Can two lockdown success stocks keep winning?

17th August 2022 10:02

by Rodney Hobson from interactive investor

Can these two companies thrive in the post-pandemic era, asks overseas investing expert Rodney Hobson.

A constant theme for investors for this year at least is to consider which of the comforts that we found to be essential during lockdowns will endure in the post-pandemic era. One winner and one loser stand out.

Warner Music Group (NASDAQ:WMG) reported sales up 7% to $1.43 billion in the three month to 30 June, Warner’s third quarter, while net income for the quarter doubled from $61 million to $125 million.

The recorded music arm capitalised on the popularity of artists such as Ed Sheeran and the highly respected, long-standing status of labels such as Parlophone. The group also publishes music from more than 65,000 composers through Warner Chappell.

- Discover more: Buy international shares | Interactive investor Offers | Most-traded US stocks

Growth did actually slow in the quarter, as revenue from streaming services through outlets such as YouTube and TikTok was up 2% rather than the 10% of recent quarters. That could be a short-term headwind but the strong dollar, which reduces the translation of overseas earnings, is continuing and will almost certainly hold back the current quarter’s figures.

However, a strong programme of releases before Warner’s financial year end on 30 September should reassure investors.

Past performance is not a guide to future performance.

interactive investor contributor Edmund Jackson alerted ii followers to what was one of the biggest floats of 2020 in June that year and his piece is still well worth reading.

One word of caution: WMG is controlled by Access Industries, which has 99% of the voting rights and is clearly not going to give up control in the foreseeable future. However, it has 84% of financial ownership and will be as keen to see dividends rising as any long-term investor is. Do bear in mind that means only 16% of the shares are traded, so the spread between the buying and selling prices could be unusually wide.

- A buying opportunity at a brand with strength and spread

- Stock market rally doesn’t convince professional investors

The shares started trading around $30 and are back around that level now but the potential looks to be on the upside. Most of the past two years has been spent above $30 and the shares have been as high as $49, while the lowest point was $25 last month.

The yield is quite low at around 2%, but Access has every interest in raising the payout.

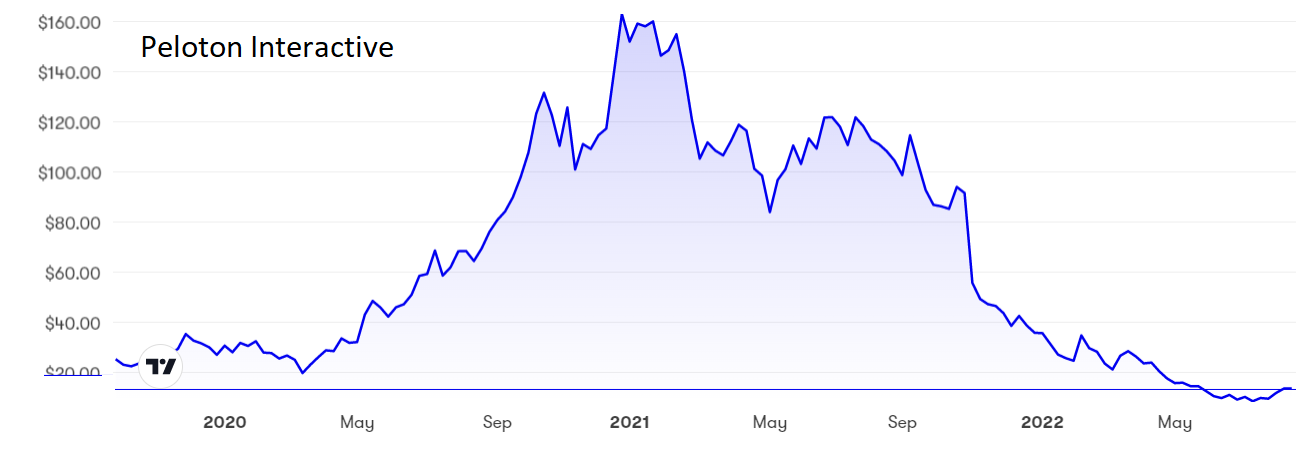

Barry McCarthy, new chief executive of Peloton Interactive (NASDAQ:PTON), the maker of bicycles that go nowhere, is on a roll, which is more than can be said for the company or its shares.

Six months into the job, he has decided that only drastic action can save the loss-making company. He is cutting 800 jobs, closing retail showrooms, outsourcing production and sales and raising prices by about a quarter.

Past performance is not a guide to future performance.

Clearly drastic action was needed as sales slumped and subscriber numbers started to slip. McCarthy acknowledges that Peloton cannot continue to haemorrhage cash but there is no guarantee that the cure will be any better. Higher prices will mean some sales will be lost and with stock piled up in warehouses it can be argued that a cut-price sale was what was needed.

- Chart of the week: follow big money back into Apple or take profits?

- ii view: Peloton shares crash to new low

The shares peaked at $180 in December 2020 but have slumped as low as $9 recently, thus losing 95% of their stock market value. They have now ticked up to $13.80 in what could well be a dead-cat bounce.

Hobson’s choice: I warned investors back in February to stay well clear of Peloton and repeated the advice in May, while there was still time to get out before the shares hit rock bottom. Peloton stock has perked up on the news that the many problems are being addressed. Those who ignored earlier warnings can now get out for a dollar or two more than they could last week. Sell.

Warner Music is a buy up to $31.50 with a short-term target of $35.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.