Equity markets, Persimmon, AB Foods, Superdry

5th July 2018 11:27

by Lee Wild from interactive investor

After a short breather, expect market volatility to return soon, writes Lee Wild, head of equity strategy at interactive investor, who also looks at the big company stories of the day.

European stocks quickly settled into a narrow range Wednesday and stayed there, free of influence from US traders busy celebrating Independence Day. This was a welcome breather for many given the recent upsurge in volatility across equity markets, but don’t expect it to last.

Aggressive trade rhetoric will continue to push markets around until both sides feel some kind of balance has been established. It seems inevitable that both China and Europe will have to give at least some ground to Donald Trump to end this disruptive and damaging situation.

Minutes from the last Fed meeting will generate interest late Thursday. Four hikes is the likely outcome for 2018, but it’s the strength of dovish influence on the committee that has the power to rattle markets now.

Watch tomorrow's US nonfarm payrolls closely too. Expect 190,000 jobs to have been added in June and an unemployment rate steady at 3.8%, which will underpin the hawkish view on borrowing costs.

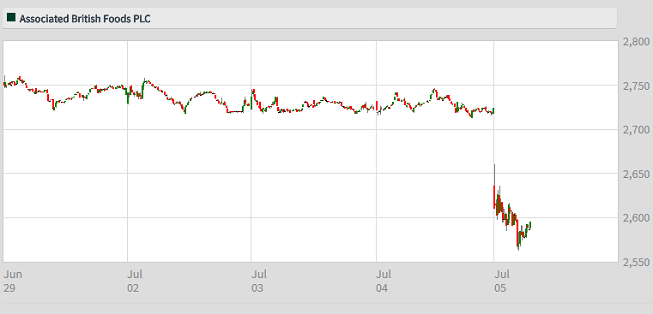

AB Foods

Lower sugar prices in the EU have hurt Associated British Foods' sugar division, although Primark's operating margin is tipped to be much higher in the second half than the first, benefiting from a weaker dollar, better buying and fewer markdowns than expected.

AB Foods' share price has struggled to establish any lasting momentum since peaking three years ago, and while Primark's eurozone stores are thriving, like-for-like sales growth in the UK slowed during the third quarter and the sugar business is at the mercy of global sugar prices. There is little in these results to suggest that the highly rated and low-yielding shares offer great value at current levels.

Source: interactive investor Past performance is not a guide to future performance

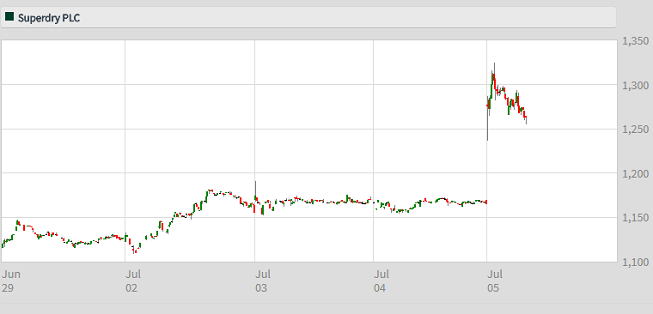

Superdry

Superdry shares have halved in value this year amid warnings that profit would disappoint, but another special dividend, this time 25p, may convince remaining shareholders to stick around.

Double-digit increases in full-year profit and sales were expected and cash generation remains strong, but growth will slow this year and margins will not improve much.

The shares are not expensive, however, and much of the negative news looks to be in the price.

Source: interactive investor Past performance is not a guide to future performance

Persimmon

One of the great post-EU referendum success stories, housebuilders have fallen out of favour in spectacular fashion over the past month. Weak economic data, higher costs, falling house prices and a likely interest rate rise later this year are all bad news for the sector.

Company results are already bearing this out and none of the big sector names will be immune.

Persimmon still increased first-half revenue by 5%, new housing volumes rose by 3.6% and prices by 1.2%.

It claims consumer confidence remains 'resilient' and rightly points out that mortgage products remain cheap, but UK economic growth is modest at best and the glory days for housebuilders look to be over.

Source: interactive investor Past performance is not a guide to future performance

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.