10 top stock picks using Buffett checklist

1st August 2018 13:13

by Ben Hobson from Stockopedia

Ignoring the noise could help you beat the market in the volatile months ahead. Stockopedia's Ben Hobson uses this Buffett-like approach to pick potential winners.

There are less than eight months to go until the official Brexit leave date on 29 March 2019. Yet even now, the more information that seeps from the government, the more mind-boggling the exercise seems. Far from being an orderly process, it feels more like a political barroom brawl. Considering there could be far reaching consequences for UK shares, the uncertainty is likely to ratchet up a great deal in the coming months.

Yet while Brexit looms large and others fret over trade wars and commodity prices, there are those who simply tune out this kind of noise. In 'The Little Book of Behavioral Finance', the analyst James Montier insists that worrying about this stuff is a waste of time. He writes:

"It is far better to focus on what really matters, rather than succumbing to the siren call of Wall Street's many noise peddlers. We would be far better off analyzing the five things we really need to know about an investment, rather than trying to know absolutely everything concerned with the investment."

One fund manager who has pulled this off with remarkable success in recent years is Keith Ashworth-Lord. He runs the Sanford DeLand UK Buffettology Fund, which over the past five years has achieved a stunning cumulative return of 128.7%.

As the name suggests, Ashworth-Lord's fund is inspired by the US investing legend Warren Buffett. But more precisely, his modus operandi is based on something called Business Process Investing. Simply put, he has a strict checklist that each stock has to pass if it’s to make it into his fund.

● Their business model is easily to understand;

● They produce transparent financial statements;

● They demonstrate consistent operational performance with earnings being relatively predictable;

● They generate high returns on capital employed;

● They convert a high proportion of accounting earnings into free cash;

● Their balance sheet is strong without unduly high financial leverage;

● Their management is focused on delivering shareholder value and is candid with the owners of the business;

● Their growth strategy is more likely to rely on organic initiatives than frenetic acquisition activity.

Source: Sanford DeLand Asset Management

This is a useful list of criteria for anyone looking for high quality, Buffett-like businesses. It's worth saying that Ashworth-Lord also spends time digging through accounts and doing valuation work so he can buy the stocks he likes at prices below their economic worth. Once he’s bought them, he holds them until the investment case changes.

For Ashworth-Lord, market noise is just that - noise. He's a buyer in uncertain conditions, when valuations fall and he can snap up shares of firms he knows well. His checklist approach is a useful template for individual investors facing a particularly uncertain near future.

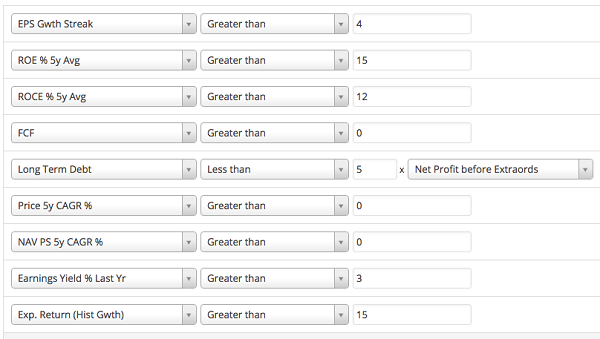

At Stockopedia we model various strategies that echo the high quality, Buffett-like approach used by Ashworth-Lord. This week's screen looks for firms with strong profitability and cash flow, low leverage, price strength and reasonable valuations.

The results include a set of stocks that may well be familiar to investors who look for high quality, high momentum stocks - although some have seen their prices weaken in recent months.

| Name | Mkt Cap £m | EPS Growth Streak | ROCE % 5y Avg | Free Cash Flow | Earnings Yield % Last Year |

|---|---|---|---|---|---|

| Rightmove | 4,412 | 9 | 2,132 | 157.1 | 4.05 |

| Mortgage Advice Bureau | 342.9 | 6 | 72.8 | 14.2 | 4.4 |

| 4imprint | 567.3 | 6 | 57.8 | 25.7 | 5.64 |

| Howden Joinery | 2,924 | 8 | 43.2 | 139.2 | 8.65 |

| Eurocell | 252.8 | 5 | 33.1 | 16.2 | 9.06 |

| JD Sports Fashion | 4,554 | 5 | 29.9 | 152.2 | 6.87 |

| Ted Baker | 982.7 | 9 | 29.2 | 7.32 | 6.46 |

| Jupiter Fund Management | 2,005 | 5 | 26.4 | 225.3 | 11.4 |

| Robert Walters | 565.1 | 5 | 24.3 | 25 | 7.85 |

| Avon Rubber | 451.4 | 8 | 23.9 | 25.8 | 4.88 |

Source: Stockopedia Past performance is not a guide to future performance

Leading the list is Rightmove, which has long been a ‘poster stock’ for anyone looking for high returns over long periods. Its price has fallen quite sharply of late on fears of a property market slowdown, but its investment profile against these rules remains impressive. Among the other larger stocks are the fashion retailers JD Sports Fashion and Ted Baker and the funds group Jupiter Fund Management.

This approach picks up high quality growth small-caps like Mortgage Advice Bureau (Holdings), 4imprint Group, Eurocell, Robert Walters and Avon Rubber.

One certainty amid the months of confusion that lie ahead is that stockmarkets could become volatile as the UK edges towards the EU door. The lack of clarity about what any deal - if there is one - will look like, sadly adds to the uncertainty.

It's precisely in these conditions that it’s worth revisiting a personal investing checklist. Regardless of what strategy you use, preparing for the prospect of a bumpy road ahead could be time well spent. Ignoring the noise and focusing on what really matters could help you keep your head when everyone else is losing theirs.

About Stockopedia

Stockopedia helps individual investors beat the stock market by providing stock rankings, screening tools, portfolio analytics and premium editorial. The service takes an evidence-based approach to investing, and uses the principles of factor investing and behavioural finance to help investors make better decisions.

Interactive Investor readers can get a free 14-day trial of Stockopedia byclicking here.

These investment articles are simply for generating ideas. If you are thinking of investing they should only ever be a starting point for your own in-depth research.