Can these stocks handle rising inflation?

9th February 2017 13:08

by Lee Wild from interactive investor

Have you seen the price of butter in Sainsbury's recently? Last time I did the weekly shop, just before Christmas, own-brand unsalted butter was 110p. It's now 140p, an incredible 27% hike. Kidney beans are 30% more expensive, tomato puree 10% - I was cooking chilli - and frozen broccoli 12%. There are far fewer deals, too, and the food bill is noticeably higher.

It's something confirmed this month by the British Retail Consortium (BRC), which said that while food prices are 0.8% lower than a year ago, they were higher than in December. And Kantar says prices rose at Christmas for the first time since 2014.

The researcher also warns that increases have spilled over in to the new year, with like-for-like inflation on a basket of everyday groceries up to 0.7% from 0.2% last time.

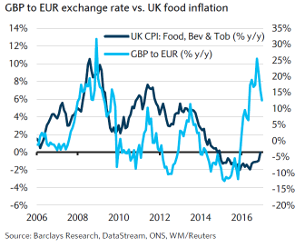

A monthly UK Spend Trends report published by Barclays illustrated quite clearly where it thinks prices are heading. It says:

"Recent FX movements strongly suggest that UK food inflation should soon be on a steep upward curve - indicating that the impact of inflation may soon come through for supermarkets."

It's not a huge problem at the moment. But it will be. According to Joanne Denney-Finch at researcher IGD, two-thirds of shoppers believe food prices will have the biggest impact on their personal finances this year; more than petrol prices, energy bills and interest rates.

With wage growth stagnant, more expensive supermarkets like Waitrose and run the real risk of handing market share back to the discounters.

Already, Aldi has become Britain's fifth largest supermarket, according to Kantar. , cheaper than many rivals, just took market share for the first time since summer 2015, and Asda's decline is slowing.

Sales at Lidl jumped 9.4% in the 12 weeks to 29 January, and budget frozen food chain Iceland grew by 8.6%, the tenth consecutive period of sales growth. Meanwhile, sales at Sainsbury's remained flat and it is losing market share.

For the food manufacturers, it's the plunge in the pound since the EU referendum that's causing problems. Sterling is down 16% against the dollar and almost a fifth against the euro, which makes ingredients more expensive.

, the AIM-listed ingredients, cake decorations and baking firm said last week that high commodity prices, especially butter, sugar and oils, were making life tough. It even solved my riddle of the surging butter price, explaining that the cost of butter has more than doubled in price.

Feeling the pain

Mr Kipling firm is feeling the pain, too. Its share price plunged in January following a warning that the cost of sugar, chocolate, dairy, wheat and palm oil had rocketed, and that the weak pound made things much worse. Supermarkets ditching multi-buy deals twisted the knife.

Companies have to protect margins, so always look to cut costs elsewhere, but they must also pass on some of the pain to consumers, which is why food deflation will soon be a thing of the past.

And rising costs are a problem not just for food retailers. High street bellwether has already warned that it will raise prices by 5% this year, and others will inevitably follow.

Don't take a broad-brush approach to stock selection

Put in context, a 5% increase in prices across the entire £358 billion a year industry would cost shoppers an extra £18 billion in 2017. Ouch! It will take a bit longer to take hold, but shoppers will become more discerning and either spend less, or trade down.

Having already underperformed the wider market by over 13% since September, expect anxiety around Brexit to keep Britain's shopkeepers on their toes.

Trading updates are already peppered with words like "cautious". The trick for investors now is to watch like a hawk for any discernible deterioration in rhetoric.

Tony Shiret, retail analyst at Haitong Securities, warns against taking a broad-brush approach to stock selection, however.

"We are inclined to keep our positive stance on where the new clothing strategy is quite difficult to read, but it could allow clothing margins to recover a lot from current levels," he writes.

"Next has strong yield support but we need to see some more positive views expressed by Simon Wolfson. We recently raised to a 'buy'.

"We continue to believe that is over-expanding and that needs to show better progress than we have confidence in it achieving on its transformation plan in 2017."

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.