10 fast-moving growth stocks resisting market concerns

Despite all the uncertainty around financial markets, some stocks are showing few signs of concern.

11th September 2019 15:24

by Ben Hobson from Stockopedia

Despite all the uncertainty around financial markets, some stocks are showing few signs of concern.

Over the past two years, there's been an understandable sense of unease among stock market investors. Confidence has been knocked by the unpredictability of Brexit and the direction of economic growth at home and abroad. Like the dull thud of a mild headache, you might sometimes forget about it, but that nagging pain is always there.

But while the outlook is - as always - uncertain, there are some stocks that are showing few signs of concern. For some of the market's fastest moving growth shares, it's business as usual, and their price momentum proves that investors are backing them.

Before we look at the traits of some of these fast-growing firms - and how to find them - what is it about the market that suggests that sentiment is wavering?

Well, at just over 4,000 points, the FTSE All Share index - a rough, market-cap weighted cross-section of the UK market - is virtually unchanged from where it was a year ago. In fact, while there have been some gentle swings, the index is actually very little changed on where it was two years ago. So in many ways, the market has been drifting for months.

But of course, the index is just the average. It's as close to a barometer as we've got for measuring investor confidence, but it doesn't tell the whole story. Dig a little deeper and it's possible to find fast growing stocks that are doing very well in these drifting conditions.

This of course is the classic territory of growth investors. Looking for fast moving stocks with the power to electrify investment returns has been the bread and butter strategy of investors ranging from the American legends Philip Fisher and T. Rowe Price to modern day heroes like Peter Lynch and Jim Slater.

The job of the growth investor is to find companies that are at an early stage in the growth cycle. Firms need to be growing their earnings quickly but they also need some kind of edge that will protect them from competition. Growth can evaporate quickly if a business isn't strong enough to protect itself.

To do this, growth investing strategies tend to look at two key factors: historic growth and forecast growth. Typically, the early signs of a growth stock will be a track record of earnings-per-share growth - certainly over the previous three years. And some investors will want to see those figures increasing on a quarter-by-quarter basis.

After that, extrapolating historical growth into the future is challenging, but analyst forecasts can provide guidance on what is likely to happen next - and you can see that in longer-term earnings forecast upgrades.

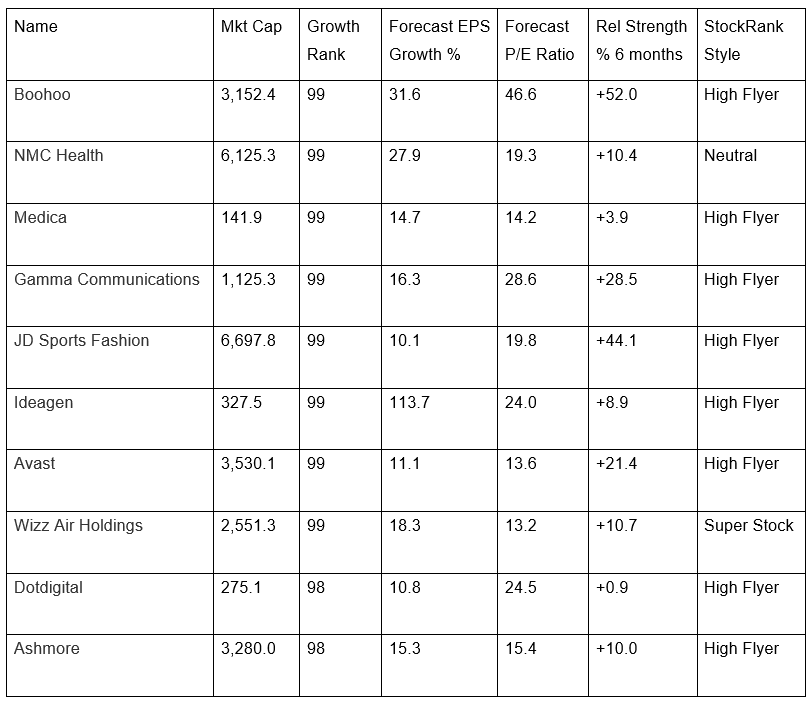

With this in mind, we screened the market to get an idea of which companies have some of the strongest growth profiles at the moment. We used a GrowthRank - from 0 (poor growth) to 100 (excellent growth) - which scores and ranks each stock based on its overall exposure to these growth factors.

On top of that, six-month momentum had to be positive and we also included details about the forecast earnings growth and PE ratios of these stocks - as well as how they rate against Stockopedia's StockRank 'Style' framework.

Interestingly, there's a mid-cap tilt in the results. Larger stocks like the fashion retailers Boohoo (LSE:BOO) and JD Sports Fashion (LSE:JD.), private healthcare group NMC Health (LSE:NMC), cloud communications specialist Gamma and IT security software group Avast (LSE:AVST) are notable names. But among the smaller stocks are the technology and software firms, Medica Group (LSE:MGP), Ideagen (LSE:IDEA) and dotDigital (LSE:DOTD).

A common trait among these fast growing stocks is a profile of high quality financials and strong positive momentum, which classifies most of them as 'High Flyers'. In bullish conditions, these kinds of growth shares have been known to produce stunning returns - but in bear markets they can also be the first to suffer.

For investors uncertain about the outlook for UK stocks, the risk with high flying growth stocks is that they can become expensive. But in the absence of a downturn - or even a market rally - stocks with this kind of profile could potentially outperform for long periods. But if the market does start to turn bearish, having an idea about which growth stocks are popular with investors could be a useful guide to where to look for possible bargains.

About Stockopedia

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

- Interactive Investor readers can enjoy a two-week free trial and £50 discount to Stockopedia using the coupon code iii014 - click here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

interactive investor readers can get a free 14-day trial of Stockopedia here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.