Best (and worst) funds of 2019 so far

'A rising tide lifts all boats', but the speed differs wildly. Saltydog analyst reveals just how much.

23rd September 2019 13:32

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

'A rising tide lifts all boats', but the speed differs wildly. Saltydog analyst reveals just how much.

Each week we look at the performance of thousands of Unit Trusts, Open Ended Investment Companies, Investment Trusts and ETFs.

We break them down into their Investment Association sectors, and then combine these into our own proprietary Saltydog groups, based on their historic volatility.

The groups are:

• Safe Haven – very low risk, but also very low returns.

• Slow Ahead – normally a low risk level and often with adequate returns.

• Steady as She Goes – generally medium risk, with potentially higher returns.

• Full Steam Ahead – higher risk, with potentially the best returns. There are quite a few sectors that fall into this risk category and so we split them into Emerging Markets and Developed markets.

By managing the amount invested in each group it’s possible to control the overall volatility of a portfolio.

We put a lot of emphasis on selecting the best performing sectors because we believe that the relative performance of the sectors is determined by the state of the global economy. This is where we would expect to find the strongest trends. Having selected which sectors to invest in, picking the funds should be relatively straightforward.

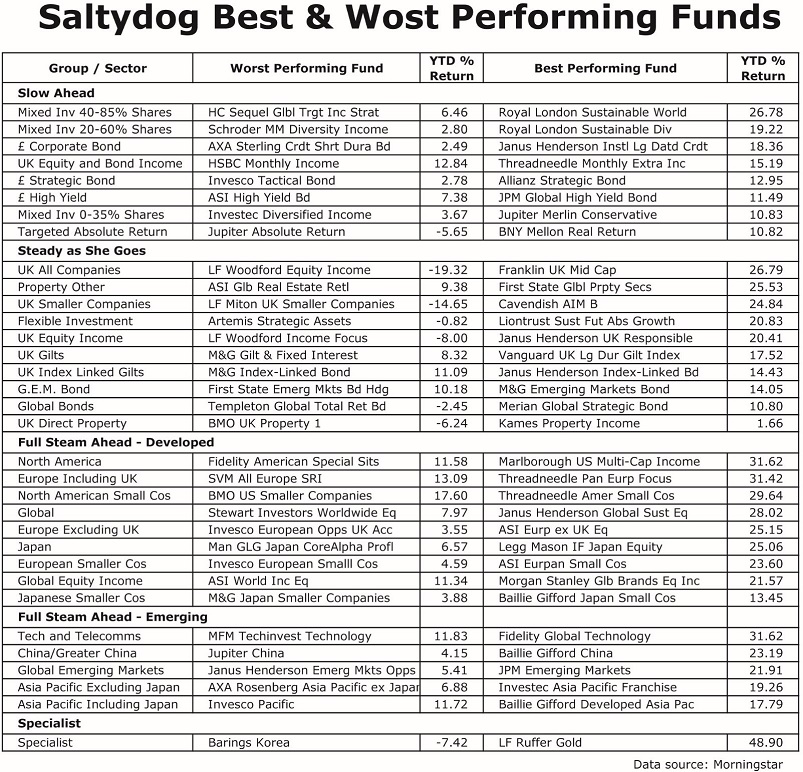

Although straightforward, it is still important to select the best-performing funds as there can be significant differences between funds in the same sector. The table below shows the best and worst funds in each sector, based on their performance so far this year.

The best-performing fund is LF Ruffer Gold from the Specialist sector, it's up 48.9% since the beginning of the year. The worst-performing fund in the Specialist sector is Barings Korea which has made a loss of 7.4%.

However, this isn't a very fair comparison because the funds in the Specialist sector can invest in a very wide range of assets and have different management objectives. It would make more sense to compare LF Ruffer Gold with the Junior Gold fund, which is up 24.9%.

Another interesting comparison is in the Technology and Telecommunications sector where the leading fund, Fidelity Global Technology, is up nearly 32%, compared to the MFM Techinvest Technology fund which has gone up by 12%. That's a difference of 20%.

The same is true for the North American sector at the top of our 'Full Steam Ahead – Developed' Group. The Marlborough US Multi-Cap Income is also up 32%, but the Fidelity American Special Situations is only up 12%.

The largest difference, apart from in the Specialist sector, is in the UK All Companies sector. The Franklin UK Mid Cap fund has made 27%, whereas the LF Woodford Equity Income has lost over 19%. The LF Woodford Income Focus fund is also struggling.

It's at the bottom of the UK Equity Income sector, having lost 8% while the Janus Henderson UK Responsible Income fund has gone up by more than 20%.

It's said that 'a rising tide lifts all boats', but some tend to rise faster than others and it assumes that they're not holed below the waterline.

For more information about Saltydog, or to take the 2-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.