The Analyst: handling portfolio construction and risk

Analyst Dzmitry Lipski examines the two most common approaches to construction and risk management of multi-asset portfolios.

8th September 2025 11:46

by Dzmitry Lipski from interactive investor

Global markets have experienced elevated volatility this year, driven primarily by fluctuating US trade policies, geopolitical shifts and broader economic uncertainty. This heightened volatility spans all asset classes. As a result, many investors are reassessing their portfolio strategies to ensure they are as resilient as possible in the face of what lies ahead.

While uncertainty is never comfortable, it can also create opportunities. The ability to adapt and find value in turbulent conditions is an essential part of managing investments effectively.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

When it comes to portfolio construction and risk management of multi-asset portfolios, two of the most common approaches are risk-targeted allocation and static asset allocation.

Static asset allocation porfolios

Static asset allocation portfolios maintain fixed percentage allocations to different asset classes (e.g. 60% equities/40% bonds), regardless of market conditions or changes in risk. These allocations remain constant over time and are periodically rebalanced back to their target weights. While this approach is simple to manage and easy to understand, it doesn’t adjust to shifts in market volatility, which means portfolio risk can fluctuate significantly.

A clear example of this approach is the Vanguard LifeStrategy 60% Equity fund, which maintains a fixed allocation of 60% to equities and 40% to bonds, investing in these via passive index funds. The fund is automatically rebalanced daily to these target weights rather than making tactical adjustments when volatility rises or falls. With this simple and unchanging approach to asset allocation, the strategy has delivered strong returns over time.

Risk-targeted porfolios

Risk-targeted portfolios enable investors to diversify while staying within their preferred risk tolerance. This approach gives investors greater confidence that their portfolio will remain aligned with their chosen risk level, regardless of market conditions. In today’s volatile macroeconomic environment, this feature is especially important.

Risk-targeted portfolios have an explicit risk target as part of their investment objective and are therefore constructed and rebalanced to remain within a constant range of portfolio risk (e.g., standard deviation or Value-at-Risk) rather than a constant asset allocation.

- How did one-stop shop funds fare amid tariff turmoil?

- 10 tactics when researching funds, investment trusts and ETFs

Asset weights adjust dynamically in response to changes in market volatility and correlations. For example, when volatility is low, portfolios may allocate more to equities to capture higher expected returns. Conversely, in periods of high volatility, allocations may shift towards bonds or cash to reduce risk. The aim is to maintain a stable risk profile, (e.g. 10% annualised volatility), across market cycles.

Take the abrdn MyFolio Index III fund as an example where strategic asset allocation is reviewed at least quarterly to ensure it remains appropriate in changing market conditions. As such, it is both the key driver of long-term performance and the main determinant of whether funds stay within their pre-defined risk targets.

Risk-targeting is set towards specific levels of global equity volatility as represented by the MSCI World Index over 10 years. For example, the abrdn MyFolio Index III fund targets a level of 45% to 75% of the volatility of global equity markets over the long term. A relative volatility target is more appropriate than an absolute target as the market environment and volatility regime constantly evolve over time. Similar to the Vanguard LifeStrategy funds, the underlying investments are (predominantly) in passive funds.

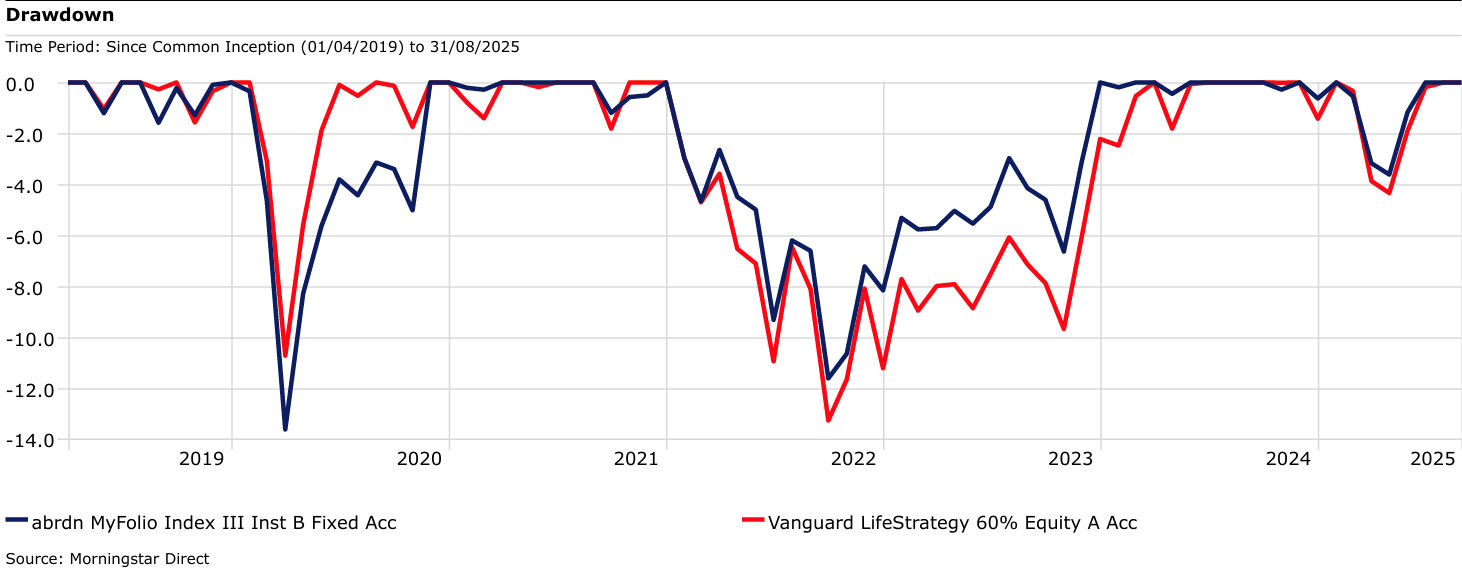

The fund has delivered strong absolute and risk-adjusted returns over both short and long time periods, outperforming peers in the relevant Morningstar Category. It also demonstrated lower drawdowns (peak-to-trough declines) during periods of market stress, such as in 2022.

Performance

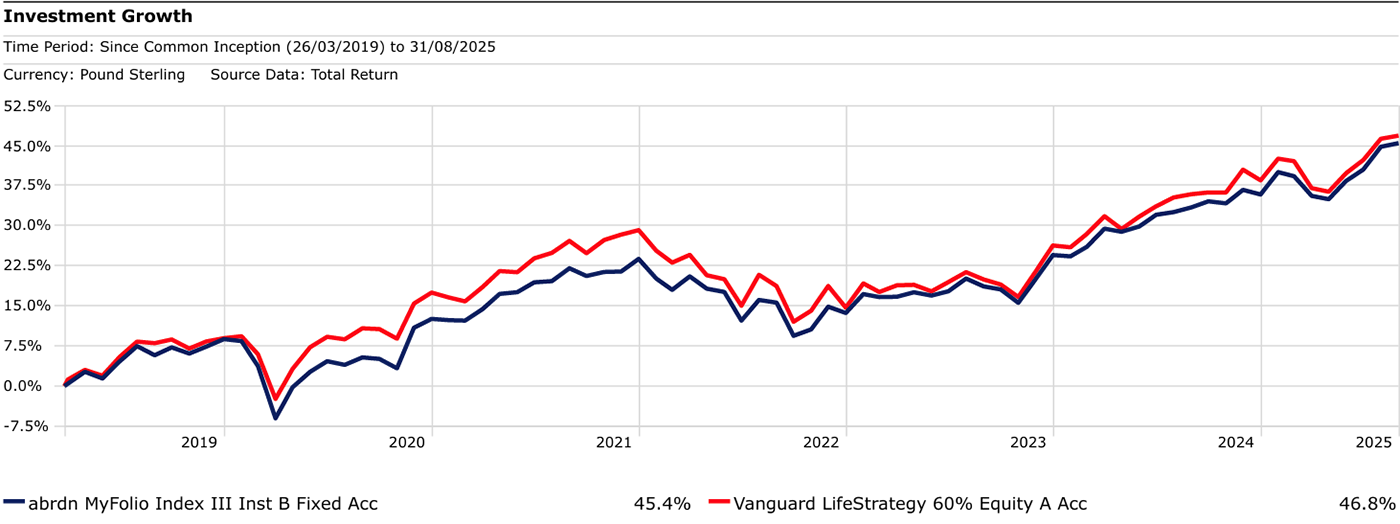

Here’s the performance comparing the static 60/40 portfolio represented by the Vanguard Life Strategy 60% Equity fund to a risk-targeted portfolio represented by the abrdn MyFolio Index III fund:

Past performance is not a guide to future performance.

The static allocation portfolio (red line) keeps a constant 60% in stocks and 40% in bonds, regardless of market conditions, and experienced larger drawdowns but outperformed during strong bull markets due to higher constant equity exposure.

The risk-targeted portfolio (blue line) adjusts its allocation dynamically to maintain a steady risk level and therefore delivered smoother returns and lower volatility, especially during periods of high market stress such as 2022.

Overall, each approach offers distinct merits to investors. Risk-targeted investing allows for a more consistent and predefined risk exposure and potentially better risk-adjusted returns. However, the approach can appear complex, and it may underperform in low-volatility bull markets where risk limits constrain equity allocations.

In contrast, because of their straightforward design, static portfolios are well suited for passive, long-term investing. They are especially attractive for DIY investors who value transparency and simplicity. However, the main limitation is that they don’t adapt to changing risk environments or incorporate tactical shifts in response to market conditions.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.