Another chance to buy into this dominant global brand

This company is a market leader and known the world over, but the share price dipped despite great quarterly results. Overseas investing expert Rodney Hobson updates his analysis of the business.

29th May 2024 08:31

by Rodney Hobson from interactive investor

Selling more of your products at higher prices is a clear recipe for success. Shares in drinks giant Coca-Cola Co (NYSE:KO) have slipped since the company unveiled great first-quarter figures, opening up a possible buying opportunity.

In the three months to 29 March, net income rose 2.3% to just shy of $3.2 billion, with net income per share 2.9% higher. Revenue climbed 2.9% to $11.3 billion, helped by higher prices and a more lucrative mix of products.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

The better figures allowed Coca-Cola to raise its outlook for sales growth for the full year. Organic revenue growth is now expected to be 8-9%, up from previous guidance of 6-7%. Forecast growth in earnings per share was admittedly not raised from 4-5% as indicated three months ago, but shareholders will be encouraged to believe that the indicated range will be beaten rather than prove too onerous.

It is important that Coca-Cola has been able to make price rises stick, as many of its markets have been suffering inflation, in some cases severe inflation. Another encouraging sign in these health-conscious days is that the zero-sugar version of the iconic drink grew three times as fast as other soft drinks sales.

Furthermore, the emerging markets in Latin America and Asia-Pacific have been driving growth of late and should continue to do so. While the Atlanta, Georgia, based company still has a solid and growing home market, it now makes most of its sales and profits outside the United States.

Shareholders will be reassured after a slight wobble towards the end of last year when net income took a dip in the final quarter despite further solid progress in sales.

- Shares for the future: a business I love is in great shape

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

Coca-Cola shares had been on the rise ahead of the latest figures, in particular closing 0.5% higher the previous day, so it was not entirely surprising that they ran into mild profit-taking afterwards.

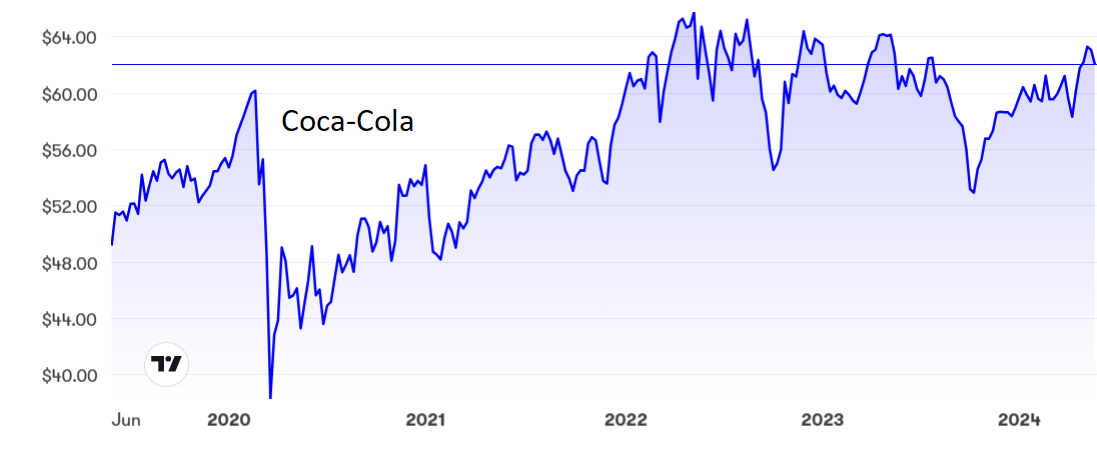

After hitting a 12-month peak at $63, they have slipped back below $62, where the price/earnings (PE) ratio is toppy at 24.9 but not too demanding for a company of this quality. There is also a useful yield of 3%.

Source: interactive investor. Past performance is not a guide to future performance.

Investors should note, though, that there is a solid ceiling at $65 that has held on numerous occasions over the past two years and the upside will be limited until that can be broken decisively. If we get more encouraging quarters, perhaps it will be.

Hobson’s choice: The shares should hold above $58, not far from the level at which I last recommended buying, so although the upside looks limited for the moment Coca-Cola is worth buying, at least up to $64. It will maintain its dominant market position and it still looks more attractive than nearest rival PepsiCo Inc (NASDAQ:PEP), where the PE is similar but the dividend a little lower.

Update: Safety-hit aircraft manufacturer Boeing Co (NYSE:BA) admits it will burn rather than generate cash this year. Now there’s a surprise. This follows an expert panel’s observation that there has been a disconnect between senior management and employees over safety.

The mid-air panel blowout on a new Alaskan Airways jet in early January prompted a six-fold increase in submissions on safety concerns from employees. Better late than never, but perhaps the workforce was suddenly emboldened to speak out, given that Boeing could hardly deny that it has safety issues.

I warned Boeing shareholders to sell for the third time at the start of this month, but for a reason that is hard to fathom the shares actually rose from below $170 to a peak of $188. The latest cash warning sent them plummeting, but at $174 it is not too late to get out. There is simply no attraction in these shares.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.