Dramatic turnaround and upgrades inflate this industry giant

Already the biggest of its kind, this well-known company’s share price has just surged to a record high. Overseas investing expert Rodney Hobson updates his analysis of the stock.

22nd May 2024 08:17

by Rodney Hobson from interactive investor

Last year, America’s largest retailer Walmart Inc (NYSE:WMT) seemed to be struggling. This year there has been a dramatic reversal of fortunes. Just about everything seems to be working out at the moment.

In the three months to 30 April, the first quarter of Walmart’s financial year, net income nearly trebled to $5.3 billion compared with the first quarter last year. Revenue rose 6% to $161.5 billion, beating Walmart’s previous guidance of a 4-5% improvement.

These figures were good enough to prompt Walmart to upgrade its forecasts for the rest of the year, with sales growth at the top end or even slightly higher than its previous guidance of 3-4% growth. Given its earlier caution, we can expect better than 4%, perhaps appreciably better.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

For the second quarter to the end of July, sales are seen as rising between 3.5% and 4.5%. Come August when the actual figures are published, shareholders will understandably be hoping for another pleasant surprise.

Walmart did well during the pandemic as it geared up competently to online sales. That could all have gone downhill as in-store shopping came back into vogue, yet Walmart is still seeing online sales rising by 22%, with pick-up and delivery services both driving growth. Sales through third-party marketplaces are also thriving.

What is really intriguing is that households earning more than $100,000 a year are being attracted by Walmart’s subscription service that offers fast delivery at cheap prices. This may be in part because high inflation has finally put a squeeze on higher earners in the US, but once those higher earners are hooked in they are likely to provide lucrative repeat business. It encourages the view that such customers will be able to withstand some increase in prices as inflation persists.

Another encouraging sign is that sales are rising even faster in the international division than they are in the US. While it is important to demonstrate solid growth in any company’s home market, Walmart now has more stores in 19 foreign countries than in the US, despite its earlier retreat from Europe.

- Six secrets to bagging the next Nvidia

- Nvidia Q1 results preview: will stock blast past $1,000?

- Morgan Stanley’s five cutting-edge ‘long shot’ investment ideas

Meanwhile, Walmart is tidying up its operations by closing Walmart Health, launched in 2019 with 51 health centres in five US states plus a virtual care operation. Walmart has taken the painful but correct decision that escalating operating costs are not going to be recovered by the charges it can impose on patients. Better to call time now rather than struggle on and having to face the inevitable after throwing good money after bad. The chain can now concentrate its healthcare services through its longer-established pharmacies and Vision Centre outlets, which will continue to operate.

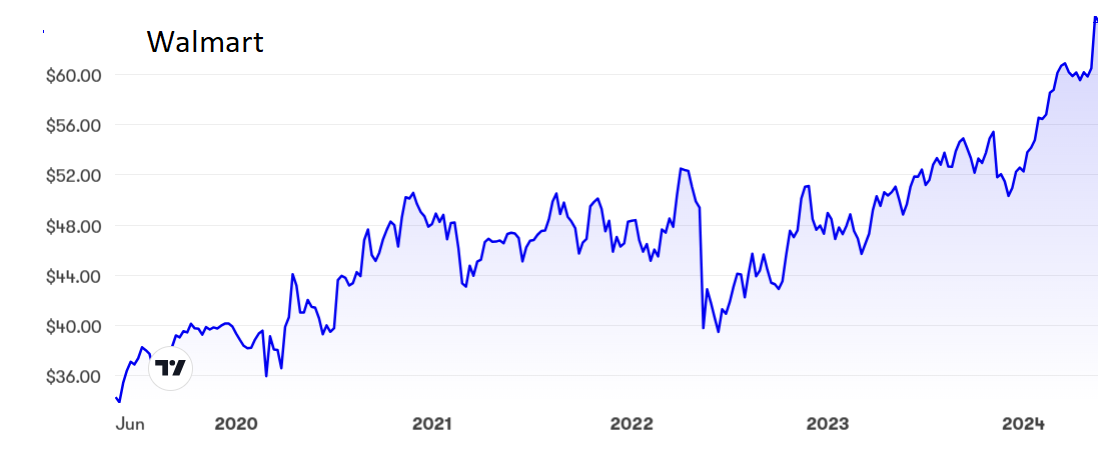

Walmart shares shot up 7% immediately after the quarterly results, almost reaching $65, and have just got past that peak, having nearly doubled in value over the past five years. This run has pushed the price/earnings ratio to a challenging 27, while the best that can be said about a yield of 1.23% is that it is better than nothing. Dividend increases are likely to be limited for as long as Walmart pursues its admittedly profitable international ambitions.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: I rated Walmart a buy at $51 [converted following 3 for 1 share split in February 2024] but moved my recommendation to hold prematurely as the shares rose above $60. I last wrote about the stock in February, when I suggested buying if the price slipped back to $57, which unfortunately did not happen. Shareholders should not consider taking profits yet, but I still feel the shares are a bit pricey given that Walmart has struggled to convert increased revenue into higher profits. Latest figures suggest that is being put right at last, so if you are in, hold on. Consider buying below $60, though you may wait in vain for that level to reoccur.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.