The big dividends on offer from Big Oil

Oil prices are rising again and our overseas investing expert has found an attractive dividend promise.

10th February 2021 09:26

by Rodney Hobson from interactive investor

Oil prices are rising again and our overseas investing expert has found an attractive dividend promise.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

The light at the end of the tunnel could be an oil flare. While the oil majors have been among the worst affected stocks during the pandemic, with investors worrying about the effect of reduced global activity on crude prices, a possible upturn is back on the agenda.

Brent crude this week topped $60 a barrel for the first time in just over 12 months, a remarkable recovery given the slump in gross domestic product in the US, UK, Europe and elsewhere. Optimism that this year really will be the start of a global recovery is starting to take hold.

Much of that has been prompted by the stimulus package proposed by incoming US President Joe Biden, one that Congress looks set to pass now that the divisive days of President Donald Trump have been replaced with an uneasy spirit of cooperation between Democrats and some leading Republicans.

New Treasury Secretary Janet Yellen claims the country could soon return to full employment, although the pick-up in jobs has so far been disappointing. The Congressional Budget Office predicts that the US economy, the largest in the world, will return to its pre-pandemic levels by the middle of 2021 and that its performance in the third quarter will be 3.7% ahead of last year.

That will be welcome news for the oil majors, despite the nascent shift towards electric cars and Biden’s avowed aim to create a greener energy policy.

- Your 50 most-popular US stocks

- Want to buy and sell international shares? It’s easy to do. Here’s how

- Investing in the US stock market: a beginner’s guide

- What is earnings season?

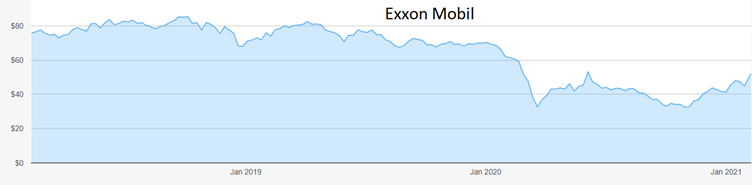

Certainly 2020 was tough, culminating in Exxon Mobil (NYSE:XOM) last week reporting a heavy loss in the fourth quarter of a year. It was described by Chair and Chief Executive Darren Woods as "the most challenging" market conditions the firm has ever encountered.

Source: interactive investor. Past performance is not a guide to future performance

Exxon swung from a profit of $5.7 billion in the comparable period on 2019 to a loss of just over $20 billion in the final three months of 2020, though that figure did include impairments of $19.3 billion. Total losses for the year reached $23.2 billion. Even so, it declared a dividend of 87 cents for the quarter.

Revenue fell from $67.2 billion to $45.5 billion in the quarter despite signs that output had levelled off, leaving the figure for the full year down more than a third from $265 billion to $181.5 billion.

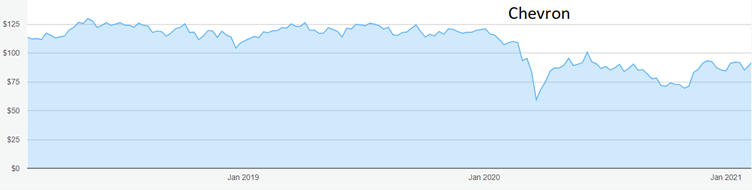

Exxon is not alone. Rivals BP (LSE:BP.) and Royal Dutch Shell (LSE:RDSB) both posted losses the wrong side of $20 billion for the full year. Chevron (NYSE:CVX) recorded a net loss of $5.5 billion last year as it, too, suffered from the sharp drop in crude oil prices at the beginning of the pandemic.

- Why you must spread your investing wings in 2021

- BP books a loss as Covid-19 hits oil demand

- Shell’s results are ugly – but not unexpected

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Woods reckons that initiatives and reorganisations will eventually reduce costs by $6 billion a year and that cash flow in 2021 will cover capital expenditure and a maintained dividend. This is based on the assumption that Brent remains above $50 a barrel. If crude prices slip below this level – and it could happen, given that the depths of $16 were plumbed early last year – then Woods believes he can reduce costs further to offset a drop to $45. Below that we are back in gloomy territory.

The bigger oil outfits are likely to come out stronger as the weak struggle, and it could be that we will see another round of mergers similar to those of 20 years ago, despite concerns that regulators will raise competition issues.

Exxon and Chevron have just admitted they held talks on a potential merger last year but it came to nothing. Together they would be the second-largest oil and gas producer after Saudi Arabian Oil. Such link-ups may be necessary as the sector struggles to cope with a world that is reducing dependence on fossil fuels.

Source: interactive investor. Past performance is not a guide to future performance

Hobson’s choice: Exxon has been a disappointment since I first suggested buying at around $75 two years ago, but I did comment last year that the stock’s time had surely come while it languished below $46. The shares are back above $50 and offer a very tempting yield of 6.7%. It is not too late to buy. Chevron has promised not to cut its dividend and offers a yield of 5.6%. I repeat my stance that the stock is worth buying up to $100. The current price is $91.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.