10 fund tips: How to profit as ‘cheap UK’ returns to form

With the election won and Boris Johnson pushing a Brexit resolution, is the British economy a good bet?

16th December 2019 11:38

by Cherry Reynard from interactive investor

With the election won and Boris Johnson pushing a Brexit resolution, is the British economy a good bet?

The narrative on the UK tends to follow a familiar pattern: yes, UK shares are cheap, particularly domestic-facing small caps, but few are going to reinvest until Brexit is resolved.

Brexit paralysis

While the Conservatives, who this week won a landslide majority in the UK general election, promise to Get Brexit Done, this also means concluding a trade deal with the EU by the end of 2020. No country has ever negotiated a trade deal of this magnitude in such a short space of time, and Boris Johnson has declared himself ready to leave on World Trade Organisation (WTO) terms. In short, any meaningful resolution to the Brexit paralysis seems some way off, no matter what the politicians are promising.

Following the election result, Shanti Kelemen, investment director at Brown Shipley, said:

“For many firms – particularly utilities, housebuilders and banks – the result has removed a significant level of pressure from some Labour policies. For others, however, the elephant in the room remains Brexit. The crucial part of setting our future relationship with the EU is yet to come, and there is little time to negotiate it. A move to WTO trade terms would be damaging for many UK businesses.”

UK shares are undoubtedly cheap relative to their global peers. Analysis by Invesco suggests that a dollar of revenue generated in the US is currently valued three times as highly as a pound of revenue generated in the UK. It says UK domestic companies are now trading at a 25% discount to their international peers. So it is no surprise to see UK funds languishing near the bottom of the sector performance tables over three and five years.

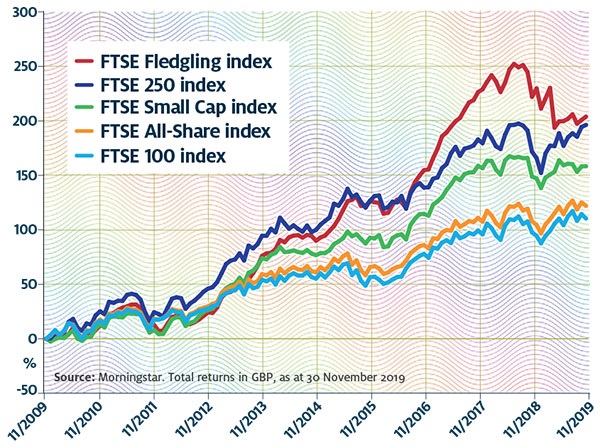

Smaller companies have had a particularly tough time. Seen as tethered to the fortunes of the domestic economy, they have been friendless while the threat of a Labour majority or a no-deal Brexit have faced the UK.

So far, this perfectly fits the narrative for the UK economy; but it isn’t always necessary to have a catalyst for a country’s stock market fortunes to change, and even pre-election there were early signs attitudes towards the UK are improving.

Over the three months to end November, the Investment Association UK smaller companies sector has beaten any other, while UK all companies and UK equity income are third and fourth only to Japan. The question is, is this a more permanent reversal in fortune, or a short-term bounce in response to the election's conclusive results?

Towards clarity

Will McIntosh-Whyte, a fund manager on the Rathbone Multi Asset Portfolio funds, gives UK equities a tentative endorsement: “We hold a number of direct UK stocks, but have also recently been increasing our exposure to UK equities more broadly through a tactical passive allocation, through both a FTSE 100 tracker and a FTSE 250 tracker.

“We believe we are moving towards greater clarity over the future of the UK, and UK equities – in particular those more domestically orientated – should benefit as investors return to the UK market. But even with some sort of Brexit deal, there remains significant uncertainty over the future of the UK’s relationship with Europe and a relatively tight timeline on which to negotiate the details.”

On investments, Keleman said: “The UK equity market has been out of favour with international investors since the 2016 referendum, but a decisive election result could prompt some investors to rethink their views on the UK.

"We are leaving the European Union and voters may not go to the polls again until 2024. This may well build momentum around UK assets in the short term, but some may wait for further clarity on our future trading relationship with the EU before piling back into UK companies.”

On the economy too, fund managers see better times ahead. Neil Veitch, manager of the SVM Opportunities fund, says investors shouldn’t underestimate the UK economy’s resilience:

“It has well-established intellectual property, good education, the rule of law, is in the right time zone, and operates in the lingua franca of business. It is well-placed to grow.”

To date, the UK economy has not tipped into recession. It has undoubtedly slowed, but has been kept afloat by consumer spending. The problem has been capital expenditure. James Henderson, director of UK investment trusts at Janus Henderson, points out that overseas investors have pulled back, with some sectors – such as the automotive industry – particularly hard hit. However, he spots the seedlings of recovery:

“There are cycles in capital expenditure. Government and corporate spending projects can’t be put on hold forever… Whatever the politics, we need to have replacement spending picking up from these low levels.”

With this in mind, he believes GDP in 2020 may be better than forecast: “That’s not a bad place for equities,” he says. “There could be some stabilisation, some growth in corporate margins. We’re not there yet, but we might be next year. The cost line for UK companies is well-controlled, so it would only need to be a little bit better to make a real difference.”

He further believes that merger and acquisition activity has been constrained by concerns over a Labour government, but the weakness of sterling has left valuations of UK companies looking cheap for overseas buyers.

“Bids are coming in for a very diverse selection of undervalued companies,” he adds. This could emerge as a strong source of support for UK companies.

FTSE 100 trailing wider UK market

Retail woes

Certainly, there are still ‘landmine’ sectors. The retail sector needs to be handled with care as bankruptcies mount – Thomas Cook (LSE:TCG), Debenhams (LSE:DEB), Forever 21. Retail woes are also being felt by bricks-and-mortar property groups, though share prices show a significant discount to the net asset values of the underlying property portfolios. Henderson believes they probably reflect the potential weakness.

Where does that leave investors? Options are divided: Gavin Haynes, an investment consultant, believes that UK equity income could be a reasonable place to hunt. “It is a very unloved asset, and that won’t change overnight. But the valuations of domestically focused areas are now justifying some interest. There is light at the end of the tunnel if some sort of Brexit agreement is put in place. Valuations look very attractive, and the yields available look good relative to very low interest rates. Bonds are on a negative yield, while investors are getting 4%+ in dividends from the UK markets.”

As always, Haynes believes investors need to be cautious about the concentration of UK equity income funds. The top 15 companies still pay around two-thirds of UK dividends. He says:

“The key is to find a fund manager who can look for out-of-favour companies, good quality businesses that are well-positioned to maintain and grow their dividend.”

Haynes likes Man GLG UK Income, where Henry Dixon has delivered “some really good performance despite the prevalence of growth overvalue in recent years”. Schroder Income Growth (LSE:SCF) is his choice for someone wanting more of a large-cap focus. For really out-of-favour companies, he suggests Chelverton UK Equity Income.

Henderson thinks small cap is increasingly promising: “Small cap has underperformed mid cap very severely, as quite a lot of businesses are tied to the UK domestic economy. There has also been a move to stocks with greater liquidity.” Here, he believes the environment is stabilising and the worst may be over.

Laura Suter, personal finance analyst at AJ Bell, suggests Franklin UK Smaller Companies fund as “a disciplined investment process combined with an astute awareness of the UK smaller companies’ sector”, and a concentrated portfolio. She also likes Merian UK Smaller Companies, which has “a heritage in small cap investing”.

The opportunity probably isn’t among the larger international companies. As Veitch says:

“If there was some form of resolution, I would expect sterling to rally. It could move 6-7% from where we are today. That would be good for UK-based, UK-sensitive companies. That said, the FTSE 100 has a lot of companies with dollar-based earnings. They would have a headwind in that environment and the index may not make a lot of progress.”

It has been a rocky road for the UK and there are still plenty of hurdles for Johnson and the Tories to navigate. However, much has been priced into markets and last night's decisive result gives some much-needed clarity.

Five passive plays: How to buy the region

These five passive options for exposure to different parts of the UK market are all Money Observer Rated Funds for 2020.

1iShares Core FTSE 100 ETF (LSE:ISF) offers investors core exposure to UK blue-chip companies and costs 0.07%.

2Fidelity Index UK fund for low-cost broad UK exposure, tracking the FTSE All-Share Index and with ongoing charges figure (OCF) of 0.06%.

3Vanguard FTSE 250 UCITS ETF (LSE:VMID) for more of a focus to the domestic economy, yielding 3.1% and with an OCF of 0.1%.

4 Vanguard UK Equity Income Index fund for a dividend strategy; yields 4.4% and the ongoing charges figure is 0.14%.

5 SPDR® S&P UK Dividend Aristocrats holds the UK’s highest dividend-paying companies that have held payouts for at least the past seven years. The yield is 4.5% and the ongoing charge figure is 0.3%.

This article was written before the UK general election result and has been updated.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

This article was originally published in our sister magazine Money Observer, which ceased publication in August 2020.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.