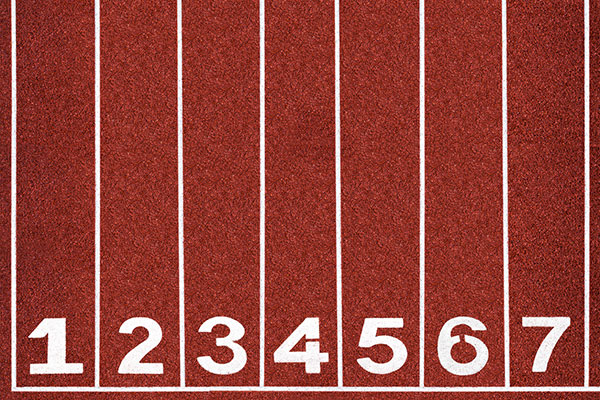

Are these seven baby steps the secret to a wealthy retirement?

23rd January 2023 15:32

by Alice Guy from interactive investor

Dave Ramsey has helped thousands become debt free and build their wealth. Alice Guy explores the pros and cons of this American personal finance star's strict approach.

According to Dave Ramsey, his seven baby steps to wealth are “not a fairy tale, [they work] every single time!”

The US-based “tough love” money guru has first-hand experience of financial hardship having dragged himself out of bankruptcy to build his wealth and set up a successful multi-million dollar business.

- Invest with ii: Open a Stocks & Shares ISA | What is a Stocks & Shares ISA? | ISA Offers & Cashback

His website, chat show The Ramsey Show and bestselling books including The Total Money Makeover explain a simple way to manage money, pay off debt and build wealth.

Ramsey argues for extreme frugality and “gazelle intensity” paying off debt, believing that short-term pain equals long-term gain. His motto is “If you will live like no one else, later you can live like no one else.”

So, how do his baby steps work in practice? Do they work in the UK and do they, as claimed, work for everyone?

I’ll first explain his baby steps, then examine the pros and cons.

Step 1) Save $1,000 for your starter emergency fund

Step one is to build a $1,000 emergency fund (around £800). This stops you needing to dip into your overdraft or rack up credit card debt if you get an unexpected bill. You’re not going to use debt from now on.

Ramsey argues that an ultra-tight budget is key: “a budget is telling your money where to go instead of wondering where it went.”

Step 2) Pay off all debt (except the house) using the debt snowball

Next, it’s time to pay off debt with what Ramsey calls a “debt snowball”.

Ramsey’s method is to list your debts, apart from your mortgage, and “put them in order by balance from smallest to largest - regardless of interest rate”.

You then pay off debt in order, starting with your smallest debt first and paying the minimum balance on your other debts. Once you’ve paid it off, you add your payment amount to the next smallest debt and “knock out your debts one by one”.

For those struggling with debt, Ramsey has a tough message: “eat beans and rice, rice and beans” until your debt is paid off, cut up your credit cards and take a second job if you need to bring in more money.

Step 3) Save 3–6 months of expenses in a fully funded emergency fund

Once you’ve paid off your debt, “don’t slow down now”. Instead, “take that money you were throwing at your debt and build a fully funded emergency fund that covers three to six months of your expenses”.

This will protect you from future financial surprises and stop you slipping back into debt.

Step 4) Invest 15% of your household income in retirement

Now, and only now, according to Ramsey, you can start to invest.

Ramsey argues that everyone should invest15% of their gross income for retirement, but only once they have a fully funded emergency fund.

Step 5) Save for your children’s university fund

Once you’ve paid off debt and you’re paying 15% into your pension, you should start saving for your kids’ college or university fund, assuming they will probably go.

Step 6) Pay off your home early

Now it’s time for the “big dog”: pay off your home early, so you no longer have any debt. Ramsey argues that everyone should aim for a 15-year mortgage term.

- Will overpaying my mortgage or pension make me richer?

- UK housing most unaffordable since Victorian times

Step 7) Build wealth and give

Now you have no debt and are investing for the future, you can do “anything”.

“You can live and give like no one else. Keep building wealth and become outrageously generous, all while leaving an inheritance for your kids and their kids. Now that's what we call leaving a legacy!”

Pros and cons of Ramsey’s baby steps

So much for the theory - what about the pros and cons?

Pros

Simple: There’s something compelling about the simplicity of Ramsey’s baby steps. There’s no need to waste time wondering about complex financial priorities: just follow the baby steps and you’ll be debt free and wealthy in time.

Inspiring: Dave Ramsey understands that much of how we manage our money is down to our mindset. Paying off the smallest debts first doesn’t make financial sense because they may not be the cheapest ones with the lowest rates – but it’s more rewarding to see your debts fall one by one. And reward is essential for creating good habits.

Practical: Ramsey isn’t afraid to give practical tips, like trading in your expensive car or cutting up your credit card. It’s old-fashioned, pull-your-socks-up type stuff, but many people find it works for them.

Take control: Ramsey’s focus on budgeting has helped many followers to find more money than they thought they had to save, invest, pay off debt and take control of their financial future.

Hope: Ramsey has given hope to thousands struggling with debt and he insists that “ordinary people” can “build extraordinary wealth.” It’s the American dream on steroids!

Cons

Missing out on free cash: Delaying pension contributions until you’ve paid off debt and built a large emergency fund means missing out on hugely valuable employers’ contributions and pension tax relief. In the UK, paying into a workplace pension means an £80 contribution is immediately doubled to £160 (£60 employers’ contribution - assuming 5% employee contribution and3% employer contributions (standard amount for auto-enrolment) and £20 tax relief) if you’re a basic-rate taxpayer, and more if you pay 40% tax.

- 10 essential things to know about pension tax relief

- How does your pension compare with your neighbour?

Missing out on compounding: Likewise, waiting to start a pension means you’ll miss out on investment compounding, “the eighth wonder of the world,” according to Warren Buffett, and your investments will have less time to grow.

- My top 10 investing goals for 2023

- Dividend investing: three tips for a comfortable retirement income

Unachievable for many: Ramsey’s insistence that everyone can become wealthy just isn’t true. Many are struggling on low incomes, stuck renting and can’t afford to save, or have other circumstances that make it difficult to build significant wealth.

Living for the future: There’s an argument that it’s better to live for the present rather than the future. Who wants to live like a hermit for years for a future that may never come? Instead, it’s arguably better to do a little bit of everything at once, paying off debt, having some “fun money” and also saving for the future.

Doing it alone: It’s important for those struggling with debt to know they can ask for help instead of trying to do it all themselves. Charities such as Step Change and Citizens Advice can help people with practical advice and even negotiate debt repayment plans with creditors. You don't always have to do it alone.

One-size-fits-all: Ramsey’s approach benefits from simplicity but has no room for the complexities of life. Older investors with lagging pensions may choose to pay in more than 15% of their income to their pension, whereas younger investors may be able to pay in less. Meanwhile, many British homeowners will laugh at the idea of a 15-year mortgage term, with sky-high house prices in the UK.

And, as for debt, what’s wrong with splashing out on a big holiday with, shock horror, a credit card? As long as you can afford it, it’s ultimately your money and you're free to do with it as you wish.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.