Another chance to buy this high-yield American icon cheaply

Our overseas investing expert has already made a profit on this stock and hopes to repeat the feat.

9th October 2019 10:10

by Rodney Hobson from interactive investor

Our overseas investing expert has already made a profit on this stock and hopes to repeat the feat.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

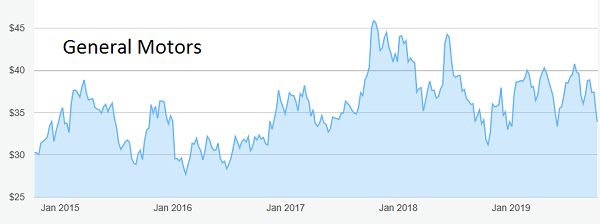

This has been a tough year for US vehicle makers but it's always worth sifting the wheat from the chaff in any sector. General Motors (NYSE:GM), America's largest car manufacturer, is faring better than its main rivals.

GM reported this month that its sales in the US were up 6.3% in the third quarter compared with the same period last year. This made up for an indifferent first half and meant sales for the first nine months were no worse than last year at 2.2 million vehicles.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

What was particularly pleasing was to see all four of GM's brands doing better in the latest quarter, with even Chevrolet, the poorest performer of 2019 so far, nudging ahead by 4.6%.

Source: interactive investor Past performance is not a guide to future performance

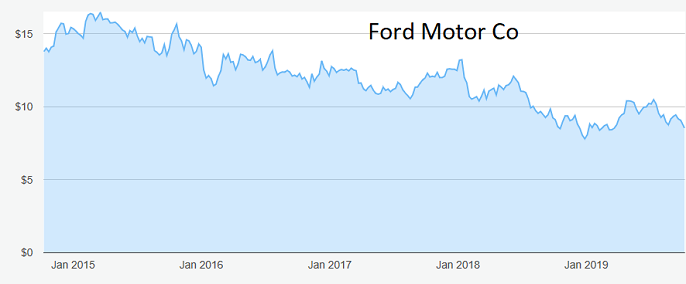

Overall, this was a better performance than provided by Ford (NYSE:F), which reported a 4.9% drop in third quarter sales, a worse fall than in the first half and leaving figures 3.9% adrift over the nine months. Car sales slumped alarmingly, and Ford’s plight would have been far worse but for an 8.8% improvement in sales of trucks.

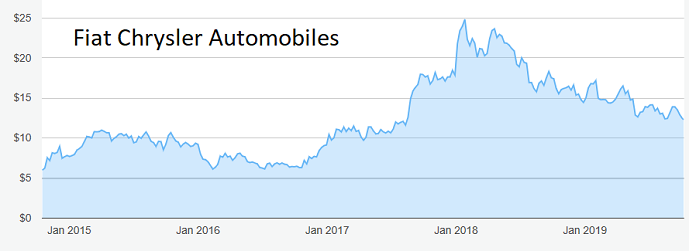

Somewhere in between was Fiat Chrysler Automobiles (NYSE:FCAU) with sales broadly flat in the third quarter, a similar performance to the first half.

Source: interactive investor Past performance is not a guide to future performance

The outlook for the American automobile industry is admittedly mixed. Donald Trump's trade wars show no signs of abating. Having scored some success with partners in North America he cannot afford to back down against China. Instead, he is now trying to turn the screw on the European Union. The desire to protect American industries, particularly in the rust belt that swung the 2016 presidential election in his favour, is probably causing more pain than gain in the US.

The American economy shows signs of slowing, although it still outstrips most of the developed world. Business investment declined in August, the latest available figure, to stand 1.7% below last year. Household spending is flatlining after growing strongly earlier in the year and job creation could be tailing off.

On the other hand, US consumers are expected to buy 17 million vehicles this year, a similar figure to last year. Since about a third of US car sales are on credit, the low interest rate environment will help. Unemployment remains low at 3.5% and wages are rising at nearly 3%.

- US earnings preview: some red flags, but no white ones – yet

- Attractive returns make General Motors one to own

- It's not just UK stocks that pay big dividends. Check out these ii Super 60 recommended income funds

- You can buy and sell US shares by clicking here

FCA's head of US Sales Reid Bigland remains optimistic despite his company's uninspiring sales figures. He said:

"Lower interest rates, a stable economy and consumer enthusiasm bolster our belief that new vehicle sales in the US are heading for a strong finish."

GM shares have traded around the current level of $34 for the past five years. The yield is an attractive 4.4% and the price/earnings (PE) ratio a derisory 5.5.

FCA shares doubled to $19.80 in the second half of 2017 but have been on a long slow downward path since. They currently stand at $11 and it may be best for investors to wait until they settle before buying. The chart suggests that $10.50 could well be the floor as the yield is approaching 6% and the PE is an undemanding 6.

The share price chart for Ford looks particularly depressing.

Source: interactive investor Past performance is not a guide to future performance

From a peak of $16.48 at the start of 2015 they have followed a downward trajectory to lose nearly half their value at $8.50. The yield is the highest of the three at 6.9% but so is the PE at 16. As with FCA, interested investors should look for signs that the slide is coming to an end.

Hobson's Choice: I recommended GM as the best prospect among US carmakers last December, and investors with a short-term perspective were able to bank a tidy profit. Now that the shares are back to December's level, another buying opportunity has arisen. It still looks to have the best future in prospect.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.