Chart of the week: Rolls-Royce shares at a critical juncture

26th April 2022 12:40

by John Burford from interactive investor

With a new Covid outbreak in China and talk of nuclear war in Europe, technical analyst John Burford issues a warning after reassessing prospects for the UK engineer.

I last covered FTSE 100 engineering giant Rolls-Royce Holdings (LSE:RR.) in my COTW of 28 March where I laid out a bullish scenario based on my reading of the overall wave pattern.

This is the monthly chart I posted then:

Past performance is not a guide to future performance.

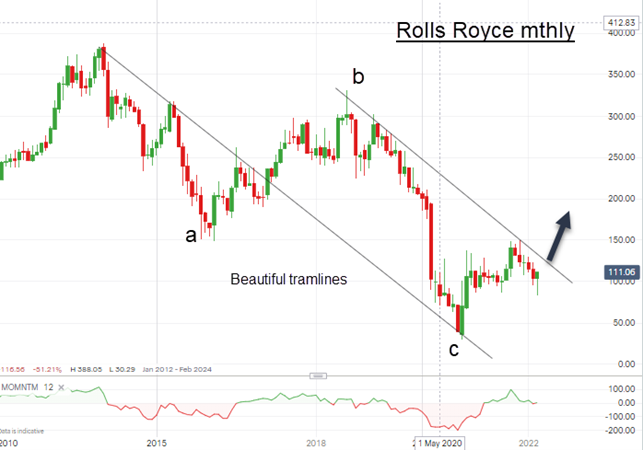

From the 2013/2014 all-time high at 387p, the shares traced out a three-down 'a-b-c ' pattern to the Corona Crash low of September 2020 at the 30p level. I marked this as the termination of the 'c' wave.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

Since then, the shares have rallied back to the upper trendline at the 150p area in November last year and have drifted lower since to the current 90p region.

This is the critical price I alluded to in March: “But provided the 90p support holds, the shares should move up to the upper tramline around the 125p area and a clear break there should propel them to 150p with much higher potential to my first major target around 180p”

In fact, it appears the 90p level is on the verge of giving way as the FTSE 100 index has suffered a decline over the last three trading days of 330 points (4.3%), while the S&P 500 has lost a hefty 6.6% in this brief time period. The outlook for both indexes is lower.

- Insider: two FTSE 250 stocks tipped to recover

- Stockwatch: time to buy the drop at this mid-cap share?

- Why reading charts can help you become a better investor

There is much talk about the effect China is having on UK and US shares. The China A50 share index has lost a stunning 40% so far off its February 2021 all-time high, and sentiment remains very bearish as the authorities are clamping down hard on its rampaging Covid outbreaks which is hurting domestic economies – and spilling over into US/UK operations.

Not only that, but there is renewed talk of a nuclear Third World War from the Russians – never a great backdrop to a share bull trend.

These developments – including the current test of the 90p support - have caused me to re-assess the outlook for Rolls-Royce shares and I now have a more likely roadmap:

Past performance is not a guide to future performance.

In this new view, I am retaining the parallel lines of support/resistance but now, instead of an 'a-b-c' pattern, I have waves 1-4 of what should emerge as a five down. This is the opposite outcome to my initial forecast.

One other possibility for the wave labels is that we still have a major 'a-b-c' pattern, but the 'c' wave has not completed and will do so with a move to just below the 30p low.

Of course, at these very low levels, there is not a lot of room to the downside! Even if the shares break below the wave 3 low at 30p, only a bankruptcy would cause them to approach that level – a most unlikely event.

Thus, if the shares do break below 30p, they should represent an excellent bargain!

John Burford is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.