AI stars Nvidia and Palantir: buy, hold, or sell?

5th July 2023 10:17

by Rodney Hobson from interactive investor

After mulling it over for several weeks, overseas investing expert Rodney Hobson has made his mind up. He’s called it right once before. This is what he’d do now.

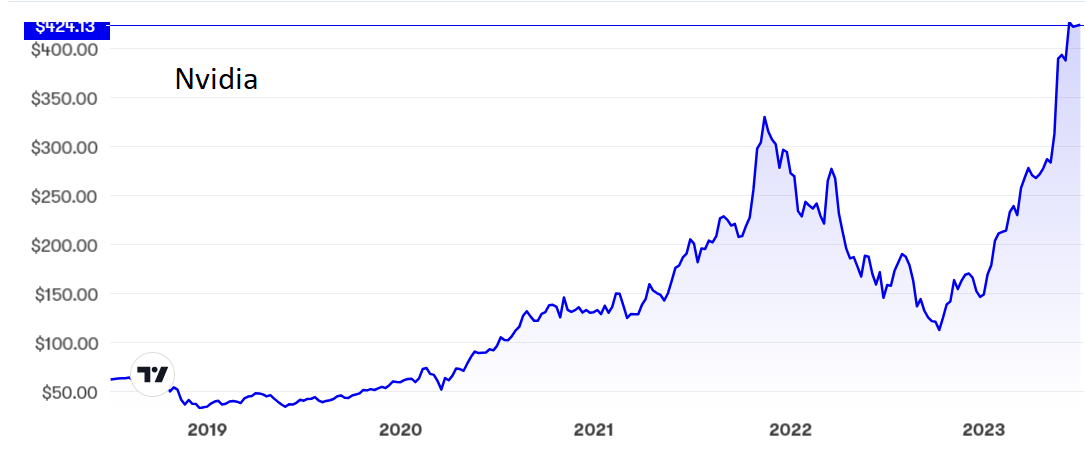

One of the most persistently popular overseas stocks among interactive investor subscribers is computer graphics chip maker NVIDIA Corp (NASDAQ:NVDA). It has certainly been a spectacular performer so far this year, and no doubt will be again, but investors should consider whether a correction is long overdue.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The rise since October last year has been nothing short of spectacular, from $112 to around $424 now. This year alone the share price is up more than 120%.

Nvidia should have a truly wonderful future as artificial intelligence (AI) takes off. It manufactures all the computer chips that leading AI systems run on. The problem is that an awful lot of good news is already in the share price and, while any potential competitor has a great deal of catching up to do, other chip makers will no doubt try to muscle into this extremely lucrative market eventually. The most obvious contenders are Advanced Micro Devices Inc (NASDAQ:AMD) and Adobe Inc (NASDAQ:ADBE).

Somewhat ominously, Nvidia had a tough first quarter for its 2023-24 financial year, with revenue down 13% on the same three months last year. Analysts expect it to bounce back over the next nine months but that is not a foregone conclusion, especially as the US is considering further restrictions on the export of computer chips to China.

The price/earnings (PE) ratio for Nvidia is an amazingly demanding 220, which assumes that earnings will snowball at a truly remarkable rate. The yield of only 0.04% is hardly worth the cost of arranging the payments.

- Be cautious of ‘AI tech hype’ as seven US stocks dominate returns

- Stockwatch: could Nvidia be stock of the century?

- Tech mega-cap index surges 61% in 2023

A correction has happened before. The shares shot up from $50 to $330 between July 2020 and November 2021, only to slump all the way back to that low of $112 less than a year later. If, as seems likely, another correction occurs, it is likely to be pretty vicious.

Source: interactive investor. Past performance is not a guide to future performance.

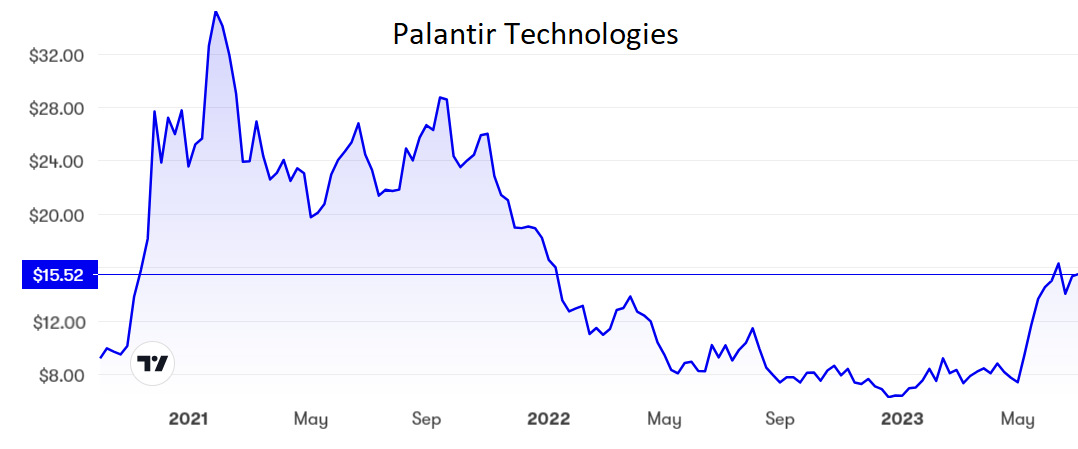

Another popular share to ride up on the back of this year’s tech boom is software specialist Palantir Technologies (NYSE:PLTR), although in this case the shares at $15.50 are still below half the $35 peak reached in 2021, a year after the company went public.

Like Nvidia, Palantir has negative factors to consider. While revenue rose 24% last year, growth was well down on the 41% gain in 2021, and a further slowdown is likely this year as companies struggle with inflation and rising wage bills. Although Palantir has at last started to produce a small profit, it has several quarters of losses to make up for and a dividend looks a long way off.

Source: interactive investor. Past performance is not a guide to future performance.

Again, the future could turn rosy as computing experts reckon Palantir will also benefit from the spread of AI. However, as I warned in November 2021, while Palantir continues to increase revenue at some rate of knots, its shares are still suffering from overhyped expectations that are clouding a potentially stellar performance.

- Artificial intelligence: is the hype real, and how to invest in the winners

- Ian Cowie: how to buy AI stock winners on the cheap

- Why you may already be profiting from AI

Hobson’s choice: I have considered recommending that shareholders should take profits in Nvidia for several weeks but, mindful of the stock market mantra that trends tend to go on for longer than you expect, I have held back. Surely now is the time to say enough is enough. Those who got in near the most recent bottom could consider hedging their bets and selling half their stake, but there will surely be an opportunity to get back in at a much lower level before the year is out.

I advised selling Palantir, or at least taking some profits, 20 months ago when the shares were top side of $20. They were down to $6.50 by the end of last year but another, less spectacular rise has renewed the opportunity to cash in again. Sell and hope to buy back at a lower level.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.