This stock's down 74% in latest small-caps bloodbath

27th June 2018 14:55

by Graeme Evans from interactive investor

There were further painful reminders about the perils of being a small-cap investor today after heavy share price falls for butcher Crawshaw Group, inkjet technology firm Xaar, and most significantly, African airline FastJet.

The past six to eight months have highlighted a higher risk profile for all small-cap stocks, given the level of punishment being meted out for negative updates.

Take Crawshaw, whose shares were down 19% after it reported more challenging conditions for its high street shops and a 12.9% decline in same-store sales for the past 20 weeks.

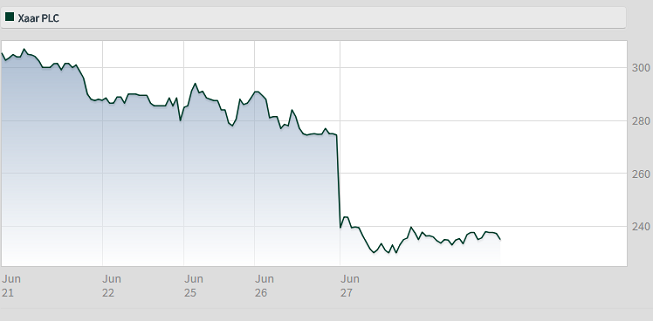

Xaar was off 13% as it said revenues in its ceramic tiles decoration division will come in short of expectations, even though mitigating cost actions mean that it is still on track to deliver group profits in line with forecasts.

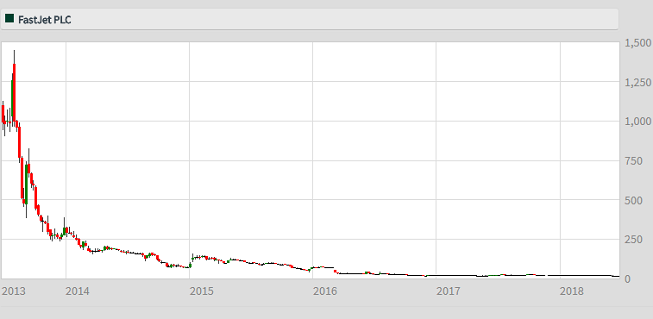

The biggest fall of all - a drop of up to 74% - came from Fastjet after it warned that it could go bust unless it obtained new funding. The airline, which was set up in 2012 to serve the eastern and southern African markets, is currently in talks with its major shareholders about the potential equity fundraising.

Fastjet is continuing to burn through cash, leaving it with a balance of $3.3 million.As Virgin Atlantic founder Sir Richard Branson once said: "If you want to be a millionaire, start with a billion dollars and launch a new airline".

Fastjet shares briefly touched 1,000p in August 2013, but investor hopes that the AIM company could eventually become a pan-African carrier quickly dissolved amid a series of cash calls and boardroom disputes. EasyJet founder Sir Stelios Haji-Ioannou is now no longer a significant shareholder at Fastjet.

Source: interactive investor Past performance is not a guide to future performance

For Crawshaw, shares have tracked consumer confidence lower amid weaker footfall on the high street. Having racked up full-year losses of £13.5 million in April, Crawshaw has stepped up sales-driving and cost-saving initiatives in the belief that most of its high street outlets can generate an improved return.

It has also opened two more factory shop outlets, taking the total to 12 as this format has continued to trade well in the current climate.

But today's warning will come as an early disappointment for former Asda meat buyer Jim Viggars, who only took charge as CEO at the end of May.

Source: interactive investor Past performance is not a guide to future performance

The Xaar share price has been stuck in a narrow range for the best part of three years, having fallen from more than 1,000p in 2014.

Its strategy is now focused on a broader range of products and market sectors, such as thin film technology and graphic arts and textiles. It is also developing partnerships to exploit the ongoing analogue to inkjet conversion within print markets.

The company said today:

"We continue to make progress with this but the rate of market adoption remains difficult to predict."

The increasing proportion of total revenues accounted for by new products is likely to mean full-year results will be even more weighted towards the second half of the financial year than first thought.

In March, Xaar announced a 7.7% fall in adjusted profits to £18 million, although the dividend increased to 10.2p from 10p.

Source: interactive investor Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.