Three small-caps racing higher

3rd July 2018 13:50

by Graeme Evans from interactive investor

Frontier Developments, RM and Utilitywise are among the big movers right now, reports Graeme Evans. Here's why.

Small-cap star performers Frontier Developments and RM were back on the front foot today as the pair gave investors more reasons to think they can continue their stunning run of form.

Frontier, whose video games include BAFTA-nominated titles Elite Dangerous and Planet Coaster, was one of the outstanding performers of the last financial year, with shares up by as much as 400% at one point.

Much of this was down to last summer's £17.7 million fundraising when Chinese entertainment company Tencent Holdings Ltd took a 9% stake as part of a strategic investment helping Frontier target the Chinese market.

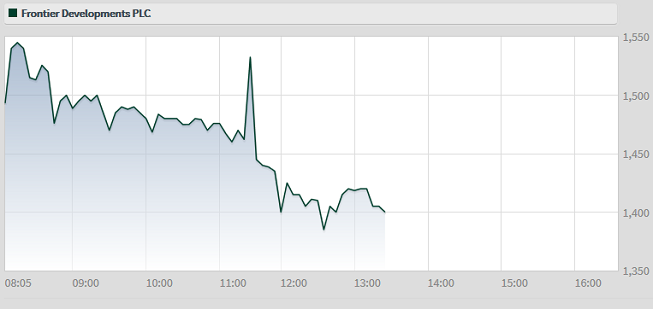

Shares peaked at 1,810p last month before jitters set in about the performance of its third big franchise, Jurassic World Evolution.

Those fears were laid to rest today as Frontier said initial digital sales had been strong and that revenues should be towards the upper end of the £58 million to £88 million range forecast by analysts for the year to May 31.

The update prompted an 8% share price jump and another flurry of positive broker comment today. Peel Hunt, for example, lifted its Jurassic World sales forecast by 250,000 units to two million in the 2019 financial year and said less discounting should increase average revenues per unit by £3 to £29.

Liberum analysts believe that shares can reach £18 amid confidence that the Cambridge-based company is on track to deliver a multi-franchise gaming strategy and annual revenues in excess of £100 million.

FinnCap also raised its 2019 revenues forecast by 30% to £75.3 million and its earnings estimate by 8% to £16.4 million.

Its analyst Lorne Daniel said: "The shares have recently fallen back from all-time highs on nervousness over Jurassic World's performance. Those concerns are allayed by today’s news and the company has proven it can select, develop and deliver a winning third party franchise.

"We expect a rapid bounce back towards our 1,750p target price on the back of this update."

Source: interactive investor Past performance is not a guide to future performance

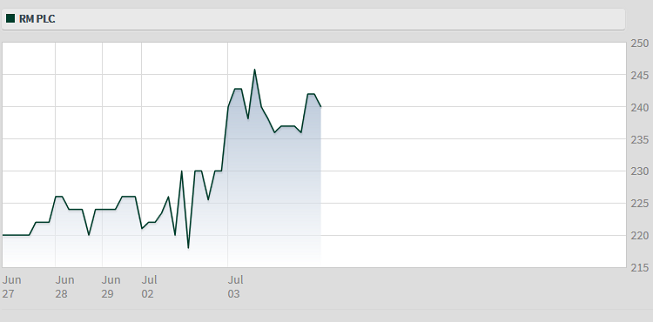

The performance of RM shares has been no less impressive, with shares up 20% in the past year amid continued progress for its three divisions spanning education resources, e-marking, and schools ICT software.

Sentiment got a further boost today with robust half-year results, helped by last year's acquisition of The Consortium from newspaper distributor Connect.

The deal meant revenues were up a third and operating profits ahead 27.4% to £8.3 million as CEO David Brooks said RM was confident of at least meeting full-year expectations.

A strong balance sheet also enabled the company to increase its interim dividend by 15% to 1.90p.

Numis Securities raised its underlying earnings forecasts by 6-7% for 2018/19 and said it was encouraged by a return to underlying growth in RM's Resources division, which provides curriculum and education resources for schools and nurseries in the UK and overseas.

Numis now has a price target of 275p, which is based a on valuation multiple for 2019 of 13 times, up from a previous forecast of 12 times.

Analyst Will Wallis said:

"We estimate that the group is currently valued at 10.5x, which we think is very attractive for this well-managed and cash generative business."

Peel Hunt also increased its price target on RM from 215p to 242p as it lifted its full-year dividend forecast from 7.3p to 7.6p.

Source: interactive investor Past performance is not a guide to future performance

Elsewhere among the small-caps, Utilitywise surged 18% after it announced a new collaboration with Vodafone Group and Dell EMC.

The company, which is an energy and water broker for smaller companies, is launching an Internet of Things (IoT) platform allowing businesses to evaluate all of their energy outputs from a single hub. It believes this can lead to big savings for customers.

Finncap analyst Guy Hewett said:

"Management has previously set a target of developing a 5% share of the £1.5 billion UK corporate energy controls market and this is a major step forward towards this goal."

Founded in 2006 as a utility services broker, Utilitywise listed on AIM in 2012. Its shares peaked at 339p in 2014 but have been in decline ever since.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.