Buying another top-performing UK fund

Saltydog Investor examines how shifting sector performance has redrawn portfolio profiles and names the high-yield bond fund it has bought.

1st October 2024 09:33

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Over the course of this year, the performance of the Technology and US sectors has deteriorated, along with most of the equity-based sectors. At the same time, the UK bond sectors have been rising up our tables.

In the first quarter of the year, the best-performing sector was Technology & Technology Innovation, with a three-month return of 11.0%. Close behind was the North America sector, which had gone up by 10.8%.

- Invest with ii: Buy Global Funds | Top Investment Funds | What is a Managed ISA?

On the whole, the sectors for funds investing in equities performed well. The only exceptions were China/Greater China, which had fallen by 0.5%, Infrastructure, which lost 1.5%, and Latin America, which ended the quarter down 2.7%.

The sectors investing in bonds and gilts did not perform as well. The UK Gilts sector fell by 1.7% and the UK Index-Linked Gilts sector went down by 2.7%. In our analysis, we usually combine all the non-UK Bond sectors into our Global & Global Emerging Bond sector – it went up only by 0.1% in the first quarter of the year.

Those of you who are familiar with Saltydog Investor will know that we group the sectors based on their historic volatility.

The least volatile sectors, Short Term Money Market and Standard Money Market, are in our “Safe Haven” Group. Next up is the “Slow Ahead” Group, which contains the UK bond sectors and the Mixed Investment sectors.

In the first quarter of the year, the best-performing sector in the group was Mixed Investment 40-85% Shares, the sector with the most exposure to equities. The Mixed Investment 20-60% Shares sector was in second place.

| Slow Ahead Group Q1 2024 | % Rtn |

| Mixed Investment 40-85% Shares | 4.2 |

| Mixed Investment 20-60% Shares | 2.5 |

| £ High Yield | 2.0 |

| Mixed Investment 0-35% Shares | 1.4 |

| £ Strategic Bond | 1.0 |

| £ Corporate Bond | 0.3 |

Data source: Morningstar. Past performance is not a guide to future performance.

The top-performing sector, in the second quarter of the year, was India/Indian Subcontinent, with a three-month return of 10.6%. However, the performance of the other equity-based sectors was mixed.

The UK equity sectors did well, with the UK Smaller Companies sector leading the way with a three-month return of 7.3%, while UK Equity Income rose by 4.6%. The China and Asia-Pacific sectors also made reasonable gains.

Unfortunately, the Europe excluding UK and European Smaller Companies sectors made losses, as did the Japan and North American Smaller Companies sectors. The worst-performing sector was Latin America, which posted a three-month loss of 13%.

In our “Slow Ahead” Group, the Mixed Investment 40-85% Shares sector was still at the top of the table, but its overall return had fallen quite significantly since the first quarter. The £ High Yield sector had moved up into second place.

| Slow Ahead Group Q2 2024 | % Rtn |

| Mixed Investment 40-85% Shares | 1.7 |

| £ High Yield | 1.3 |

| Mixed Investment 20-60% Shares | 1.2 |

| Mixed Investment 0-35% Shares | 0.7 |

| £ Strategic Bond | 0.5 |

| £ Corporate Bond | 0.1 |

Data source: Morningstar. Past performance is not a guide to future performance.

With a day to go, it looks like Infrastructure is going to be the best-performing sector in the third quarter of this year. It is currently up 6.9%, followed by China/Greater China, which has risen by 6.1%. The Financial & Financial Innovation sector is in third, up 3.7%, but then it is the £ High Yield and the £ Strategic Bond sectors.

Not only have they beaten the Mixed Investment sectors in the “Slow Ahead” Group, but they have also outperformed the UK Equity, Global Equity, European, Japanese, American, Asia Pacific, and Global Emerging Market sectors.

The worst-performing sector this quarter has been Technology & Technology Innovation, which has fallen by 4.3% since the beginning of July.

| Slow Ahead Group Q3 2024 | % Rtn |

| £ High Yield | 3.5 |

| £ Strategic Bond | 3.5 |

| Mixed Investment 0-35% Shares | 2.5 |

| £ Corporate Bond | 2.5 |

| Mixed Investment 20-60% Shares | 2.3 |

| Mixed Investment 40-85% Shares | 1.7 |

Data source: Morningstar. Past performance is not a guide to future performance.

Over the course of the year, our demonstration portfolios have adapted to reflect this shift in performance in favour of the bond funds.

At one stage we were holding a North American fund, a Technology & Technology Innovations fund, and three funds from the Mixed Investment 40-85% Shares sector. These have all been sold.

- Bond Watch: using bonds to beat savings accounts

- Will interest rate cuts reduce returns on money market funds?

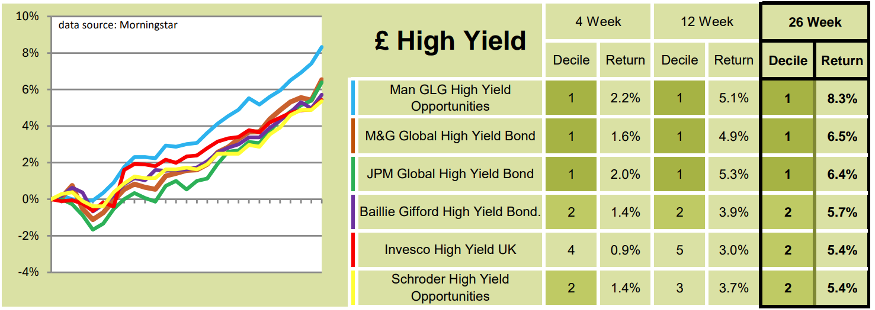

We invested in two funds from the £ High Yield sector last September, Schroder High Yield Opportunities and Invesco High Yield UK, and have added to them this year. This August, we invested in the Man GLG Sterling Corporate Bond and L&G Strategic Bond funds. Last week, we bought the Man GLG High Yield Opportunities fund.

The Schroder High Yield Opportunities and Invesco High Yield funds were still featuring in our shortlist of best-performing funds in the £ High Yield sector over the past 26 weeks, however, the Man GLG High Yield Opportunities fund was at the top of the table.

Past performance is not a guide to future performance.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.