Bank dividend cuts: Top analysts give their opinion

Do UK banks have enough capital to survive the economic shock? Are shares a buy? Read the expert’s view.

1st April 2020 12:50

by Graeme Evans from interactive investor

Do UK banks have enough capital to survive the economic shock? Are shares a buy? Read the expert’s view.

Dividend-starved investors wondering what's next for Lloyds Banking Group (LSE:LLOY) and other beleaguered financial stocks were given some reassurance by City analysts today.

Their verdict came as Lloyds shares initially dived below a paltry 30p for the first time since summer 2012, having been one of several UK banking groups to scrap dividend payments worth a combined £7.4 billion.

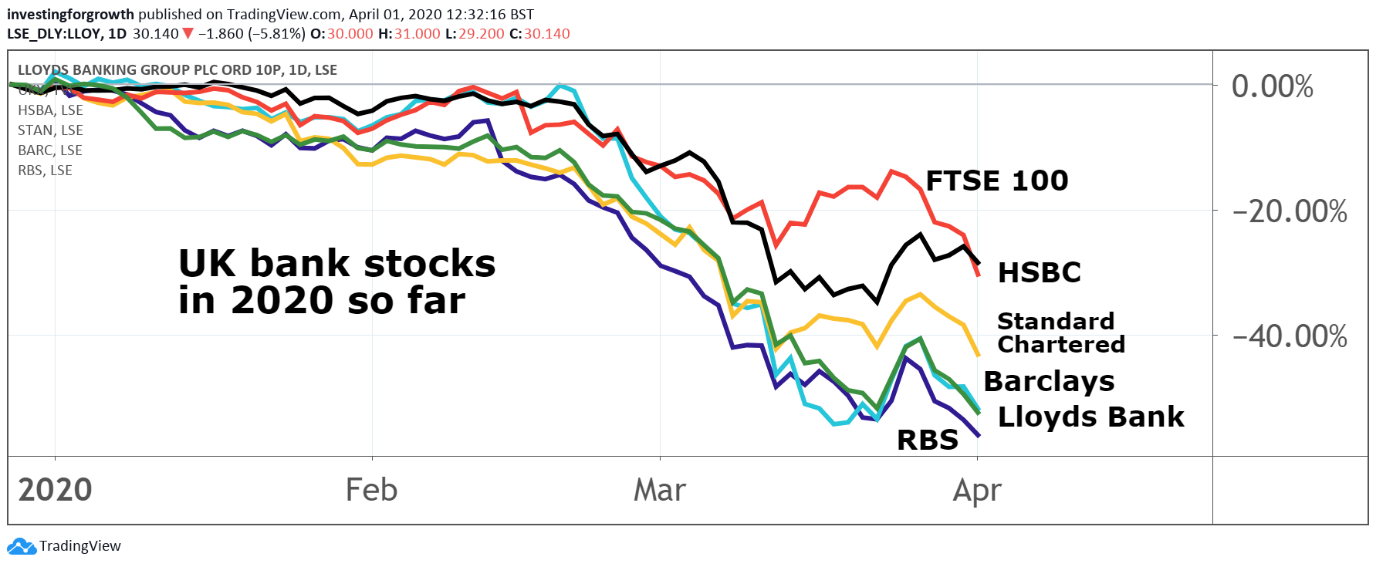

The 5% fall for Lloyds, along with declines of 6% for Barclays (LSE:BARC), 8% for HSBC (LSE:HSBA), and 5% for Royal Bank of Scotland (LSE:RBS), represent the latest blow in an already battered sector where valuations have now halved this year on the back of the Covid-19 emergency.

- Lloyds and other UK bank shares slump after halting dividend payments

- Banks, dividend tracker and most-bought SIPP shares this tax year

For existing shareholders and bargain hunters, the focus now is on whether the UK banks have enough capital to survive the economic shock without having to issue new shares.

UBS banking analyst Jason Napier is among those in the City that think they can do so, despite the massive hit to revenues and significant loan losses brought about by the lockdown. He also notes that banks like Virgin Money (LSE:VMUK) and Barclays (LSE:BARC) are trading 70%-80% below net asset value (NAV) forecasts, meaning that they will look “very attractive” if the period of the downturn is limited.

Source: TradingView Past performance is not a guide to future performance

Another factor in the sector's favour is that central banks, regulators and governments are bringing to bear support far in excess of that applied during the global financial crisis.

Napier said: “We think it's possible that the UK — at full employment until last month — may find itself with too much stimulus chasing too few assets and workers in a relatively short space of time.

“That is unless Covid-19 causes more permanent damage to balance sheets and businesses than indicated in current much-diminished market caps.”

UBS currently forecasts a 4% fall in UK GDP this year followed by a 1.5% recovery next year, although there's considerable uncertainty around these projections.

- A £9 billion dividend windfall now at risk

- 11 UK stocks where experts think the dividend is safe

- A checklist for finding dividend shares in a crisis

Following pressure from regulators, the UK's eight main lenders last night agreed to withhold 2019 dividend payments amounting to £7.4 billion and not to distribute any during 2020. UBS said this added little over a year's worth of normal loan losses to bank balance sheet defences.

Morgan Stanley added that it looked to be a prudent move given the scale of the economic contraction expected in the first half of this year. Combined with last month's decision by the Bank of England to release the countercyclical capital buffer, Morgan Stanley said UK domestic banks now had an average cushion of 440 basis points over minimum capital requirements. This varies between 700 points for Royal Bank of Scotland and 280 points for Barclays.

Morgan Stanley values Lloyds shares at 61p, with Royal Bank of Scotland at 275p. The 2009 low for Lloyds was 17p, which our own analyst John Burford said recently looked to be a possibility given that the severity of the economic downturn is likely to be far greater than in 2008.

UBS's Napier, who was a bank auditor in the 1990s and has been a banking analyst since the early 2000s, said in comparison with the financial crisis banks were better placed this time.

He added:

“Certainly, we think central bank liquidity should keep them viable even if wholesale debt markets remain dislocated and in spite of some customers' desire to draw on committed credit lines.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.