Covid vaccine rally tops your 2020 investing highlights

Our poll reveals investors’ investment highlights during an extraordinary year for global markets.

23rd December 2020 12:54

by Myron Jobson from interactive investor

Our poll reveals investors’ investment highlights during an extraordinary year for global markets.

This year has been a trying one socially, emotionally and economically, with the coronavirus pandemic tearing the status quo asunder. But in investing terms, it has been a year of extremes, with the FTSE 100 down 15% to date, but the US technology index up 43% and Tesla (NASDAQ:TSLA), for example, up 665%.

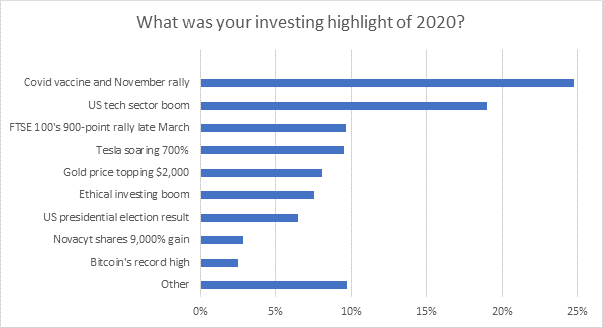

With this in mind, we asked investors what their investment highlights of the year have been.

News of the Covid-19 vaccine and the subsequent market rally tops the list of investing highlights in what has been an extraordinary year for global markets, a new interactive investor poll finds.

In a survey of 1,202 interactive investor website visitors between 21-23 December 2020, one in four (25%) respondents cited the coronavirus vaccination breakthrough which triggered a rally in share prices in November as the standout series of events, ahead of the US tech sector boom (19%).

The FTSE 100’s 900-point rally in late March and the value of Tesla stocks soaring by 700% were cited by one in 10 (10%) respondents, respectively.

A higher percentage of respondents cited Gold price topping $2,000 (8%) and the ethical investing boom (8%) than the result of the US Presidential Election (6%).

At the foot of the list is Bitcoin reaching a record high valuation (2%), behind biotech firm Novacyt (LSE:NCYT) shares 9,000% gain (3%). One in 10% cited other events.

Lee Wild, Head of Equity Strategy, interactive investor, says: “The past year has been like no other, and is one whose social and economic impact we never want to see repeated. But financial markets have shown remarkable resilience in the face of adversity, and there have been plenty of highlights for investors in 2020.

“It is not surprising that the announcement of Covid vaccines in early November, and subsequent rally in share prices, tops the list of 2020 highlights. After nine-months of lockdowns, restrictions and hardship, it was a huge relief to see light at the end of the tunnel. Now, the challenge is to successfully roll out a mass vaccine programme and get the economy running again at full speed.

“Few would have predicted the boom in US tech stocks through 2020. The beneficiaries of a forced shift to home working and a massive increase in time available to use technology, America’s tech leaders who weren’t already household names very quickly became part of our everyday lexicon. A trend which might otherwise have taken years to play out took just months.

“Tesla and its mercurial owner Elon Musk continued to prove critics wrong. Investors who backed the electric car billionaire made eyewatering profits, so little wonder it was the big moment of 2020 for one in ten respondents.

“There were high-profile performances from asset classes like gold, ethical investments and bitcoin, but plenty of company performances resonated with investors this year. Incredible rallies by Ceres Power (LSE:CWR), Games Workshop (LSE:GAW), Greatland Gold (LSE:GGP) and Synairgen (LSE:SNG) made 2020 one to remember for savvy stock pickers.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.