‘Restore the Earth’ fund options for Earth Day 2021

interactive investor shares fund suggestions and reveals bestselling ‘Embrace’ funds to mark Earth Day.

19th April 2021 15:30

by Myron Jobson from interactive investor

interactive investor shares fund suggestions and reveals bestselling ‘Embrace’ funds to mark Earth Day.

Thursday 22 April marks Earth Day, and this year’s ‘Restore Our Earth’ theme focuses on natural processes, emerging green technologies and innovative thinking that can restore the world's ecosystems.

The theme has been embraced by customers of interactive investor, the UK’s second-largest direct-to-consumer investment platform, who have increasingly invested in ethical funds over the past year.

Seven of the top 10 bestselling ethical funds/investment trusts/ETFs on ii since Earth Day last year (22 April 2020) to 15 April 2021 is categorised under our ‘Embrace’ ethical investing style* – with an environmental focus.

Funds in the ‘Embrace’ category occupy the top three positions, with the Renewables Infrastructure Group (LSE:TRIG) investment trust at the helm, followed by Greencoat UK Wind (LSE:UKW) investment trust in second position and Gore Street Energy (LSE:GSF) in third.

Becky O’Connor, Head of Pensions and Savings, interactive investor, says: “Science has shown us humanity’s damaging impact on the planet. Even for investors who are sceptical about climate change itself or our ability to reverse it, the emergence of entire sectors and industries to tackle the problem may be compelling. The United Nations 26th Conference of the Parties (COP26) takes place this year in Glasgow, placing renewed focus on joint international action to resolve the climate crisis.

“Pressure on global governments is mounting to introduce regulations and further targets to keep temperatures below 1.5 degrees. This type of collective action has the potential to change the ways of many companies. Investments that support rather than hinder these efforts are therefore in a good position to benefit.

“Normal people can choose to take a stake in this positive change within their own ISAs and SIPPs – and can still expect returns in the process. The ability to make a difference and look after your own financial future is driving more and more people towards investments such as those in the interactive ‘Embraces’ range.”

Performance

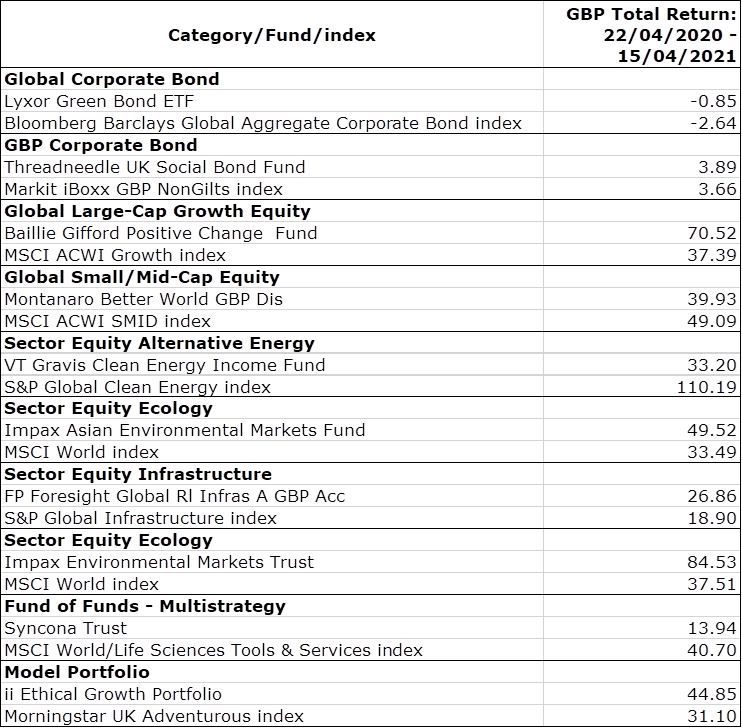

When it comes to performance, five out of the nine ‘Embraces’ ethical options on ii’s ACE 40 rated list of ethical selections, outperformed their benchmark over since earth day last year (22 April 2020 – 15 April 2021). The best performer was Impax Environmental Markets Trust (LSE:IEM), which returned 85% over the period, outstripping its benchmark index, MSCI World (38%).

It is a similar story forii’s ethical growth portfolio, a ready-made, balanced, multi-asset portfolio run within a socially responsible investing framework, which outperformed its benchmark: Morningstar UK Adventurous Index (45% versus 31%).

Myron Jobson, Personal Finance Campaigner, interactive investor, says: “Ethical investing is not a fad, but has become a mainstream consideration for investors – both retail and institutional.

“The average ii portfolio weighting to socially responsible funds (from our ethical long list of over 140 funds and trusts) has more than doubled in the space of three years – albeit from a low base (0.7% on 31 March 2018 to 1.87% on 31 March 2021). It is interesting to see propositions that fully embrace the ‘Restore Our Earth theme’ have dominated our ethical bestsellers, in a year in which the pandemic has raised some fundamental questions about how we work, and the sort of planet we want to live on.

“There is a growing pool of evidence that shows there is no performance penalty associated with ethical investing. ESG funds have been relatively resilient since the onset of the coronavirus crisis.”

Fund picks to ‘Restore the Earth’

Dzmitry Lipski, Head of Funds Research, interactive investor, says: “We like Impax Environmental Markets Trust (LSE:IEM), which invests predominantly in quoted companies that provide, use, implement or advise upon technology-based systems, products or services in environmental markets. There is a particular focus on alternative energy and energy efficiency, water treatment and pollution control, and waste technology and resource management (which includes sustainable food, agriculture and forestry).”

“The investment trust is listed on our ACE 40 as an adventurous option due to the specialist nature of the strategy.

“The trust’s holdings are predominantly listed in US and Europe and cover a range of sectors in which the trust’s objectives are directly relevant. The trust has an 18-year track record but has seen its performance go from strength to strength since 2016, when investors began to take a closer interest in ESG factors.

“The Jupiter Ecologyisone of the longest-running, environmentally focused funds in the UK. Launched in 1988, it invests across environmental themes that include renewable energy, pollution reduction, resource efficiency, water treatment and infrastructure, and waste recycling.

“At least 70% of the fund is invested in shares of companies based anywhere in the world whose core products and services address global sustainability challenges, and up to 30% can be invested in other assets, including shares of other companies, open-ended funds and cash.

“Companies must meet both a comprehensive financial assessment and environmental and social criteria including looking at a full range of ethical exclusions.

“Meanwhile, RobecoSAM Sustainable Water Equities Fund invests in companies offering technologies and infrastructure that enable efficient management and treatment of water supplies - from irrigation systems and pipeline networks that efficiently distribute water to waste treatment plants testing analytics that guarantee its quality.”

Most bought ethical funds on the ii ethical long list since Earth Day 2020 (22 April) to 15 April 2021.

| Position | Investment | ACE' category |

|---|---|---|

| 1 | Renewables Infrastructure Group (LSE:TRIG) | Embraces |

| 2 | Greencoat UK Wind (LSE:UKW) | Embraces |

| 3 | Gore Street Energy (LSE:GSF) | Embraces |

| 4 | Stewart Investors Asia Pacific Leaders Sustainability Fund | Considers |

| 5 | Liontrust Sustainble Future Global Growth | Considers |

| 6 | NextEnergy Solar (LSE:NESF) | Embraces |

| 7 | JLEN Environmental Assets Group (LSE:JLEN) | Embraces |

| 8 | Bluefield Solar Income Fund (LSE:BSIF) | Embraces |

| 9 | BGF Sustainable Energy | Embraces |

| 10 | Janus Henderson Global Sustainable Equity | Considers |

Performance of ii’s ACE 40 ‘Embrace’ options and ii Ethical Growth Portfolio versus benchmarks since Earth Day 2020 (22 April 2020 – 15 April 2021)

Source: interactive investor/Morningstar. Total returns in GBP.

Historically, investors have not always been able to navigate the sector easily, and over the last two years interactive investor has tried to plug that gap with a range of tools for investors.

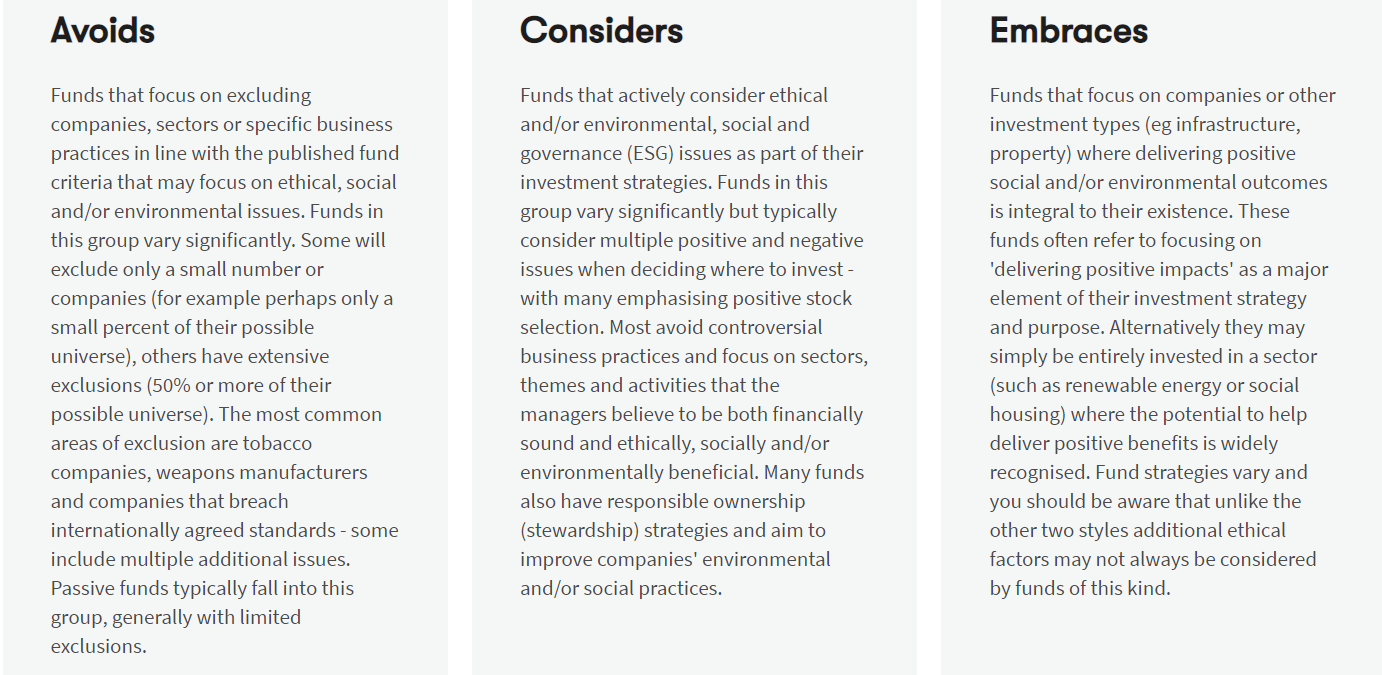

ii publishes a rated list of ethical fund selections, ACE 40, and a longlist of more than 140 socially responsible and environmental funds, investment trusts and ETFs available on the platform broken down into three interactive investor ACE investment styles: Avoids, Considers and Embraces, to help investors navigate the list.

We also offer an ethical model portfolio of 10 funds and investment trusts. In addition, we enhanced our ‘Quick Start’ recommendations this year for beginner investors, including some low-cost, multi-asset, sustainable investment funds – the BMO Universal Sustainable Map range.

Notes to editors

*There is currently no accepted industry standard for classifying the myriad approaches to ethical investing adopted by investment managers. In order to help investors to navigate their way through all the confusing technical jargon towards an ethical approach that is aligned with their own personal values, we categorise all ACE 40 investments into one of three broad ethical investment ‘styles’:

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.