Deliveroo shares crash on stock market debut

It’s been a terrible start to trading for the takeaway food delivery firm. Here's why it all went wrong.

31st March 2021 11:00

by Lee Wild from interactive investor

It’s been a terrible start to life as a public company for the takeaway food delivery firm. Here's why it all went wrong.

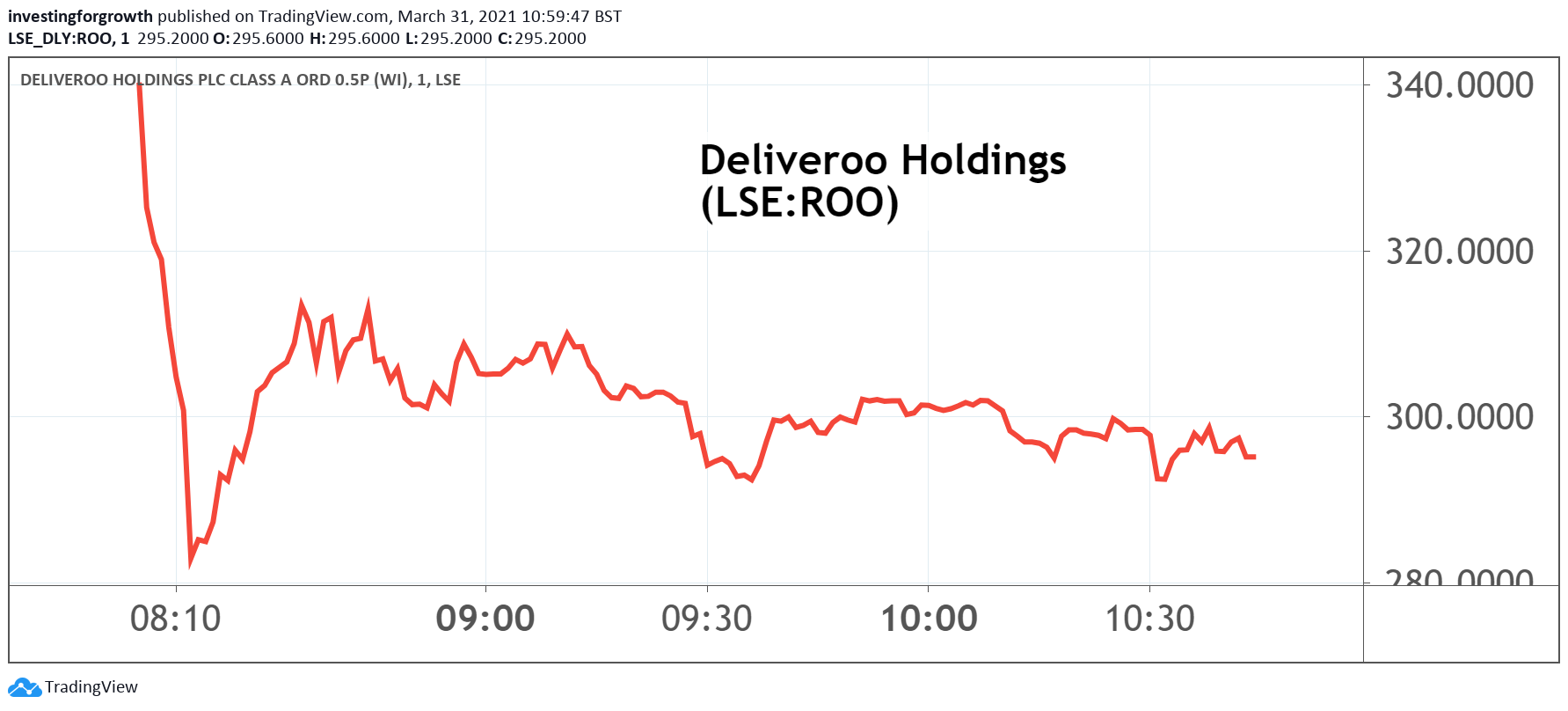

After months of speculation and drama, shares in Deliveroo (LSE:ROO) began trading on the London Stock Exchange at 8am on Wednesday. But it wasn’t the start the takeaway food delivery firm had wanted, with the price plunging by 30% in quick time.

The run-up to Deliveroo’s stock market debut has been marred by criticism of the company’s treatment of delivery riders, and by doubts among many top fund managers who chose not to invest in the flotation.

- Invest with ii: Top UK Shares | Share Tips & Ideas | Open a Trading Account

It announced this morning that existing shareholders had sold £500 million of Deliveroo stock at 390p a share, with new shareholders subscribing for at least £1 billion of shares. This valued the company at £7.59 billion.

That looks like great business for the sellers as Deliveroo shares began falling as soon as the market opened. They quickly hit a low of 271p, over 30% below the offer price, before recovering slightly to around the 300p level.

Source: TradingView. Past performance is not a guide to future performance

IPOs typically rise in value when they begin trading publicly, but preparations for this float have not been ideal, and there were several clear warning signs that all was not well.

Firstly, the company doesn’t make a profit, even though the pandemic provided the biggest tailwind it could hope for. That benefit will fade as lockdowns end and diners return to pubs and restaurants over the summer. Remember, too, that Deliveroo had to be bailed out by Amazon last year, and it continues to operate in a highly competitive market.

- Deliveroo IPO: everything you need to know

- Shareholder voting & information. Have your say on the companies you invest in

Most recently, several major City investors, including Aviva (LSE:AV.) and Aberdeen Standard, opted out of the hotly anticipated IPO citing ESG concerns related to the company’s treatment of its employees. They’re also turned off by founder and chief executive Will Shu (pictured above) who still has over 50% of shareholder voting rights.

Taxi firm Uber has already been forced to change its ways, especially around contracts and pay. Now, Deliveroo faces strike action to improve workers’ rights and pay.

It is also worth remembering that Deliveroo can cancel the IPO at any time until 7 April. That’s because the shares are currently trading conditionally – what’s called a ‘when issued’ basis. It is highly unlikely this will happen, but it’s worth pointing out.

*You can trade Deliveroo shares on the interactive investor platform. Just log into your account and search either the company name (Deliveroo) or ticker (ROO).

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.