An American company with real wind in its sails

Director share buying and activist investors sniffing around are just two reasons to track this stock.

21st April 2021 09:01

by Rodney Hobson from interactive investor

Director share buying and activist investors sniffing around are just two reasons to track this stock.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

This is the year for American companies to polish their green credentials. One company that is seizing the opportunity is regulated electricity supplier Evergy (NYSE:EVRG).

Evergy was formed from the merger of Westar Energy in Kansas and Great Plains Energy of Missouri, and its operations are still limited mainly to those two states. Even so, it has 1.6 million customers and the largest electric vehicle charging network in America.

What is changing is how it generates its energy.

Currently, over 50% of total sales come from electricity generated by coal and natural gas. That was fine while climate change sceptic Donald Trump was in the White House, but President Joe Biden has made greener, cleaner energy a key plank of his agenda.

- ‘Restore the Earth’ fund options for Earth Day 2021

- ii ACE 40 review: Q1 2021

- Want to invest ethically? ii’s ACE 40 list of ethical investments can help

- Buying US shares is easy to do at interactive investor. Here’s how

Fossil fuels are gradually losing $3.2 billion a year in tax concessions as $9.8 billion worth of benefits for renewables rise further. Installation of wind-generated capacity was already at record levels in the US in the fourth quarter of 2020 while Trump was still clinging to power; they are certain to be boosted further this year.

Fuel cells should be the next big thing in the renewable energy market, even though this sector is being held back by tariffs on the import of vital supplies of aluminium and steel imposed by Trump.

Fortunately, Evergy is in the process of closing coal-fired power stations and switching to renewables, which now account for 27% of output. Most of this is wind power, making Evergy one of the largest wind energy suppliers in the United States. It also owns 94% of the Wolf Creek nuclear plant that supplies about 17% of its generation.

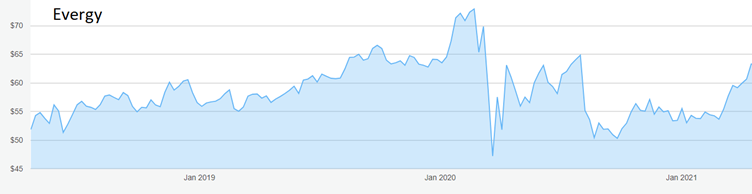

Source: interactive investor. Past performance is not a guide to future performance

Results for the final three months of 2020 did beat analysts’ expectations, as they had done in the previous three quarters. Unfortunately, at 28 cents per share, earnings were down 12.5% on the previous final quarter, mainly because of lower demand due to the pandemic. However, 2021 should be much better, with total earnings coming to $3.20-3.40 according to the company itself. Once again, though, Evergy should surprise on the upside, as unusually cold weather in February boosted demand.

Total fourth-quarter revenue at $1.1 billion was 3.3% lower year on year, partly offset by a 2.5% fall in operating and maintenance costs. Cash in hand jumped from $23.2 million to $144.9 million, which will be handy for investing in green energy. Evergy plans to spend $9 billion over the 2020-24 five-year period, modernising the grid and improving efficiency and reliability, so it will need to continue its already strong cash flow.

- Investing in the US stock market: a beginner’s guide

- Discover how to be a better investor here

- Check out our award-winning stocks and shares ISA

Last week, director John Wilder bought over 2 million shares at just under $50 each in a vote of confidence. Fund managers are also reported to be showing interest in the stock. They include activist investor Elliott Investment Management, whose presence on any share register is generally a sign that management will be under pressure to unlock value for shareholders. It is not too late for investors to follow their lead.

The shares peaked at $73 in January last year, when they looked set to keep rising before the pandemic took its toll on the stock market. They have been as low as $47 since but are on the rise again at $64, where the yield is 3.3%.

Hobson’s choice: Buy up to $65, where there could be resistance. If that ceiling is broken the stock could be heading back to its peak.

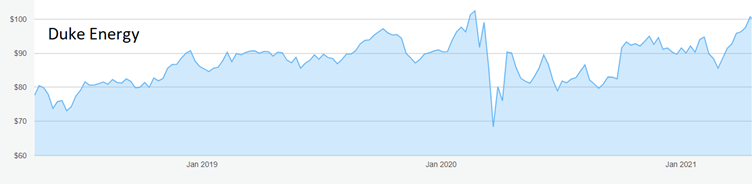

Source: interactive investor. Past performance is not a guide to future performance

Update: I suggested buying the larger energy company Duke Energy (NYSE:DUK) at $87 back in May 2019 and repeated that advice at a similar price in January 2020 and at just above $90 in December. The stock now stands above $100, giving a nice capital gain plus a solid dividend. The yield is 3.8%. The shares are likely to mark time for now but are still worth holding.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.