. Japan’s average ROE hovers around 10%, only modestly above the TSE’s 8% minimum target, underscoring how entrenched conservative capital policies still are. But structural change of this scale takes time, and we expect further improvements in time, supported by TSE pressure should momentum falter.

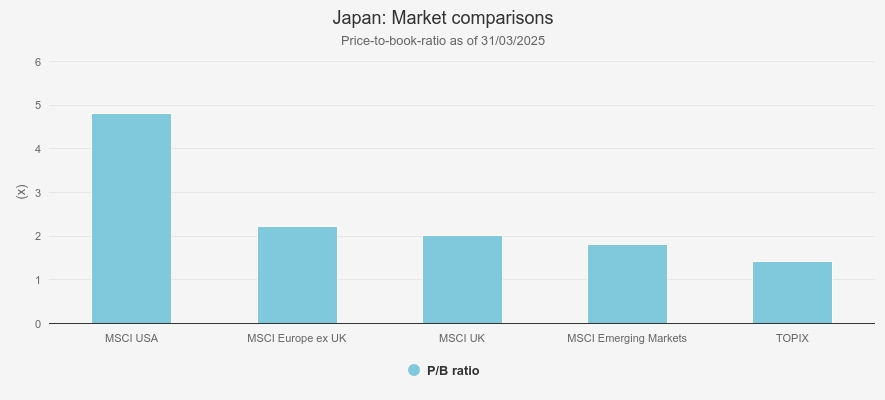

For reform to be durable, it must be sustainable – and that momentum is clearly building. The TOPIX Index ended 2024 with a P/B of 1.4x, up from 1.1x in 2022. That’s meaningful progress, even if it remains below global peers and far from the 4x multiples seen during Japan’s 1980s market peak. In our view, the market still looks attractively valued – and has potentially plenty of room to run.

PRICE-TO-BOOK MARKET COMPARISONS

Source: Bloomberg & MSCI factsheets.

Small caps, big potential

Japan’s market is in transition, and for active investors with local expertise, presents an enticing opportunity. So far, much of the early rerating from corporate reform has been concentrated among large-cap stocks. But further down the market-cap scale, smaller companies have been slower to react – precisely what makes them so interesting today. Reform momentum is beginning to filter through, and the TSE’s push for greater capital efficiency and stricter liquidity standards is nudging these laggards to adapt or risk being left behind.

Despite being home to many of Japan’s most innovative and entrepreneurial businesses, smaller companies remain under-researched and overlooked by global investors. Foreign ownership stands at just 12% – around a third of the level of large caps – and nearly 60% of small-cap stocks lack meaningful analyst coverage. What’s more, many of these businesses are highly cash-generative and increasingly shareholder-friendly.

For eagled-eyed active stock pickers with local knowledge and on-the-ground teams, this creates a fertile hunting ground for alpha, particularly considering today’s valuations. The TOPIX Small-Cap Index trades at a forward P/E of 11.2x, offering a near-10% discount to its larger counterparts.

This is a key area of focus for SJG. Manager Masaki currently allocates around 54% of the portfolio to small- and mid-cap stocks, well above the benchmark’s 32.0%. He’s drawn not just by the relative valuations, but by the higher earnings growth, as reflected in stronger 12-month forward EPS estimates.

By leveraging Schroder’s on-the-ground resources, coupled with market expertise, Masaki has uncovered hidden gems like Miura, a manufacturer of industrial boilers. While not directly in the TSE’s crosshairs, Miura has proactively embraced the spirit of reform – boosting operational efficiency, improving ROE, and deploying its cash-rich balance sheet to drive international growth, most recently through a US acquisition aimed at diversifying revenues.

This kind of voluntary self-improvement – often not expected in this part of the market – highlights the broader cultural shift under way. Reforms may have started at the top, but it’s among smaller companies where the next leg of opportunity may lie.

With over 3,000 companies in this space – many of which don’t publish results in English or engage regularly with shareholders –investment trusts in the AIC Japanese Smaller Companies sector provide valuable access to these under-the-radar businesses.

AVI Japan Opportunity Ord (LSE:AJOT), launched in 2018, was designed to tap into this part of the market. Manager Joe Bauernfreund takes an activist approach, targeting deeply discounted small caps where corporate governance reforms can unlock value. Regulatory momentum, he argues, is making management teams more open to change. The trust has already seen value unlocked in several holdings, including NC Holdings, which was taken private. Buyouts and privatisations – once rare in Japan – are becoming more common, creating fertile ground for activists willing to take large positions and drive the change themselves.

Nippon Active Value Ord (LSE:NAVF)follows a similar activist strategy, although its remit now includes mid caps. Managed by Rising Sun Management, it seeks companies where management and minority shareholder interests are misaligned. Whilst most engagement is private, management won’t shy away from public campaigns where necessary – most recently seen in its push for change at Fuji Media, calling for more efficient capital use and better governance.

For long-term investors willing to look beyond the headlines – and stomach some volatility – Japan’s smaller companies offer more than just a discount relative to larger peers. They offer access to the potential household names of tomorrow, where earnings growth potential, cultural change, and reform momentum are increasingly aligned.

Still standing: can macro headwinds knock Japan off course?

Japan’s investment renaissance isn’t just about corporate reform and valuation reratings, it’s also a story of shifting macro conditions. After decades of stagnation, monetary policy is finally edging towards normalisation, with the country seemingly on track to finally break free from its deflationary grip.

In early 2024, the BoJ ended its negative interest rate policy, lifting rates for the first time in 17 years – initially to 0.1%, and most recently to 0.5% in March 2025. Although modest by global standards, these hikes mark a symbolic shift, signalling growing confidence in Japan’s domestic recovery.

But the journey hasn’t been smooth. An unexpected rate hike in mid-2024 triggered a sharp yen rally against the US dollar, sparking a wave of carry trade unwinds as investors rotated out of low-yielding Japanese debt into higher-yielding US assets. Markets were rattled – Japanese equities sold off sharply before quickly rebounding – as investor fears of past volatility resurfaced.

By May 2025, the BoJ held rates steady at 0.5%, continuing its balancing act between supporting domestic recovery and navigating mounting external pressures – from heightened trade tensions and US tariff implications to the rapidly strengthening yen. For investors, these developments carry broad implications.

The yen often benefits from safety-seeking flows and has surged in 2025 amid escalating trade wars, tariff pressures, and geopolitical risks. It briefly broke below ¥140 to the dollar and is up around 12% year-to-date, its strongest annual gain since 2020. With the US dollar under pressure as the country contends with rising debt levels and trade disputes, we think Japanese investors are likely to be unwinding holdings in dollar-denominated assets, with a more favourable rates outlook than the country has seen for years supporting this trade. Furthermore, we think Japan may be increasingly viewed as a viable alternative by international investors. Meanwhile, in March, Japan’s 10-year government bond yield edged above 1.3% following a liquidity enhancement auction –suggesting a more bullish outlook for either growth, inflation, or both.

However, these same macro trends also pose risks. Currency strengths and tariffs could weigh on Japan’s export sector and complicate the BoJ’s already delicate policy path. A stronger yen may dampen foreign returns and blunt Japan’s export competitiveness. With exports accounting for over 20% of GDP – and the US representing around a fifth of that – the trade relationship with the US matters.

Japan’s automotive sector is particularly exposed to US tariff threats. Joe Bauernfreund of AVI acknowledges the risk to autos but notes that given the sector’s cyclical nature, AJOT has minimal direct exposure – a reflection of its long-term positioning rather than a recent shift. More importantly, Joe believes that tariffs won’t derail AJOT’s activist strategy or its focus on domestically oriented small- and mid-cap names. For him, today’s volatility is fertile ground for picking up tomorrow’s winners at compelling valuations.

Nicholas Weindling, manager of JPMorgan Japanese Ord (LSE:JFJ), acknowledges that tariffs pose a challenge for exporters, but highlights many Japanese companies have already moved production to the US, softening the potential blow. For him, the bigger story lies in Japan’s corporate evolution. He believes it’s not macro guesswork, but strengthening fundamentals, alongside improving balance sheet efficiency and rising shareholder returns that will drive earnings growth and long-term value creation.

Tariff tensions have also rippled through the financial sector. Earlier this year, Japanese banks suffered their steepest weekly drop in four decades – spooked not just by global slowdown fears, but by concerns that tariffs could delay further tightening from an increasingly cautious BoJ.

Some may view the BoJ’s caution as frustrating, but in our view, it’s understandable. Japan is entering unfamiliar territory after decades of ultra-loose policy. Tighten too quickly and growth could stall; wait too long and hard-won momentum risks fading. Whilst another rate rise later this year looks likely – given rising inflation expectations among households and corporates, a key condition for further tightening – it’s far from a done deal.

However, a more conventional interest rate environment could prove especially constructive for Japan’s financial sector. Higher rates improve lending margins and support earnings for banks and insurers. This would benefit trusts like CCJI, which has notable exposure to financials. But Richard is treading carefully, opting to take a balanced approach – focusing on pairing high-quality banks with strong franchises and robust cash flow with less rate-sensitive financials to diversify return drivers and manage risk.

Ultimately, whilst currency swings and tariff turbulence may create short-term volatility, we don’t believe they undermine the long-term case for Japan. If anything, they’re broadening the opportunity set for experienced, active investors.

Potential for virtuous cycles over vicious spirals

Another compelling development in Japan is the recent pick-up in wage growth. The 2025 Shuntō negotiations delivered average pay rises of 5.5% – the highest in over three decades. It’s a strong signal that companies are willing to compete for talent and adapt to a shrinking workforce. If this momentum holds, it could ignite Japan’s long-dormant consumption engine, with higher wages fuelling domestic demand and nudging the economy toward a more balanced, less export-reliant model.

Importantly, this virtuous cycle appears to be reshaping household behaviour. As incomes rise and inflation expectations stabilise, Japan’s longstanding preference for hoarding cash may be starting to unwind. Households are finally being incentivised to put their money to work, tapping into one of Japan’s most underutilised assets – its enormous domestic savings pool.

Revamped NISA accounts and rising deposit rates have already spurred a wave of retail participation, with flows into investment trusts and mutual funds hitting record levels. Yet the potential remains vast. Over ¥1,100 trillion (around £5.8 trillion) still sits idle in cash or deposits. Even modest reallocation could provide sustained support to equity markets, especially as Japan focusses on growth from within rather than relying on exports.

This gradual return of domestic confidence – supported by easier access to retail-friendly investments and more consistent wage growth – is giving savers new reasons to deploy capital productively, strengthening equity markets from the bottom up.

SJG’s manager is also optimistic. After three consecutive years of solid wage growth since 2023, there are signs that consumer sentiment may be finally turning a corner. Whilst a moderation in food inflation is needed, improved income expectations could boost confidence and spending, fuelling a more durable, consumption-led recovery. This backdrop favours SJG’s overweight to domestically oriented sectors.

Baillie Gifford Shin Nippon Ord (LSE:BGS) may also be poised to benefit, with over 70% of its portfolio tied to the domestic economy. Whilst recent performance has lagged—partly due to its exclusion of rallying defence stocks and its small-cap growth bias falling out of favour – many of its holdings are capital-light, high-growth firms that have proven resilient to inflation. In several cases, they’ve passed on price increases without losing demand, and earnings growth has even outpaced the benchmark. Trading on a double-digit discount, wider than its five-year average, BGS may offer an appealing entry into a high-growth segment of the market.

Of course, challenges remain. Smaller businesses, which employ the bulk of the population, have struggled to match wage hikes seen at larger firms. Meanwhile, headline inflation has remained above the BoJ’s 2% target for over a year. Whilst a positive catalyst in many respects, much has been driven by imported food and energy costs, worsened by earlier yen weakness, meaning Japan might not be fully out of the deflationary woods yet. The Engel coefficient – a gauge of how much households spend on food—has hit a 43-year high, underscoring the real squeeze on spending power.

For consumption to drive sustained recovery, wage growth must consistently outpace inflation – not merely keep pace. That will require ongoing government support to tackle rising living costs, particularly in essentials like food.

Conclusion

Macro headwinds – particularly US tariff implications, uncertainties around BoJ’s direction, and currency volatility – have added fresh complexity to Japan’s outlook. It’s fair to say these factors are weighing on short-term sentiment. Export-heavy sectors, especially autos, are facing pressures. The BoJ’s path has become less predictable, with implications for financials and broader inflation dynamics. Meanwhile, a stronger yen may erode export competitiveness.

But we don’t believe these are critical long-term threats. Japan is far less export-dependent than it once was, and the BoJ’s decision to pause rate hikes strikes us not as capitulation, but caution – an acknowledgement of lingering global uncertainties, but a stance that is likely to evolve in time. As for the currency, a stronger yen could reflect renewed confidence in Japanese assets and a broader rebalancing away from dollar dominance. As Japan regains credibility on the world stage, a firmer currency may increasingly be seen as a symbol of strength, not a constraint.

Japan’s story is still unfolding – but increasingly, it feels like one of momentum, not malaise. For long-term investors, we think Japanese equities remain compelling propositions, especially through selective Japanese investment trusts led by experienced, active managers that hold valuable, local insight to navigate near-term noise and capture the country’s rich alpha opportunities.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.