Boeing vs Airbus: whose shares are still rated a buy?

After yet another mid-air mishap, Boeing shares lost more than a fifth of their value, but does that make them a bargain? Overseas investing expert Rodney Hobson explains why he likes one and would avoid the other.

17th January 2024 08:41

by Rodney Hobson from interactive investor

It never rains but it pours. What the old saying fails to mention is that what falls out of the sky may be part of an aircraft.

It is no joke, though, that a panel from a cabin on an Alaska Airlines 737 Max 9 aircraft fell off mid-flight and landed in someone’s garden. Fortunately, the plane was able to make an emergency landing and no-one was hurt, but not all incidents involving the best-selling Max range made by Boeing Co (NYSE:BA) have ended without mishap. Two crashes involving the 737 Max in 2018 and 2019 caused hundreds of fatalities.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Aircraft manufacturers had quite enough to cope with during the pandemic, when flying ceased to be a lifestyle choice, without the reputational damage of mid-air mishaps that inevitably lead to whole fleets being grounded.

The Federal Aviation Administration immediately cancelled all flights by Max 9s indefinitely, remarking with almost comical understatement: “This incident should never have happened.” You can say that again.

Alaska Airlines has 65 Max 9s grounded and United Airlines Holdings Inc (NASDAQ:UAL) 79. Expect substantial compensation claims any day soon. At least Boeing chief executive Dave Calhoun has had the good grace to accept responsibility. He says the panel blowout was caused by a quality problem. Spot on.

Incidents do seem to recur involving the 737 Max. Since the latest incident both Alaska Airlines and United Airlines have reported finding loose components on other planes during preliminary inspections. Belatedly, Boeing has stepped up quality inspections and put more of its own staff into factories owned by Spirit AeroSystems, which makes parts for the aircraft.

The wonder is that orders have kept flooding into Boeing as airlines scramble to update their fleets with more fuel-efficient versions after a pause during the pandemic. The most recent order was for 40 Max 8s from Deutsche Lufthansa AG (XETRA:LHA) just before Christmas. It may be that quality control has suffered while Boeing copes with the inrush of orders.

Yet Airbus SE (XETRA:AIR), which also won an order for 40 aircraft from Lufthansa, and since then has added another for 33 planes worth at least $8.5 billion from EVA Air in Taiwan, seems to have coped with its own surge of orders without a similar drop in quality control.

Airbus delivered a record 735 aircraft in 2023, up 11% on the previous year, beating Boeing’s 528. Boeing reported that it had booked 1,314 net new orders over the past 12 months, but it should be remembered that most orders include options, where the purchaser can back out without giving a reason. Any more mishaps and that could well happen.

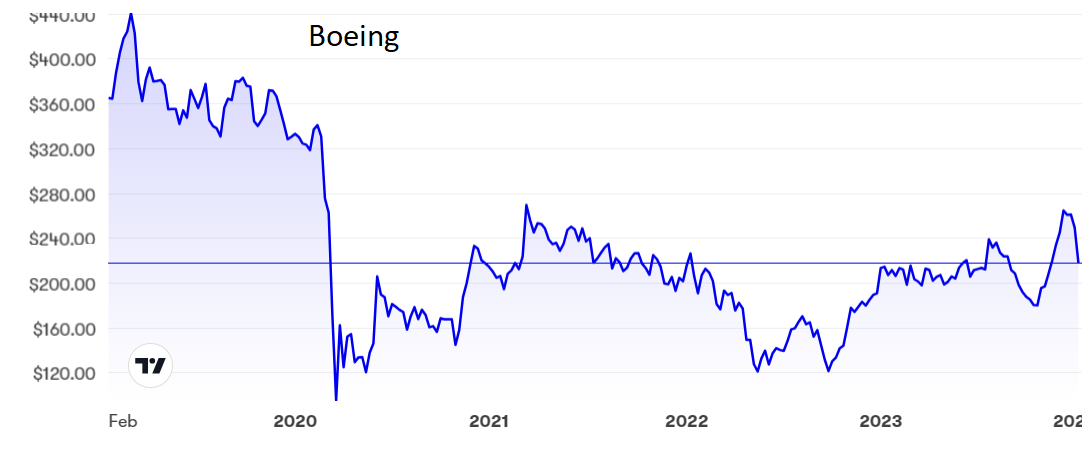

Boeing shares have nosedived from $260 to near $200 since the Alaskan Airlines issue arose. The shares were as low as $180 as recently as October before the raft of new orders sparked premature optimism. Since the most recent figures showed the company making a loss, it is impossible to calculate a price/earnings (PE) ratio. Nor is there any dividend.

Source: interactive investor. Past performance is not a guide to future performance.

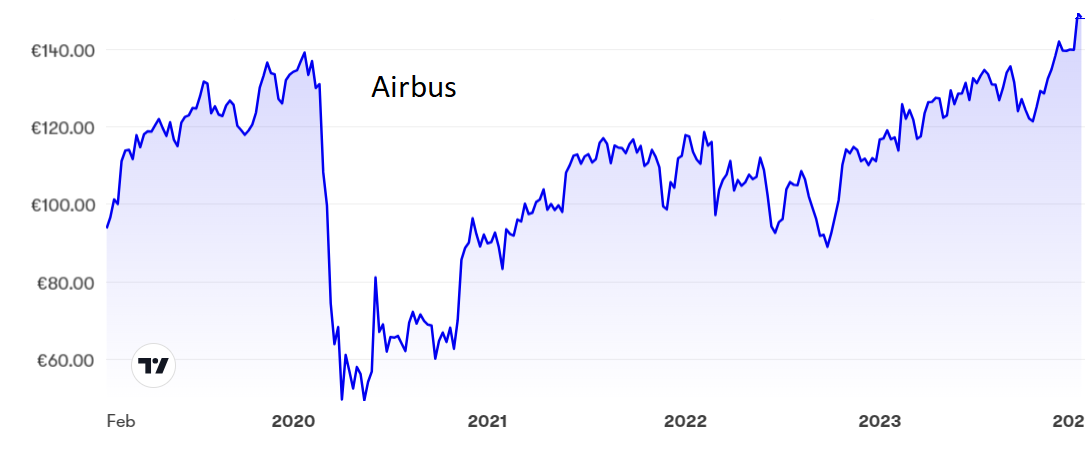

Airbus shares have risen steadily from €90 to nearly €150 over the past 15 months. The PE is admittedly heavy at 29 and the yield miserly at 1.2%, but profits are profits and a small dividend is better than none.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I said in November that Airbus was the better prospect and to buy below €140. That has proved good advice with the shares now around €148, but it is not too late to get in. I said then that Boeing was no more than a hold. Even that modest stance was too generous. If you are in, sell before the shares fall further, as seems likely. If you are out, avoid. The risks are just not worth the hassle.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.