Best AIM stocks of 2019: Who's up 1,700% so far?

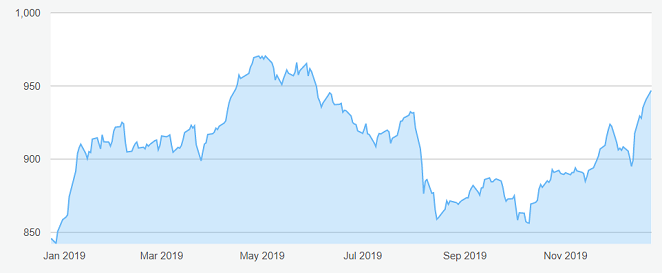

As 2019 ends, we run through the best and worst AIM stocks this year and why small-caps are rallying.

24th December 2019 12:41

by Graeme Evans from interactive investor

As 2019 ends, we run through the best and worst AIM stocks this year and why small-caps are rallying.

AIM delivered its usual crop of spectacular share price gains in 2019, potentially softening the blow for small-cap investors impacted by the woes of fund manager Neil Woodford.

The demise of Woodford Equity Income reverberated through London's junior market in the summer, given that the fund manager's wider portfolio featured stakes of more than 3% in at least 35 AIM stocks. Liquidity issues make it harder to offload AIM stocks, with a small share sale by a private investor likely to have a significant impact on the share price.

The Woodford situation has served as another reminder for investors about the risks as well as the considerable riches on offer from the 740 or so stocks in the FTSE AIM All-Share.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

While 47 AIM company shares are currently twice the value they started 2019, another 124 have lost half their stock market worth or more.

Fortunes can quickly change, as demonstrated by gaming technology group Bidstack (LSE:BIDS) after its shares jumped 526% in the first half of 2019 to secure the Best Performing Share Award at the AIM Awards in October.

The stock, which joined AIM in September 2018, has subsequently lost 75% of its value to stand at just below 10p, albeit still double the position it was in at the start of 2019.

Source: interactive investor Past performance is not a guide to future performance

The title of best performing stock across 2019 belongs to Ireland-based exploration and production company Petrel Resources (LSE:PET) after it surged over 1,70% to 24p. It had been even higher earlier in the year! Petrel, which is a veteran on AIM having listed back in 2000, has benefited from "an influential group of substantial investors" building up a significant stake in the company.

Their oil and gas expertise will be put to use as the group looks to acquire and develop assets in the Middle East, particularly Iraq. Petrel has worked in the region since 1999, which it believes offers unique oil and gas opportunities for those companies with the know-how.

- 47 AIM company shares are currently twice the value they started 2019

- 124 have lost half their value or more

- 15 are now worth over £1 billion

- Since the General Election result, 60 AIM All-Share companies have risen by 20% or more

- Only 10 FTSE All-Share stocks have managed the same

- The best-performing FTSE 100 stock – Severn Trent (LSE:SVT) - is up just 13%

Another high up the list of AIM risers is Silence Therapeutics (LSE:SLN), which is enjoying a return to form after slumping the year after it won the Best Performing Share Award at the AIM Awards in 2007. Silence is also an original member of the junior market when it started in 1995.

Its 686% rally in 2019 follows a transformational year in which Silence signed a collaboration with US firm Mallinckrodt Pharmaceuticals for the commercialisation of its RNAi Therapeutics technology. Silence has already received a US$20 million upfront payment and stands to get more depending on various commercial milestones.

Shield Therapeutics has a similar story to tell, with its shares up 495% in 2019 after gaining US Food & Drug Administration (FDA) approval for iron deficiency treatment Feraccru. The approval was broader than anticipated and this has doubled the potential market.

Among other AIM success stories, Open Orphan (LSE:ORPH) is up 209% as Irish investor Cathal Friel continues his push to create a larger scale specialist pharma services business.

Having already reversed into Venn Life Sciences, the European rare disease and orphan drug business recently agreed a deal to merge with fellow AIM stock hVIVO (LSE:HVO). The expansion comes with the orphan drug sector expected to grow two times faster than ordinary prescription drugs, with 58% of FDA approvals currently in this area.

ReNeuron (LSE:RENE) is another stock worth mentioning, given that the cell therapy company had been 33% owned by Woodford's equity income fund and Patient Capital Trust. Shares are still 170% higher over 2019, helped by progress at the start of the year when it revealed progress in its clinical development programmes for retinitis pigmentosa and stroke disability.

The share price performance is in contrast to other Woodford holdings, US biotech Verseon Corporation (LSE:VERS) and Xeros Technology (LSE:XSG), whose value has fallen more than 90% in 2019.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.